Hong Kong Exchange (388.HK) Jumped on More IPO Initiation

Hong Kong Exchange jumped more than 7% after more Chinese Technology companies would initiate the IPO in Hong Kong Exchange.

Ant Group, the largest online payment platform in China, announced its plan of listing in Hong Kong Exchange and Shanghai Exchange. Bloomberg reported that the fintech giant would target a $200 billion valuation (roughly HK$1.55 trillion) in valuation and seek raising $10 billion.

Besides, Didi Chuxing, a ride-hailing company in China, plans to list in Hong Kong as fast as this year, according to chinastarmarket.cn. The media reported that the company would target a valuation of $80 billion.

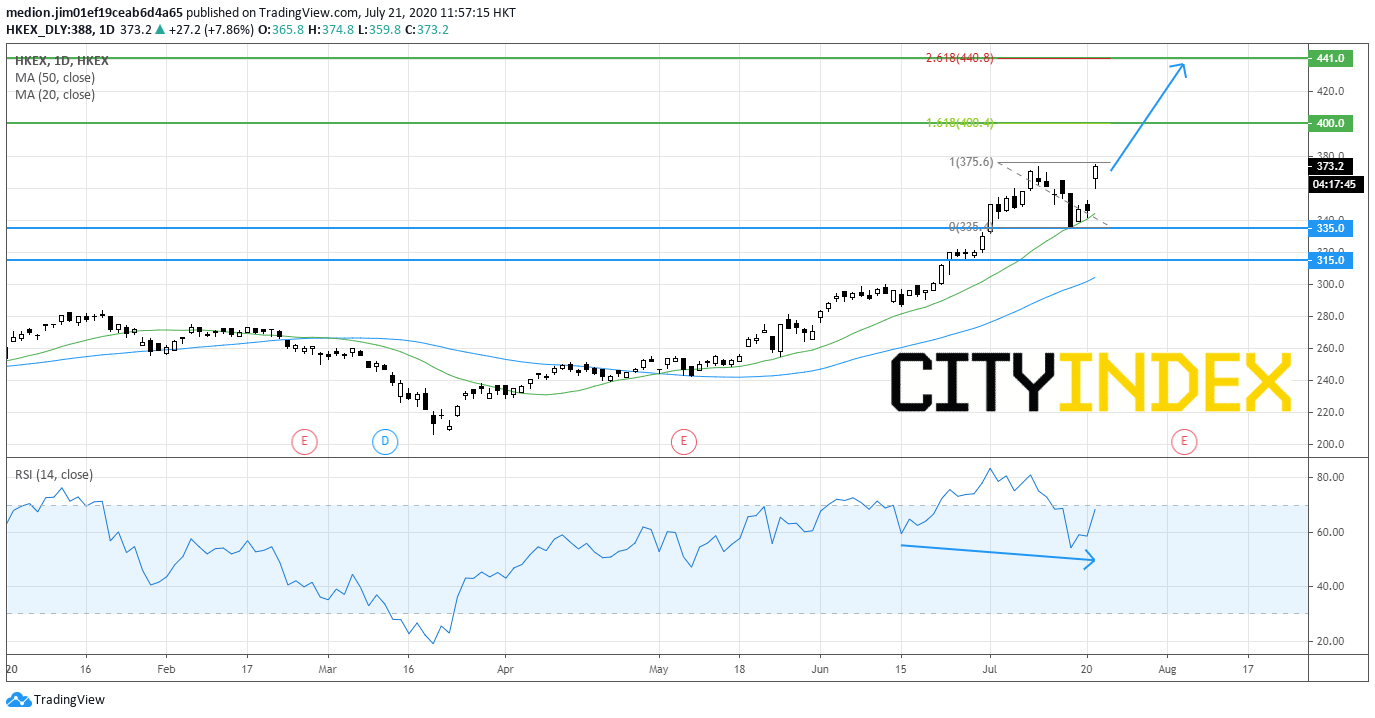

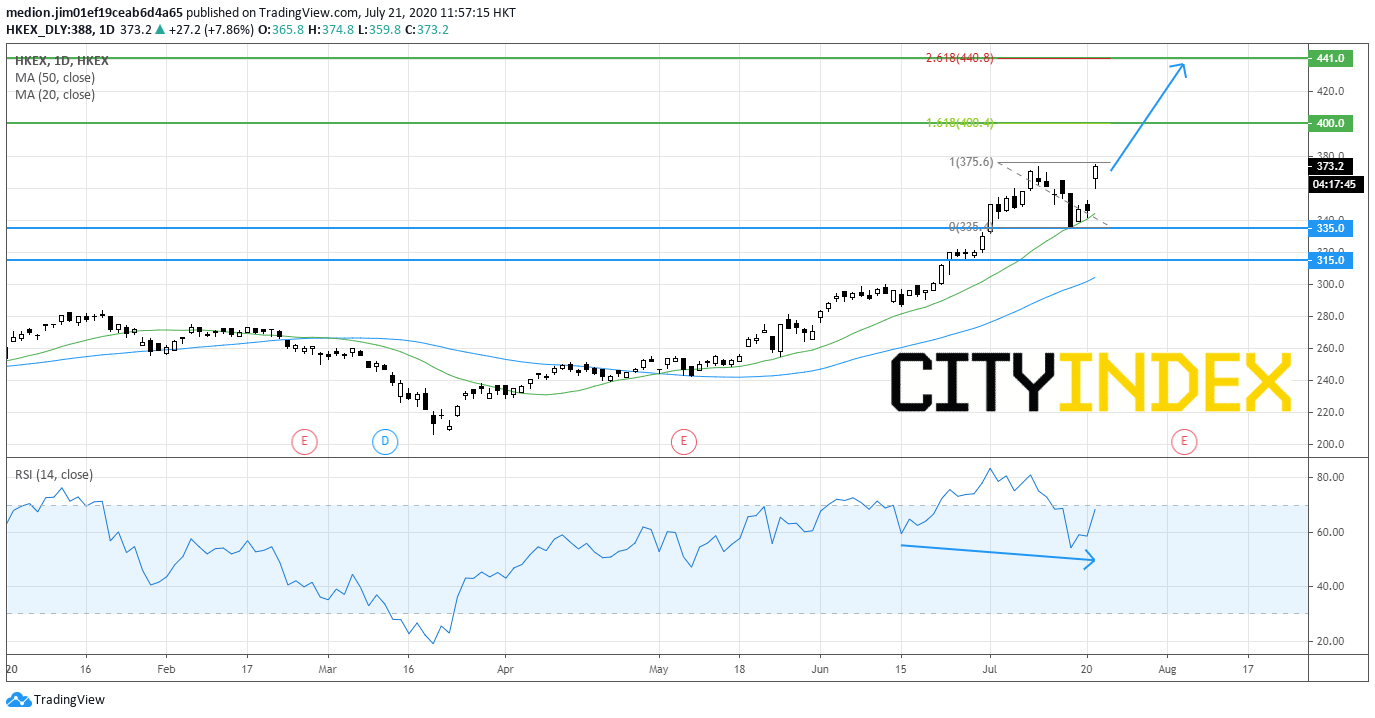

From a technical point of view, the stock posted a bullish gap after touching the 20-day moving average on the daily chart.

The RSI indicated a positive reversal signal, suggesting the resumption of recent uptrend.

Bullish readers could consider the nearest support level at the previous low at HK$335, while the resistance level would be located at HK$400 (161.8% retracement) and HK$441 (261.8% retracement).

Source: GAIN Capital, TradingView

Ant Group, the largest online payment platform in China, announced its plan of listing in Hong Kong Exchange and Shanghai Exchange. Bloomberg reported that the fintech giant would target a $200 billion valuation (roughly HK$1.55 trillion) in valuation and seek raising $10 billion.

Besides, Didi Chuxing, a ride-hailing company in China, plans to list in Hong Kong as fast as this year, according to chinastarmarket.cn. The media reported that the company would target a valuation of $80 billion.

From a technical point of view, the stock posted a bullish gap after touching the 20-day moving average on the daily chart.

The RSI indicated a positive reversal signal, suggesting the resumption of recent uptrend.

Bullish readers could consider the nearest support level at the previous low at HK$335, while the resistance level would be located at HK$400 (161.8% retracement) and HK$441 (261.8% retracement).

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM