After 4.5 years of wrangling a Brexit trade deal has finally been reached. The agreement is not yet sealed, and it still needs to be formally ratified by both sides. However, a swift and efficient ratification is expected. So far there have been no major signs of discontent from the UK backbenchers.

FTSE rises pre-announcement

The FTSE 250, which is more domestically focused rallied 1.2% hitting a 10 month high. The international FTSE 100 closed prior to the announcement but extended yesterday’s gains in early trade closing up 0.1%. Stocks linked to the economic health of the economy benefitted the most with banks and house builders dominating once again the FTSE leader board.

Where next for the FTSE?

The cleaning up of the Brexit saga will bring some relief to investors. However, the immediate reaction in FTSE futures has been one of buy the rumour sell the fact.

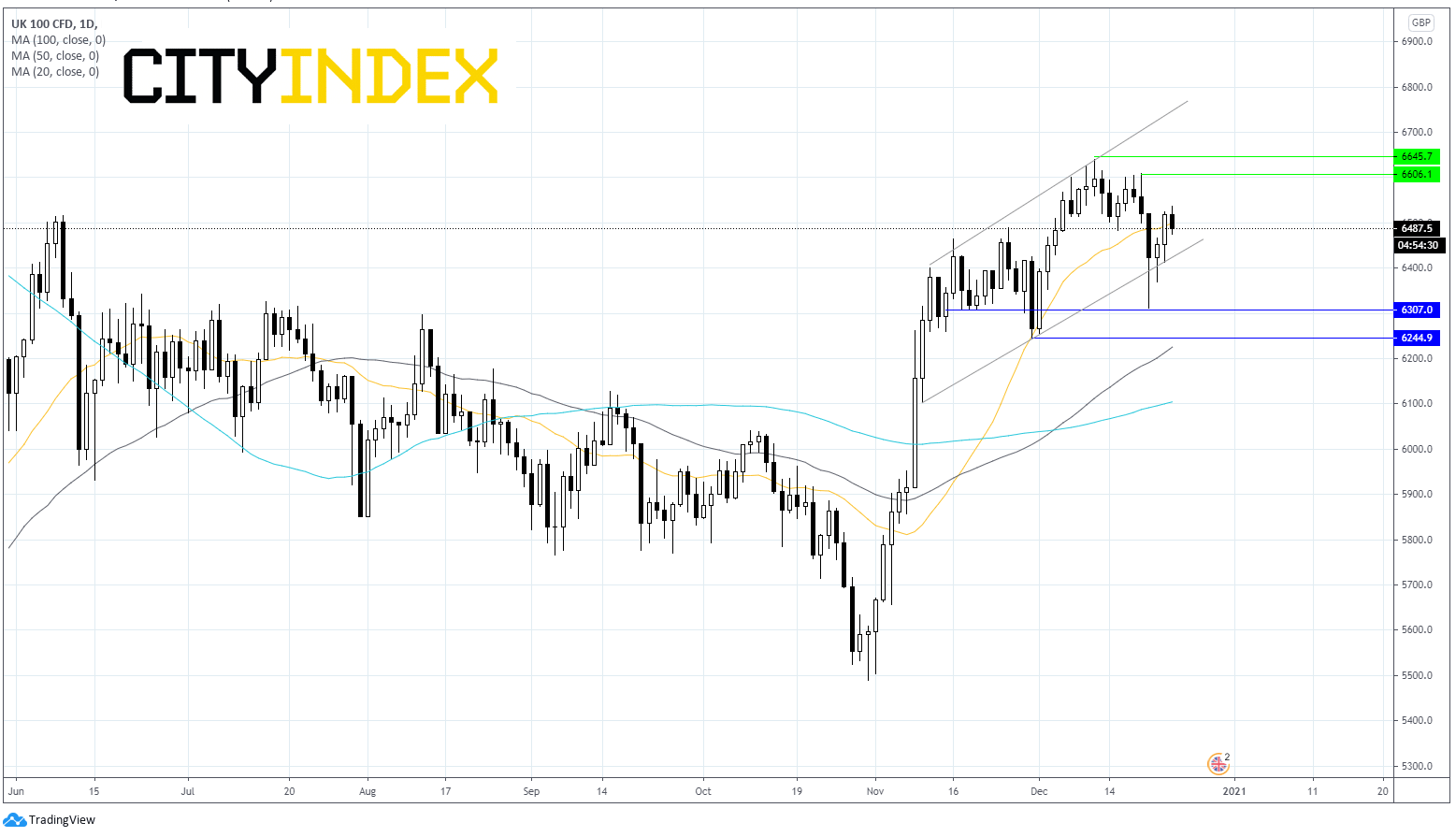

FTSE futures are -0.4%, although continue to trade within an ascending channel dating back to early November. The index is testing its 20 sma but trades above its 50 and 100 sma suggesting a medium term bullish bias.

A break below the 20 sma at 6490 could see the FTSE decline towards the lower band of the ascending channel at 6435. A break down of this level could open the door to 6300 horizontal support which has offered support since early November and then 6245 December low and 50 sma.

Immediate resistance can be seen at 6536 today's high, prior to 6600 (high 18th Dec) before 6645 (December high) prior to 6850 (March high).

Learn more about trading indices.