ICBC Escaped from Declining Channel

ICBC (1398), a top Chinese bank, announced that 1Q net income grew 3.0% on year to 84.49 billion yuan and operating income increased 2.2% to 206.19 billion yuan on net interest income of 154.29 billion yuan, up 2.2%. Also, core tier 1 capital adequacy ratio was broadly steady at 13.15%, compared with end-2019, and non-performing loan ratio was unchanged at 1.43%.

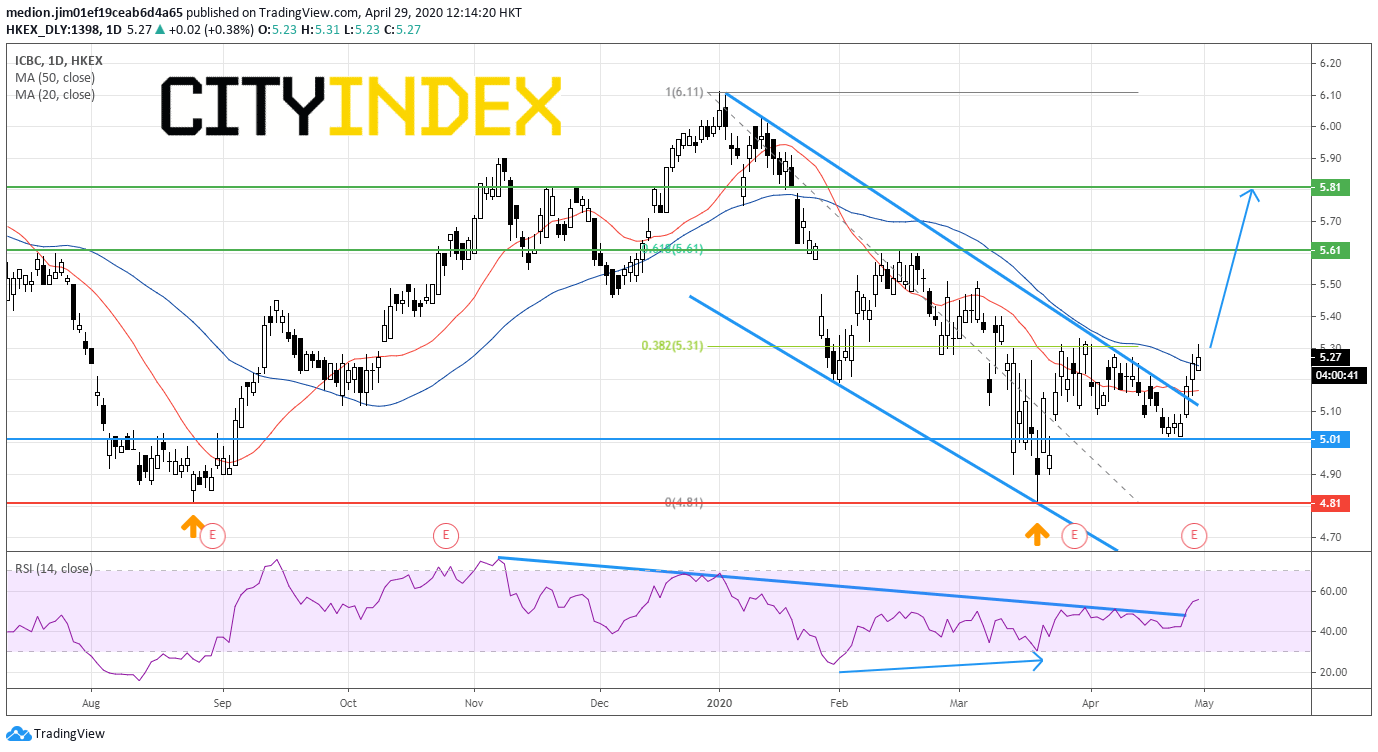

From a technical point of view, the stock posted a rebound from $4.81 after touching the lower line of the declining channel and the low of August 2019) on the daily chart. After that, the prices have escaped from the declining channel drawn from January top. It indicates that the outlook of the stock would turn to positive. A break above $5.31 (38.2% retracement between January top and March low) should enhance the bullish bias.

In addition, the RSI also posted a bullish divergence signal, when the stock made a bottom at $4.81. In addition, the RSI also broke above the declining trend line drawn from November. It suggests that the momentum of the stock is turning upward.

In this case, as long as the previous low at $5.01 is not broken, the stock could consider a challenge to the resistance level at $5.61 (61.8% retracement and reaction high at February 17). A break above this level would trigger a further advance to the overlapping resistance level at $5.81.

Source: GAIN Capital, TradingView

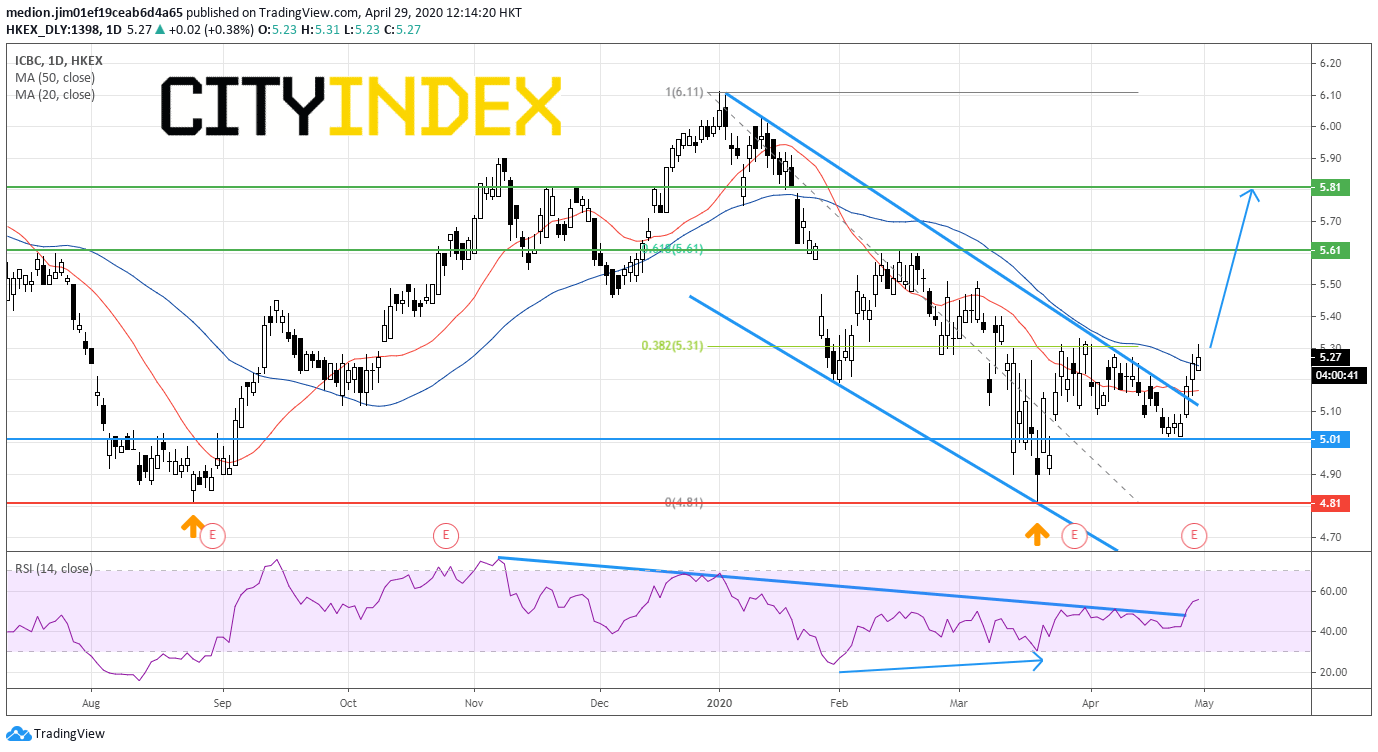

From a technical point of view, the stock posted a rebound from $4.81 after touching the lower line of the declining channel and the low of August 2019) on the daily chart. After that, the prices have escaped from the declining channel drawn from January top. It indicates that the outlook of the stock would turn to positive. A break above $5.31 (38.2% retracement between January top and March low) should enhance the bullish bias.

In addition, the RSI also posted a bullish divergence signal, when the stock made a bottom at $4.81. In addition, the RSI also broke above the declining trend line drawn from November. It suggests that the momentum of the stock is turning upward.

In this case, as long as the previous low at $5.01 is not broken, the stock could consider a challenge to the resistance level at $5.61 (61.8% retracement and reaction high at February 17). A break above this level would trigger a further advance to the overlapping resistance level at $5.81.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 08:33 AM