Well, very low if the trend of disappointing macro data continues…

As bond prices rise and yields fall, yield-seeking investors’ default position is to continue favouring equities over other assets as they provide comparatively higher returns for acceptable levels of risk, even if the outlook for corporate earnings growth continues to deteriorate with a slowing global economy. Meanwhile the opportunity cost for holding noninterest-bearing assets such as gold and silver, and currencies where yields were already very low, such as the Japanese yen and Swiss franc, is falling as the race to zero and beyond for yields continue. So, both stocks and precious metals are currently on the rise. However, there is so much stocks can go higher from here as eventually the risks of an economic downturn will outweigh the benefits equities are receiving from falling yields and lower interest rates.

Indeed, the start of this week has been very bad for data, causing yields to sink further lower. On Monday we had poor manufacturing PMI data from around the world, including the Eurozone, UK and China. That poor run of form continued today with the release of disappointing services PMI from the UK, where activity nearly stagnated in June.

In the US, the services sector also cooled more than expected in June. According to the Institute for Supply Management (ISM), economic activity in the sector fell to its lowest level in almost 2 years. This helped to reinforce market expectations of a rate cut by the Federal Reserve later this month. The PMI came in at 55.1, its lowest level since July 2017 and down from 56.9 in May, missing estimates for a more modest drop to 55.9. The devil is in the detail, and although the sub-indices for prices and backlog of orders rose, new orders and more crucially employment fell with the latter sliding by 3.1 percentage points. This comes on the back of a disappointing payrolls data from ADP, which excludes the farming industry and government. The 102,000 increase in private payrolls was less than 140,000 expected by analysts.

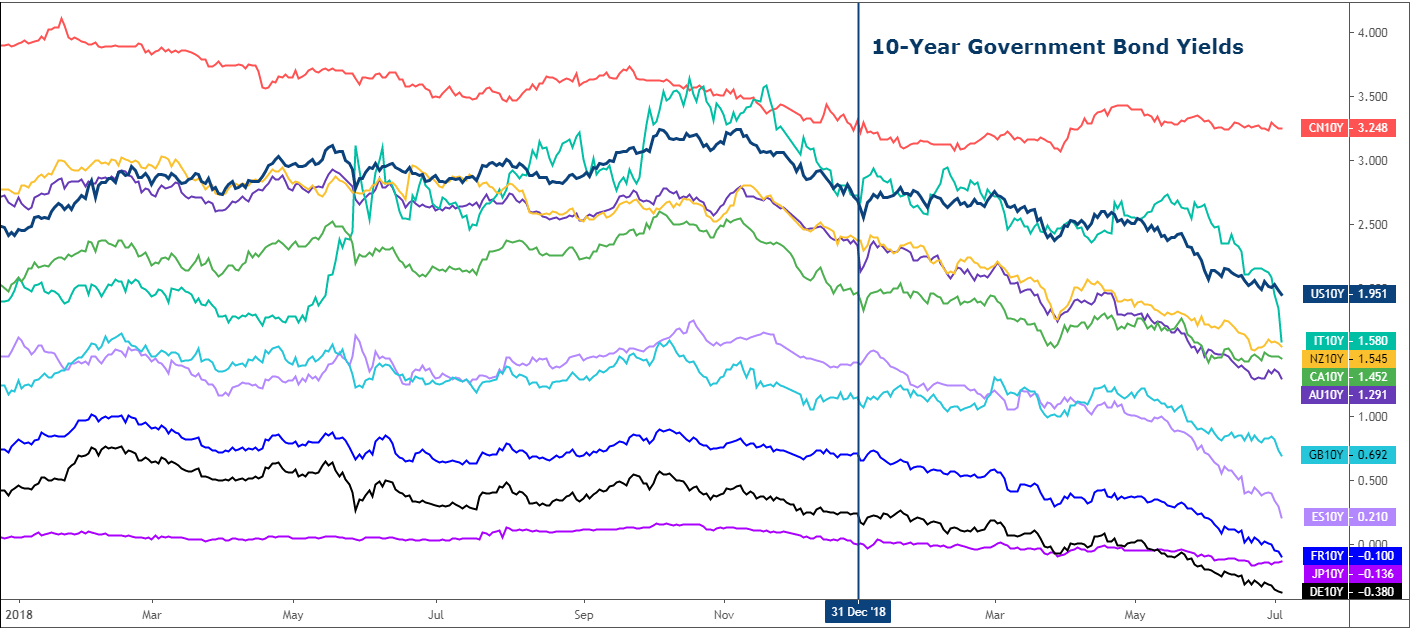

As can be seen from the chart below, only the Chinese 10-year yield has managed to rise slightly since the turn of the year. Japanese yields have dropped the least, but yields across Australasia, Europe and North America have all taken a nose dive. And if we have a poor nonfarm payrolls report on Friday then expect US yields to fall even further.Source: Trading View and City Index. Please note this product may not be available to trade in all regions.