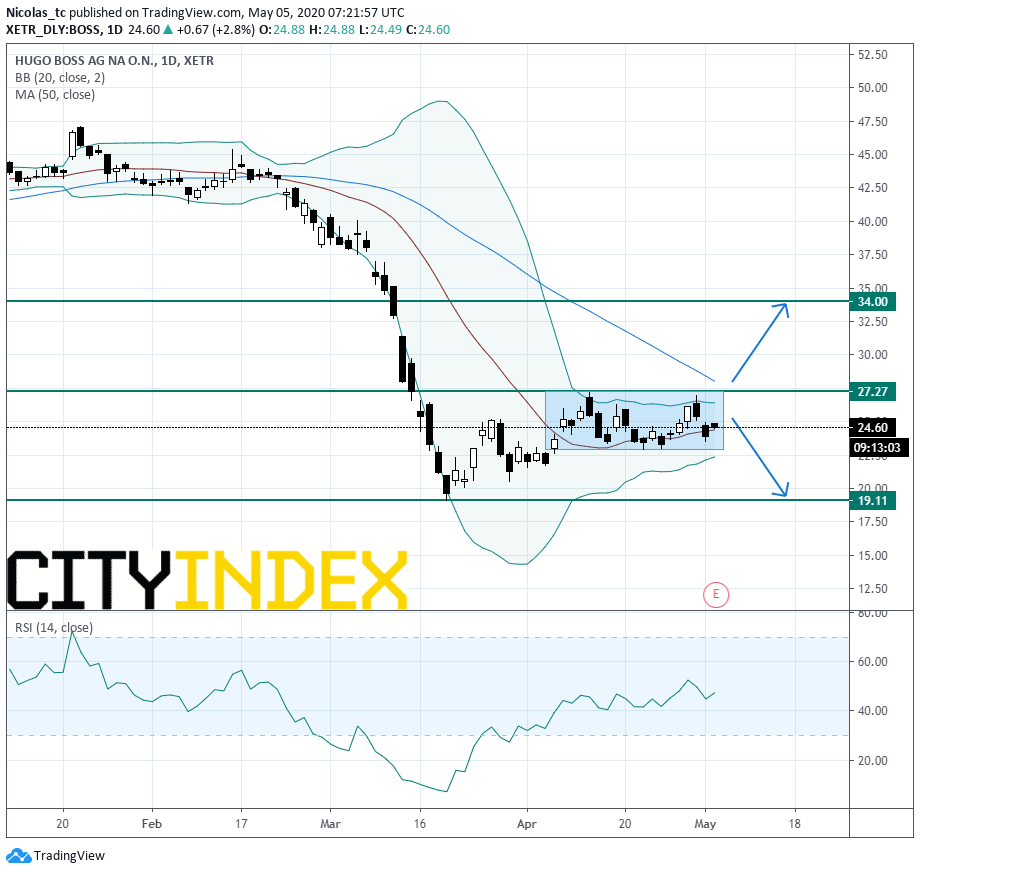

Hugo Boss: key resistance at 27,27E

Regarding the outlook, the company stated: "HUGO BOSS hence expects currency-adjusted Group sales to decrease by at least 50% in the second quarter. Nevertheless, the company is confident that from the third quarter on, the retail environment will gradually improve. This should also positively impact the Group's sales and earnings development in the second half of the year."

From a technical perspective, the stock price remains capped by a key horizontal resistance at 27,27E (March 16th gap). Bollinger bands are narrowing meaning that the price is likely to fluctuate within a trading range on a short term basis. Readers may want to wait until the stock price breaks above the resistance at 27,27E before opening long positions.

As long as 27,27E is resistance, the price could fall again towards March 19th low at 19,11E. A break above 27,27E would call for a quick rise towards 34E (20WMA).

Source: GAIN Capital, TradingView