Index in focus: Is this the end of “buy the dip” for the S&P 500?

If the last year has taught index investors anything, it’s that “buy the dip” is absolutely infallible advice.

Of course, once any strategy in complex adaptive systems like markets becomes infallible, it’s often a sign that its about to stop working.

This brings us to the S&P 500, which has been one of the clearest “up and to the right” charts on the planet. The widely-followed US index has gone more than 10 months without seeing even a -5% pullback (vs. the historical average of roughly 3 per year).

See our guide to trading the S&P 500 here!

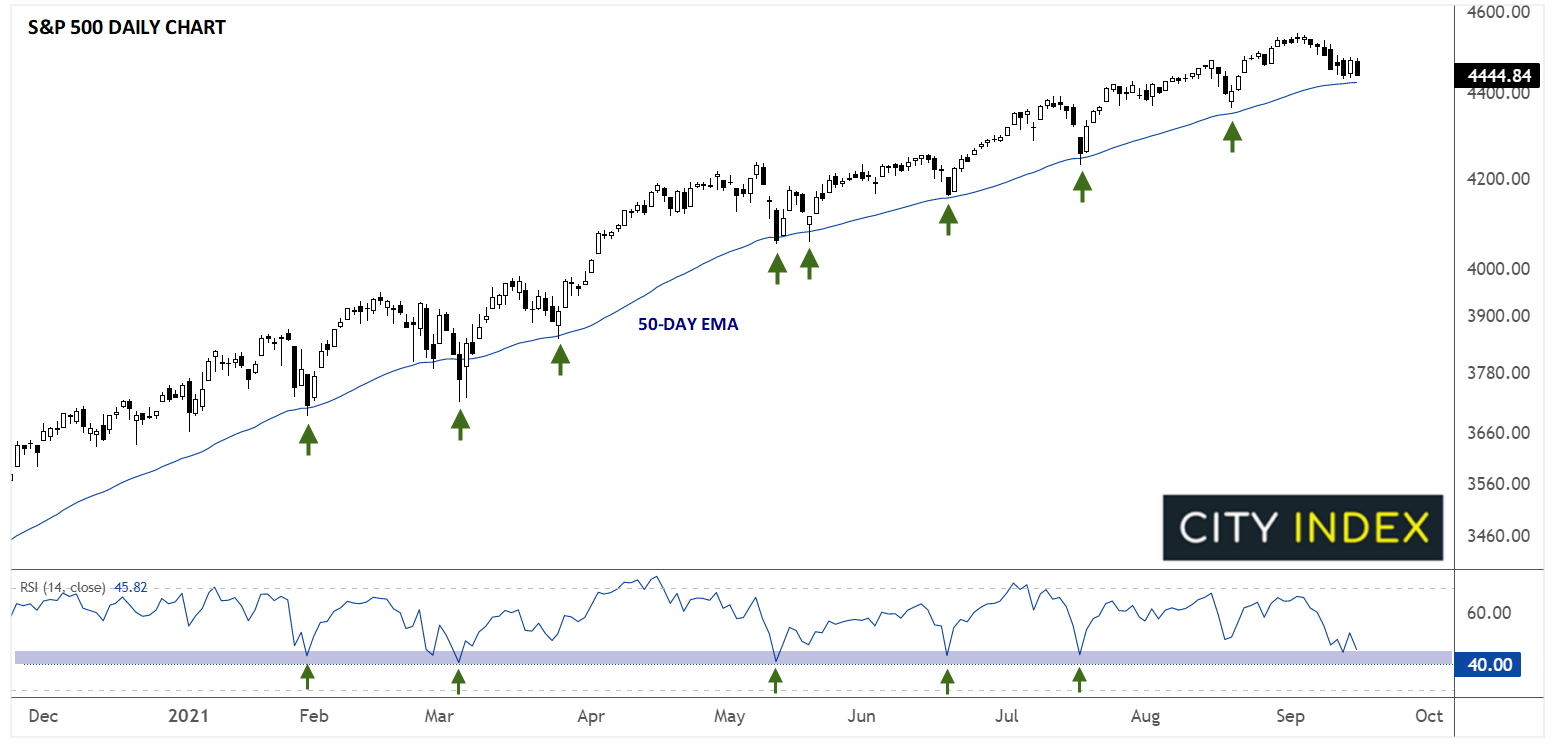

More actionably for technically-inclined traders, the S&P 500 has immediately found support and rallied to new highs every time it’s pulled back to its 50-day exponential moving average (EMA) over the last 10 months. Likewise, the 14-day RSI indicator has repeatedly bottomed out at the 40 level over that period.

As we go to press, the index is once again approaching its 50-day EMA and the RSI is hovering just above 40. Will we see another bounce, or will the “infallible” buy the dip mentality finally fail?

Source: Tradingview, StoneX

The short answer is: We don’t know. And no one does.

…But that doesn’t mean there isn’t an actionable trade opportunity. For example, bullishly-inclined traders could consider buy opportunities near current levels with a tight stop below the 50-day EMA, targeting fresh record highs in the index for a strong risk-reward ratio.

Conversely, rather than guessing that the reliable pattern we’ve seen over the last 10 months will definitively end this time, bearish-leaning readers could set a stop sell order below the 50-day EMA with a stop back above it and a target at 4300 or lower to be prepared if this finally is the end of the “buy the dip” pattern without taking on unnecessary risk.

Either way, the technical setup in the one of the world’s most popular indices points to a potential swing trading opportunity emerging in the coming week or so.

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade