Tighter lockdown restrictions coming

There is a distinct lack of good news as the FTSE kicks off trading for the week. New daily covid infections continue to rise sharply. With large pats of the UK seeing tighter lockdown restrictions and fears growing that London could be next. British Medical Advisor Chris Whitty is due to make a public briefing later this morning where warnings that the UK is at a critical point ahead of a very challenging winter are likely to keep sentiment depressed.

Bank’s can’t stay out of trouble

British banks are back in the spotlight for all the wrong reasons. A report that some of the world’s largest banks enabled flows of dirty money in suspicious transactions over a period of two decades, despite warnings from regulators is keeping the sector out of favour. HSBC was one of the 5 global banks which appeared heavily in the report, along with Standard Chartered, JP Morgan Chase & Co, Deutsche Bank and Bank of New York Mellon Corp.

HSBC at 25 year low

Heavyweight HSBC is a standout loser as the global bank faces trouble on several fronts as it is caught up in political turmoil and an economic slump. In fact, things couldn’t get much worse for the bank which is reeling under covid pressures and its increasingly difficult position in no-mans land, supported by neither the East or the West.

Not only is the suspicious transaction report extremely damaging, but the bank is on the brink of being added to China’s “unreliable entity” list, potentially threatening its plans to expend into China.

The so-called unreliable entity list looks to punish firms that damage national security. Should HSBC find itself on the list the bank will experiencing problems expanding into mainland China after investing heavily in directing the business that way over the past few years.

The stock is trading at a 25-year low and the outlook is troubling at best.

Looking ahead

The economic calendar is light in Europe and the US. US tech stocks will remain in focus, with fears of the selloff continuing despite progress in the TikTok WeChat saga.

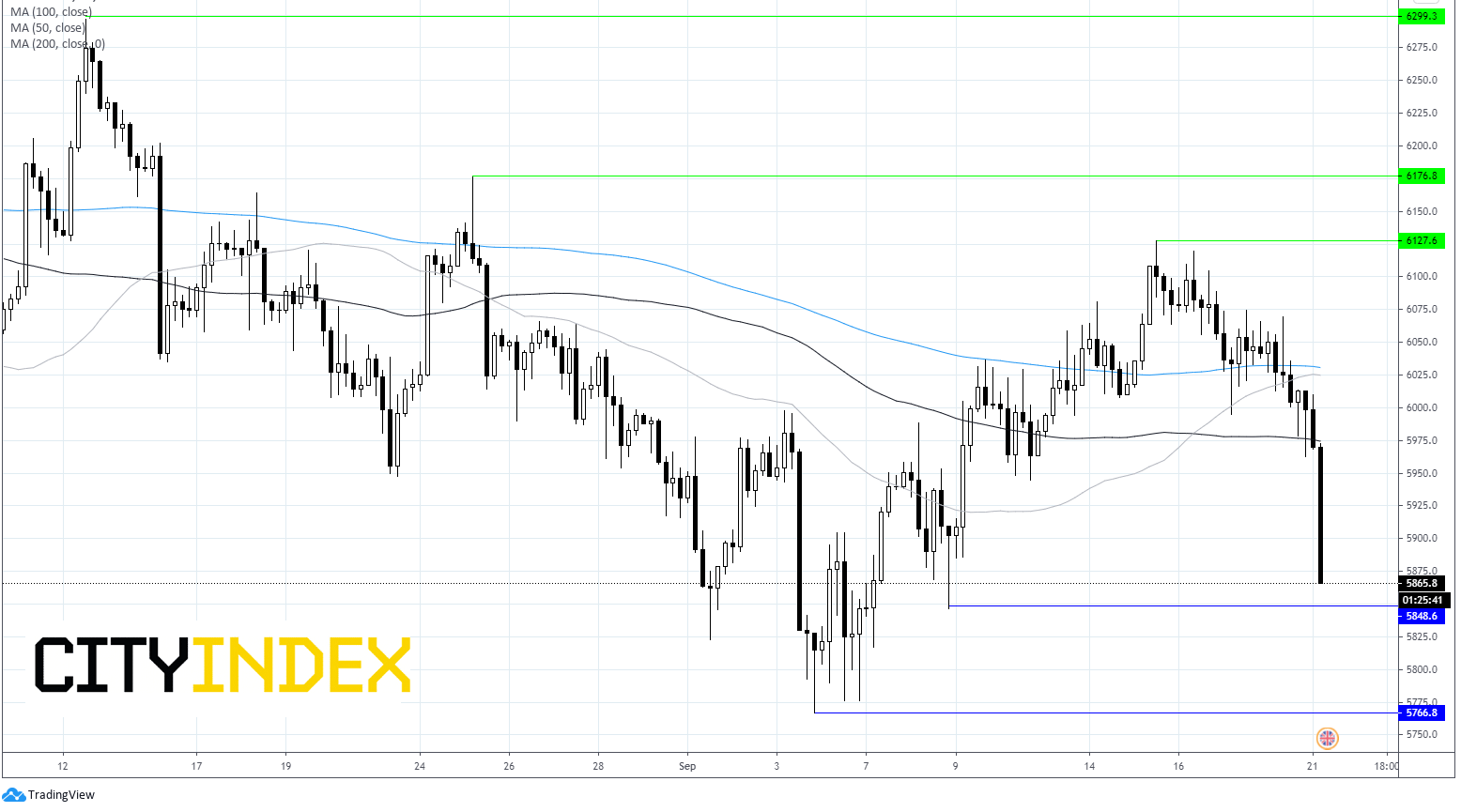

FTSE Chart