Q1 could scarcely have gone better, in Asia

Whilst HSBC shares still show the ravages of investor disdain stemming from a dire 2018, Friday is their best day since January, with a 3% rise at best.

- Q1 pre-tax profit +31% to $6.20bn, best in 14 quarters, forecast: $5.58bn

- Adjusted revenues, +9% to $14.4bn, 3 times the pace of adjusted operating expenses

- Core capital ratio rebounded to 14.3% after falling 50 basis-points in 2018

The biggest caution in the results was ironically represented by HSBC’s best return to previous strengths. 80% of Q1 profits were derived from Asia, with just 1% from Europe. And whilst the CEO’s aggressive spending crackdown helped all key divisions rebound, regionally, only Asia shone. Three years after a 14-year lawsuit over HSBC’s U.S. Household International ended, it still sees stateside operations as its “most challenging strategic priority”. Problem operations also showed little progress. Stock dealing tanked 34%, the worst equities performance across U.S. and European banks, leaving markets revenues down 5%.

Asia-over-dependence, intractable U.S. drag, and lacklustre rest-of-world has kept the share reaction measured most of the session. The buyback pencilled in for the half-year amid improving capital could underpin the stock’s recovery. But Q1 momentum looks unsustainable. And of all giant lenders, HSBC has certainly been amongst the least predictable lately.

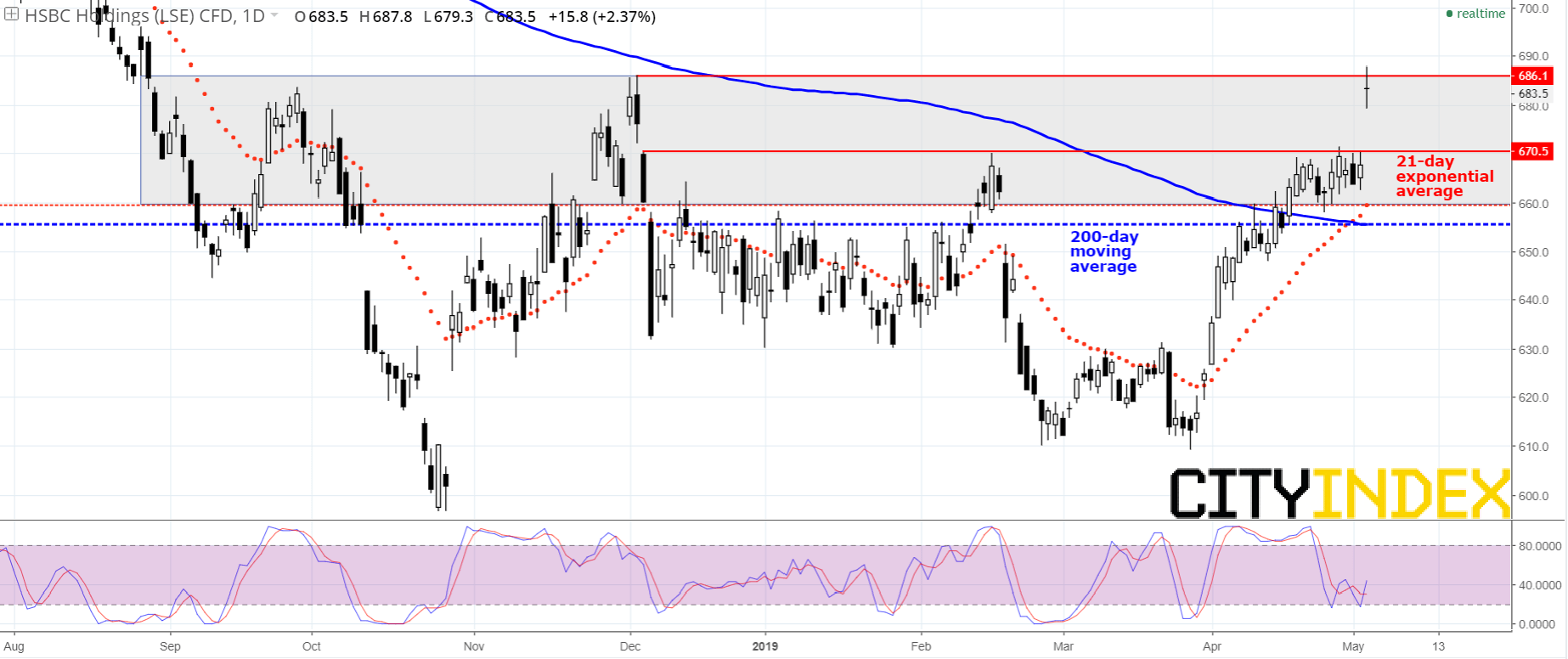

Chart thoughts

- Stock reaches top of 660p-686p resistance zone

- Technical/fundamental outlook suggests near-term gap fill; watch 670p support

- True deterioration would be symbolised by a break of 200-day average support (latterly 655p)

- Remaining above 670p would imply conquest of the resistance zone soon

HSBC Holdings CFD [03/05/2019 12:53:44]

Source: City Index