British Airway’s parent company IAG are expected to report final results tomorrow. The results come as the share prices plunges to a 4-month low after having shed 20% of its value this week and 10% of its value today.

News that the Court of Appeal has found plans for a third runway at Heathrow unlawful sent the share price sharply lower on Thursday.

The news added pressure to the airline, which is already on the back-foot owing to the impact of coronavirus and the anticipation of lower demand globally.

British Airways joined other airlines in suspending flights to a and from mainland China back in January. Today BA has cancelled some flights to and from Milan, Italy and Seoul, South Korea as a result of reduced demand.

Investors will be almost solely focused on commentary on the impact of coronavirus in IAG's outlook. It will be very difficult for the airline to quantify the expected impact, but we are certain that they will attempt to. Disruption in the first quarter is expected to be significant but the effects could easily spill over into the second quarter and beyond.

So far, Air France KLM has said that it expects to lose €150 - €200 million should flights to Asia be suspended until April. A similar number from IAG could be in the pipeline.

Chart thoughts

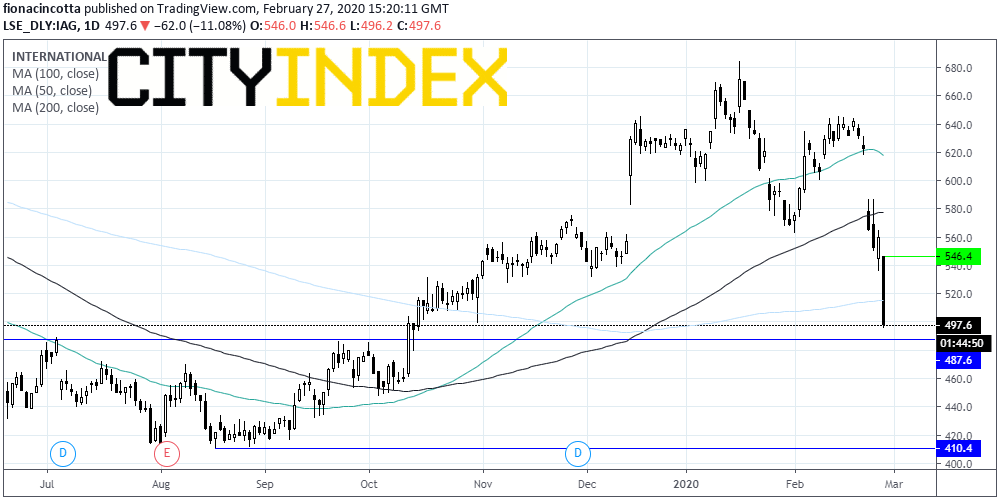

IAG has been on a virtually uninterrupted bullish run since hitting a low of 410p at the end of the summer. Since then the share price has rallied some 65% to a high of 684p in mid-January.

The share price has plunged 20% this week, breaking through the 50, 100 and then today the 200 sma, on the daily tax negating the bullish trend

Immediate support can be seen at 485p (high 1st Oct & 23rd September) prior to 450p (low 3rd Oct) and 410p (Aug low).

Resistance can be seen at 516p (200sma), prior to 546p (today’s high) and 576p (100 sma).

Latest market news

Today 08:15 AM

Today 05:45 AM