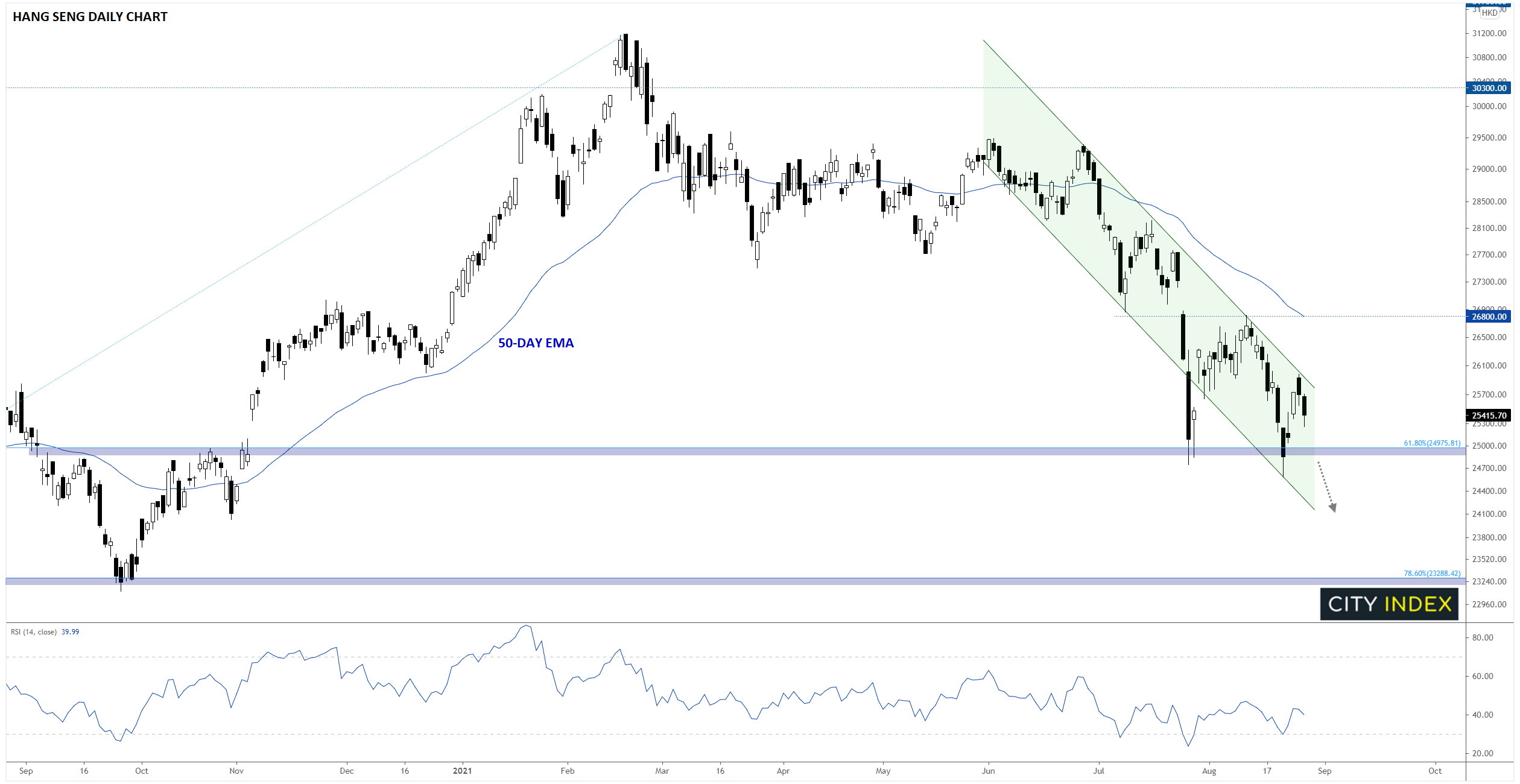

Index in Focus: Hang Seng probing key support near 25K

While US indices continue to set new highs on a seemingly daily basis, stock markets in some other areas of the world are struggling. In the case of Hong Kong’s Hang Seng index, prices are approaching an outright bear market, with a nearly -20% drop from the February high. The region continues to struggle to get the COVID pandemic under control, and the combination of ongoing economic restrictions and regulatory uncertainty are taking a toll on the economy.

Looking at the chart of the Hang Seng, the first thing that jumps out is the clear bearish channel that has pushed prices lower for the past 11 weeks. At the moment, the 61.8% Fibonacci retracement of the March 2020 – February 2021 rally near 25,000 continues to provide support, but the bourse has been unable to make a new “higher high” for months, leaving the overall technical bias favoring the bears.

Moving forward, a conclusive break of support in the upper-24,000s would open the door for a continuation lower in the Hang Seng, with the next major level of support coming in at the confluence of the 78.6% Fibonacci retracement and the October low near 23,200. While a break out of the established bullish channel may weaken the bearish outlook on the index, it would take a move above the 50-day EMA and previous-support-turned-resistance at 26,800 to flip the medium-term bias remotely bullish:

Source: StoneX, TradingView

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.