If the US Dollar’s Going to Bounce, It Better Do It Here

The high-volatility, alternating up-down rollercoaster in risk appetite that has characterized this week’s trade has seemingly broken on the final trading day of the week; that is, markets remain highly volatile, but we’re not seeing a recovery in risk assets after yesterday’s drubbing. Instead, equity indices across the globe are trading another 2-4% lower, while global bond yields collapse and gold tacks on another 1%.

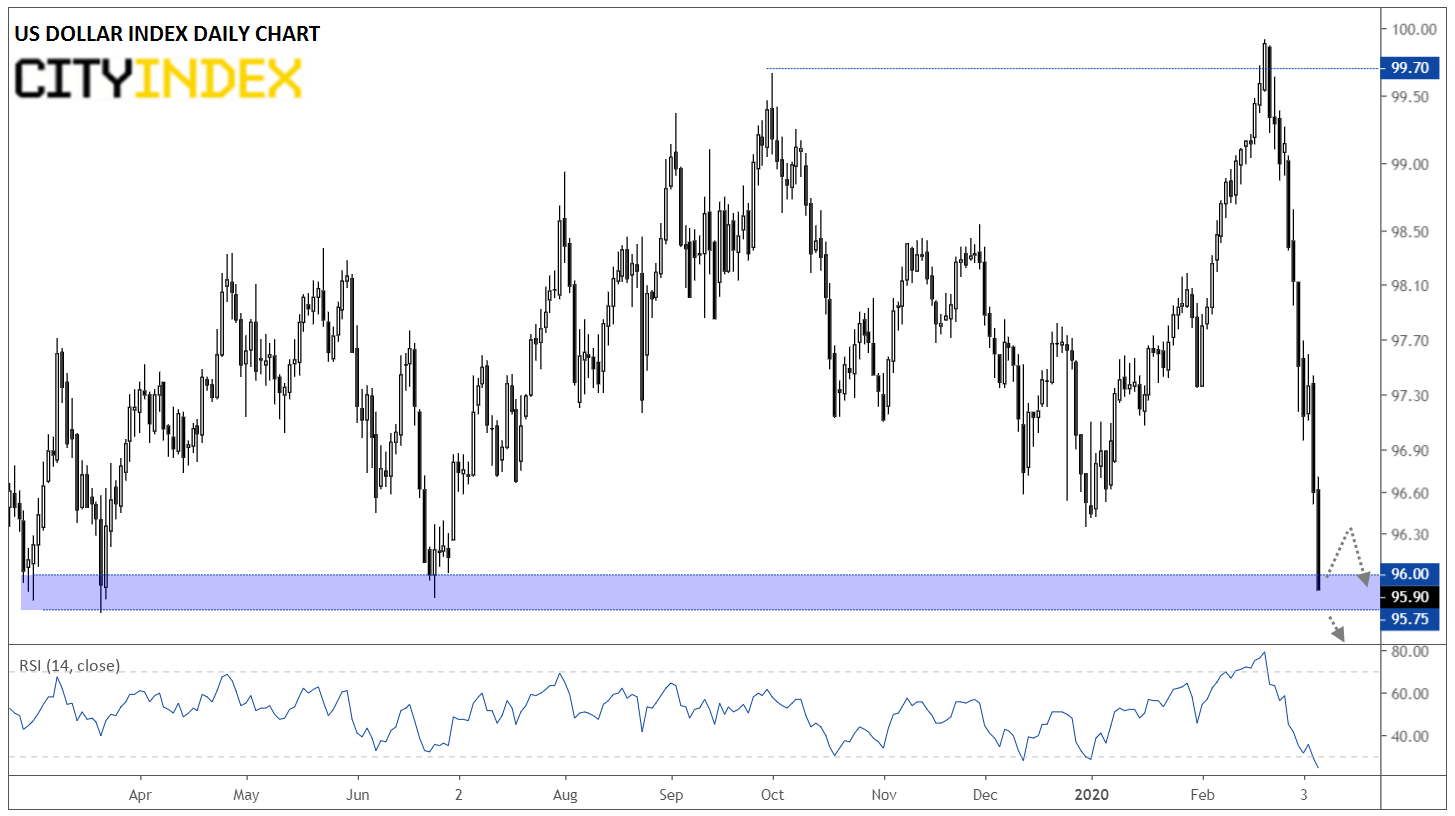

Meanwhile, the US dollar just can’t seem to get up off the proverbial mat. Looking at the widely-followed US dollar index, the world’s reserve currency has lost 4% of its value in a little over two weeks, and the currency is now testing a massive support level in the 95.75-96.00 range:

Source: TradingView, GAIN Capital

After such a dramatic drop, it’s no surprise that the RSI indicator for the dollar index is deeply oversold, raising the probability of a bounce off this key support zone. That said, the narrative of the US dollar as the “cleanest dirty shirt” amongst a slow-growth global economy has been ripped to shreds.

For years, buck bulls have pointed at the US dollar’s relative yield advantage over its zero- and negative-yielding rivals, but with the yield on the benchmark 2- and 10-year treasury bonds falling to just 0.49% and 0.76% respectively, that comparative advantage has all but disappeared. Indeed, traders are now pricing in at least another 50bps of interest rate cuts from the Federal Reserve at its meeting in the middle of the month, meaning that the central bank will likely lower its benchmark rate by a full 1% in just two weeks.

In the short term, today’s Non-Farm Payroll report may have some bearing on the greenback, with the potential for a stronger-than-expected report to lead to a recovery rally off support in the greenback (see our full NFP preview report). Nonetheless, the technical and fundamental momentum in the US dollar index remains strongly bearish, so traders may look at any short-term bounces as an opportunity to add new shorts at a more favorable price.