Stanley has been a Chief Investment Officer in various guises since 1978 and gained fame in the early 90s after he and George Soros took on the Bank of England to short the British pound. The trade is believed to have earned the Quantum fund more than $1 billion in profits.

The link to the interview was posted on the City Index Twitter handles on Saturday morning, however for those that missed it, the link is available here.

In the interview, Druckenmiller described the current economic environment as the “wildest cocktail I’ve ever seen in terms of trying to figure out a roadmap”.

Druckenmiller also shared his upbeat thoughts on China, the subject of today’s note after data today showed that Chinese inflation slipped back into negative territory. A development that has largely been ignored by the China complex, including the AUD/USD.

The weakness in today’s inflation data was mostly expected - the result of weaker travel activity, and services consumption following the Covid19 resurgence in some regions of China. The Covid19 resurgence also played a part in the slowing growth pulse seen in other China data series of late.

Overall as explained by Druckenmiller, the Chinese economy is in very good shape, reinforced yesterday in the PBOC’s 4Q20 Monetary Policy implementation report. In a nutshell, the report confirmed Chinese authorities are tightening monetary policy at a pace that strikes a "balance between supporting growth recovery and preventing risks".

As is well known, the outlook for the Chinese economy is extremely important for the outlook for the Australian economy. Reassured by a supportive macro drop, the AUD/USD has easily shrugged off last week's dovish RBA communique.

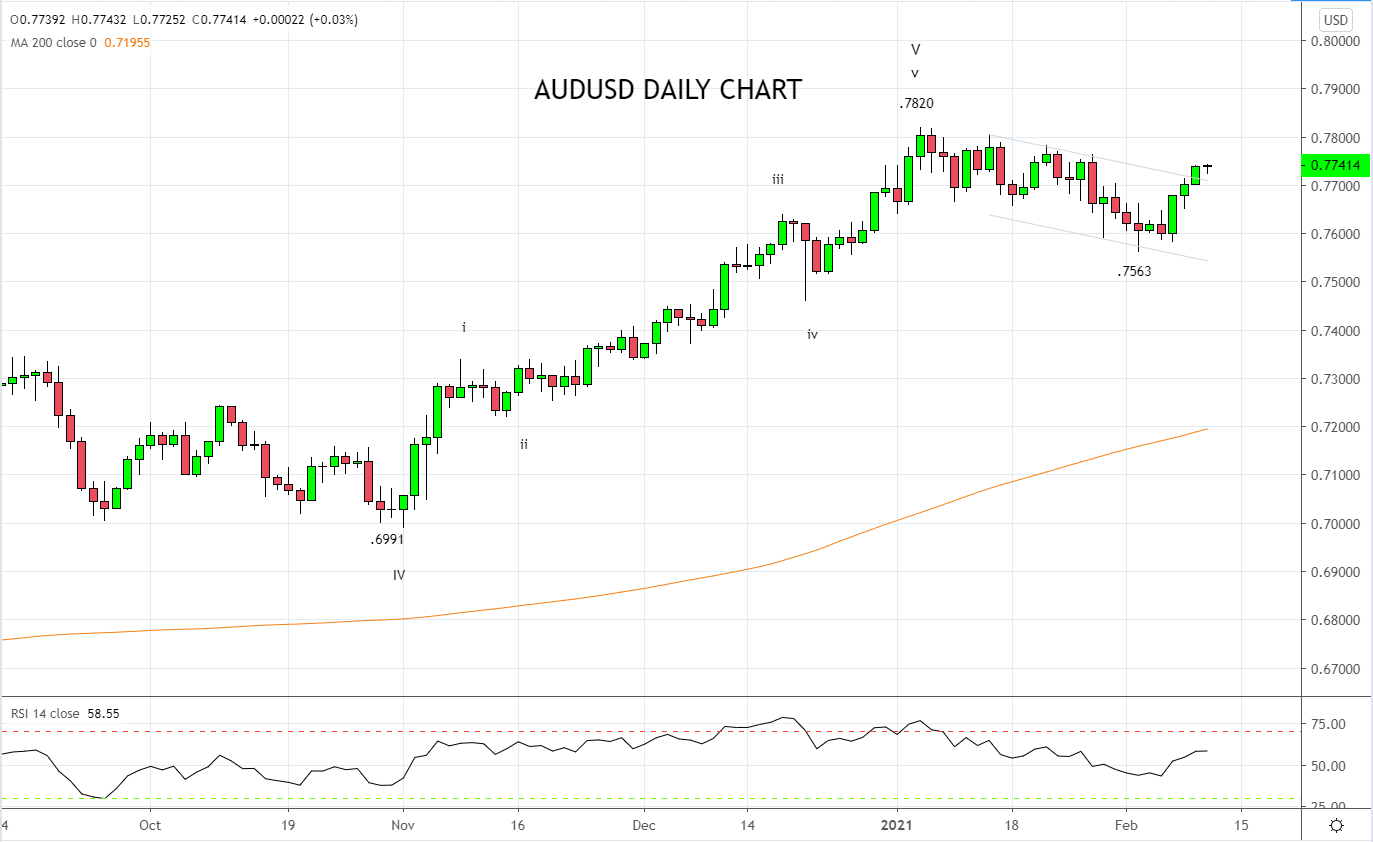

Technically, the break above key resistance at .7700/10 indicates the recent correction in the AUD/USD is compete at the .7563 low. Long AUD/USD positions on dips towards .7710, are favoured in anticipation of a retest of the January .7820 high, before .8000c.

Source Tradingview. The figures stated areas of the 10th of February 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation