HSBC: Technical rebound in a bearish trend

HSBC, the global banking group, announced that 3Q adjusted profit before tax declined 20.6% on year to 4.30 billion dollars on adjusted revenue of 12.07 billion dollars, down 9.6%. 3Q profits beat market expectations. Adjusted expected credit losses reduced to 785 million dollars from 3.95 billion dollars in the prior quarter and 843 million dollars in the prior-year period. The bank said it will consider paying a "conservative dividend" for 2020, which "would be dependent on the economic outlook in early 2021, and be subject to regulatory consultation".

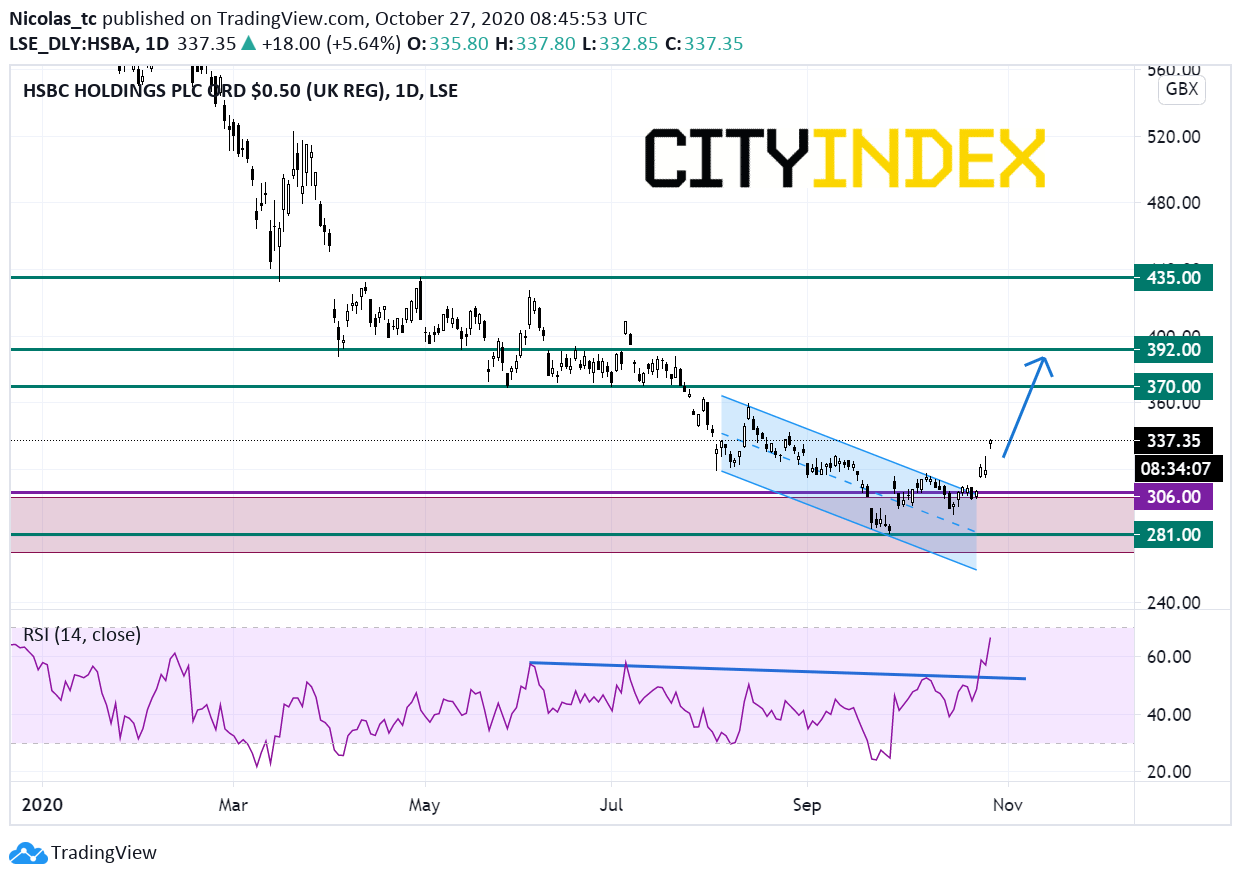

From a chartist point of view, the stock price has landed on a massive support zone near 2009 low and is posting a rebound. The daily Relative Strength Index (RSI, 14) validated a bullish divergence calling for a technical rebound within the bearish trend. In addition, prices escaped from a downward-sloping channel. Readers may want to consider the potential for opening Long positions above the support at 306p with 370p and 392p as targets. A break below 306p would negate the bullish view and would call for the resumption of the medium term down trend.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM