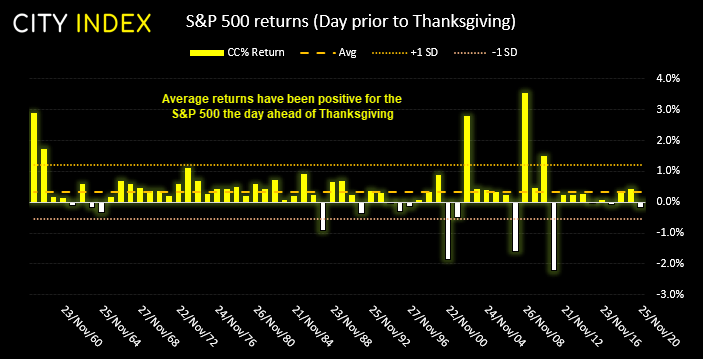

Average returns have been positive for the S&P 500

Using daily data of the S&P 500 (via Refinitiv) we have analysed percentage returns the day before and after Thanksgiving. As the public holiday lands on the fourth Thursday of November each year, it means we’ll look at returns on the Wednesday before and Friday following it.

Since 1957, the S&P 500 has produced an average return of 0.34% the day ahead of Thanksgiving. It has also closed higher on 64.5% of the time, with a maximum gain of 3.5% and maximum loss of -2.1%. On the face of it, these numbers look pretty good.

Returns were more consistent on the S&P 500 in earlier years

However, if you look at the chart above you should notice that between 1965 – 1992 the positive relationship was much more apparent, as it only closed lower on 5 sessions over this period. It also posted a positive return on 22 consecutive occasions between 1965 and 1987 (although the 1987 crash may have had something to do with that eventual, pre-Thanksgiving, down-day)

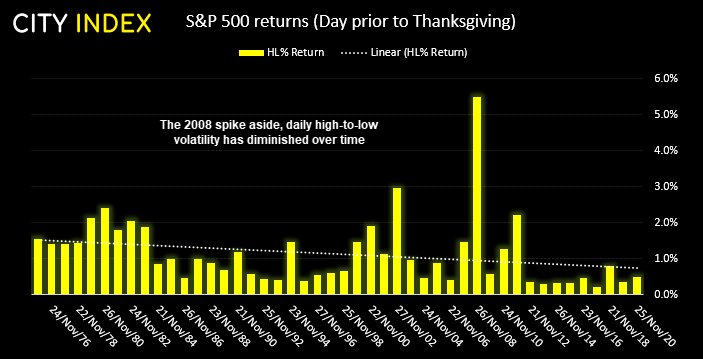

Since 2000, it has posted an average return of 0.23% with a 66% win rate. Therefore, whilst average returns have diminished in recent years it still seems to have a positive expectancy overall. On a side-note, volatility has also diminished in recent years with the trend for the daily high-low volatility sloping lower.

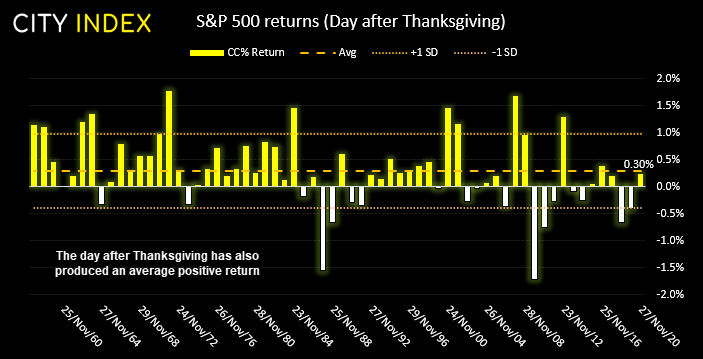

The S&P 500 the day after – party on

Since 1957, the S&P 500 has posted an average daily return of 0.3% the trading day after Thanksgiving. It has also closed higher 65.2% of the time, although once again positive returns were more apparent between the 60’s and 90’s.

Summary

- S&P 500 has posted positive average returns the day before and after Thanksgiving

- Positive returns were more consistent between the 1960s – 1990s

- Daily volatility on these days have been trending lower over the years

Maybe this time it will be different

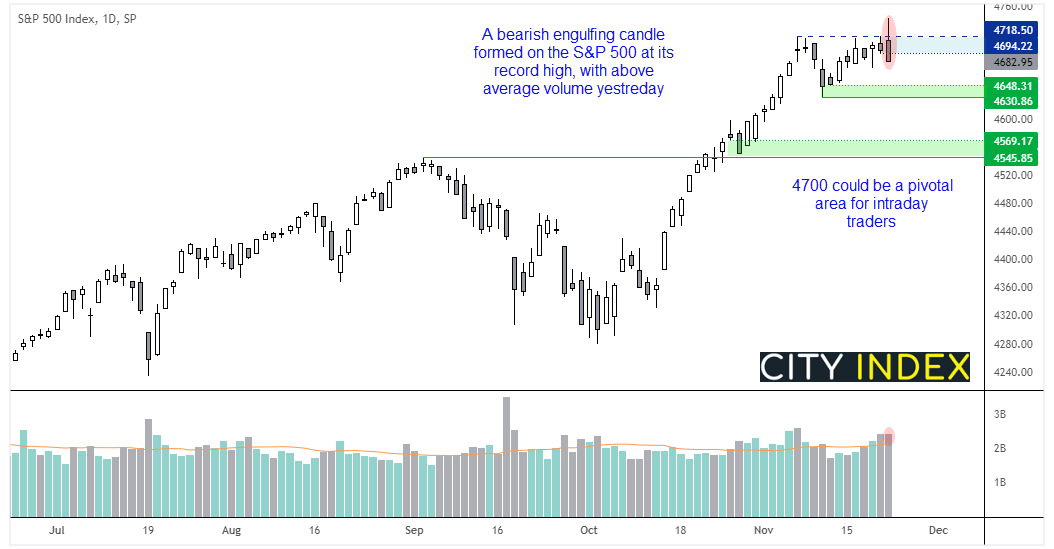

Whilst the odds have favoured a positive expectancy overall, it does not provide a roadmap to futures gains. And each new data point is independent from the set it is within. So it’s important to use price action as a guide.

Besides, the S&P 500 printed a bearish engulfing candle on the daily chart yesterday with above-average volume, at its record high. So we go into today’s session with a bearish bias whilst prices remain below the 4700 area, which could be a key focal point for intraday traders today early in the session.

Take note that US stock markets are closed on Thursday for Thanksgiving, and close early on Friday 1pm EST.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade