If asked to identify the most significant development in markets this week, it was EU leaders reaching an agreement on the EU Recovery fund.

We first flagged the possibility of this in an article back in May here following a joint press conference where German Chancellor Angela Merkel and French President Emmanuel Macron proposed a €500bn Recovery fund to support the regions worst hit by COVID-19.

Shortly afterward the size of the proposed fund was bumped up to €750bn. As noted in a subsequent article in early June here we thought this would result in the EURUSD then trading near 1.1130 to test year to date highs, 1.1500 area.

Returning to the just-completed EU summit, most analysts believed it would be a stepping stone to an agreement in the coming months. The ability of EU leaders to strike a deal and to get ahead of market expectations timing wise, is something rarely seen before from the EU.

While the final component of grants vs loans was lower than expected at €390bn, the important point here is after taking the first steps to fiscal solidarity, it becomes easier for the EU to increase the size of grants if needed in the future.

In summary, the outcome of this week’s EU summit reinforces the EU region's ability to recover from the pandemic and the positive medium-term momentum for the EURUSD. We favour buying corrective pullbacks towards support at 1.1450/30 in expectation of a move towards the June 2018, 1.1852 high in the coming weeks.

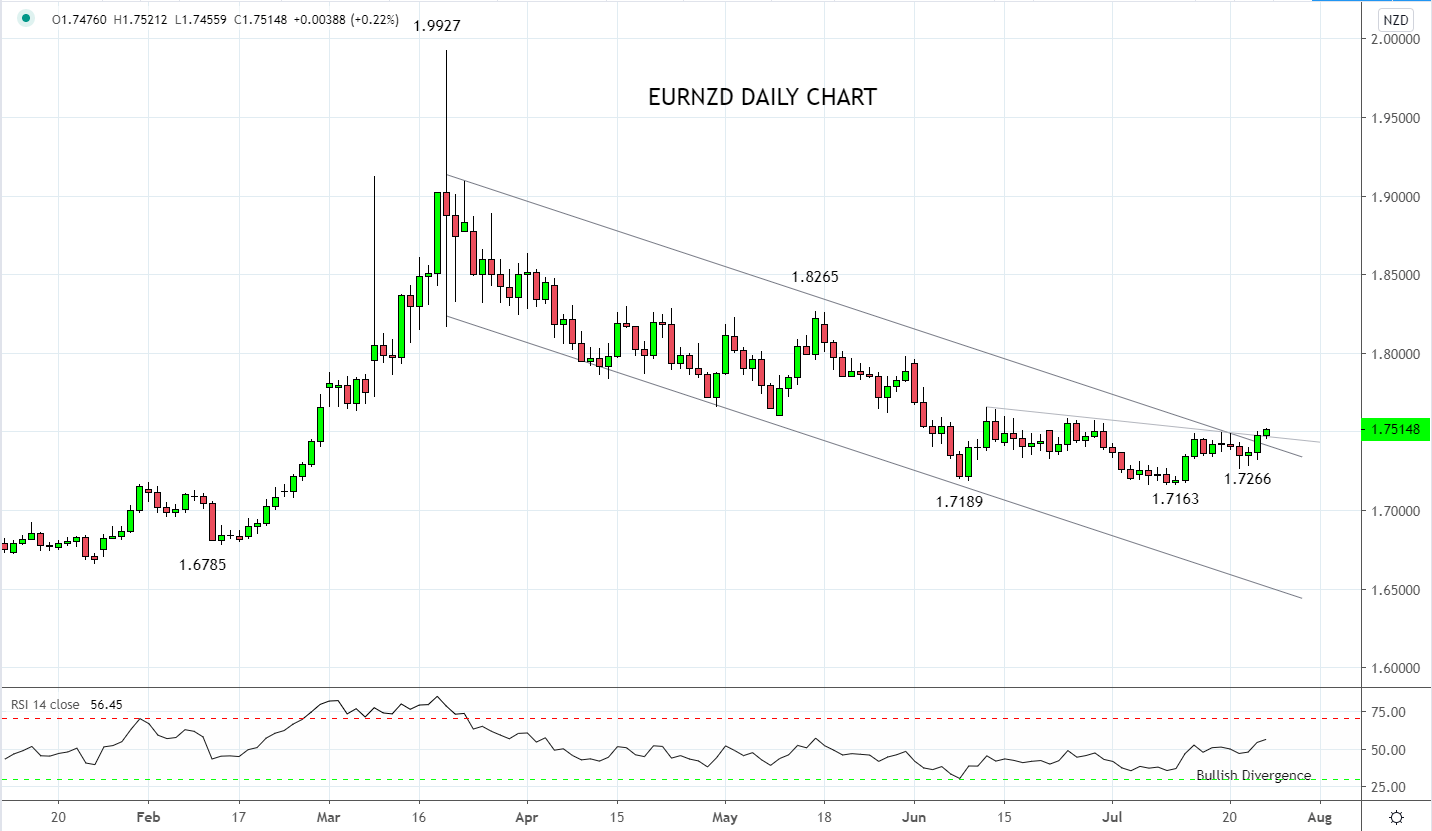

In the short term, EURNZD is currently of interest as it provides exposure to the positive EUR sentiment and some protection from a selloff in equities into the weekend.

Technically, as supported by the bullish divergence at the 1.7163 low and the overnight rally above trend channel resistance, EURNZD appears to have based. We would consider longs in EURNZD at the current price of 1.7515 with a stop loss below the 1.7266 low, looking for the rally to extend towards 1.8000.

Source Tradingview. The figures stated areas of the 24th of July 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation