Hon Hai Precision Industry (Foxconn) at “make or break” level

While the consumer-facing “big tech” stocks like Apple (AAPL) and Tesla Motors (TSLA) garner all the headlines, strong end-consumer demand also helps “upstream” suppliers of smartphones and parts for EVs.

The stock of Hon Hai Precision Industry (2317), better known as Foxconn, has been on a rampage since the start of December. The company, which is best known as the exclusive assembler of Apple’s (AAPL) 5G iPhone 12 Pro and iPhone 12 Pro Max, recently reported strong sales, prompting Wall Street analysts to raise price targets on the stock. Separately, the firm also signed a deal to manufacture vehicles for Byton Ltd., a high-profile Chinese EV startup, in addition to its ongoing supplier arrangement with Tesla. In today’s climate, it would be hard to pick a better combination of businesses for a manufacturer than smartphones and electric vehicles!

Hon Hai Precision Industry technical analysis

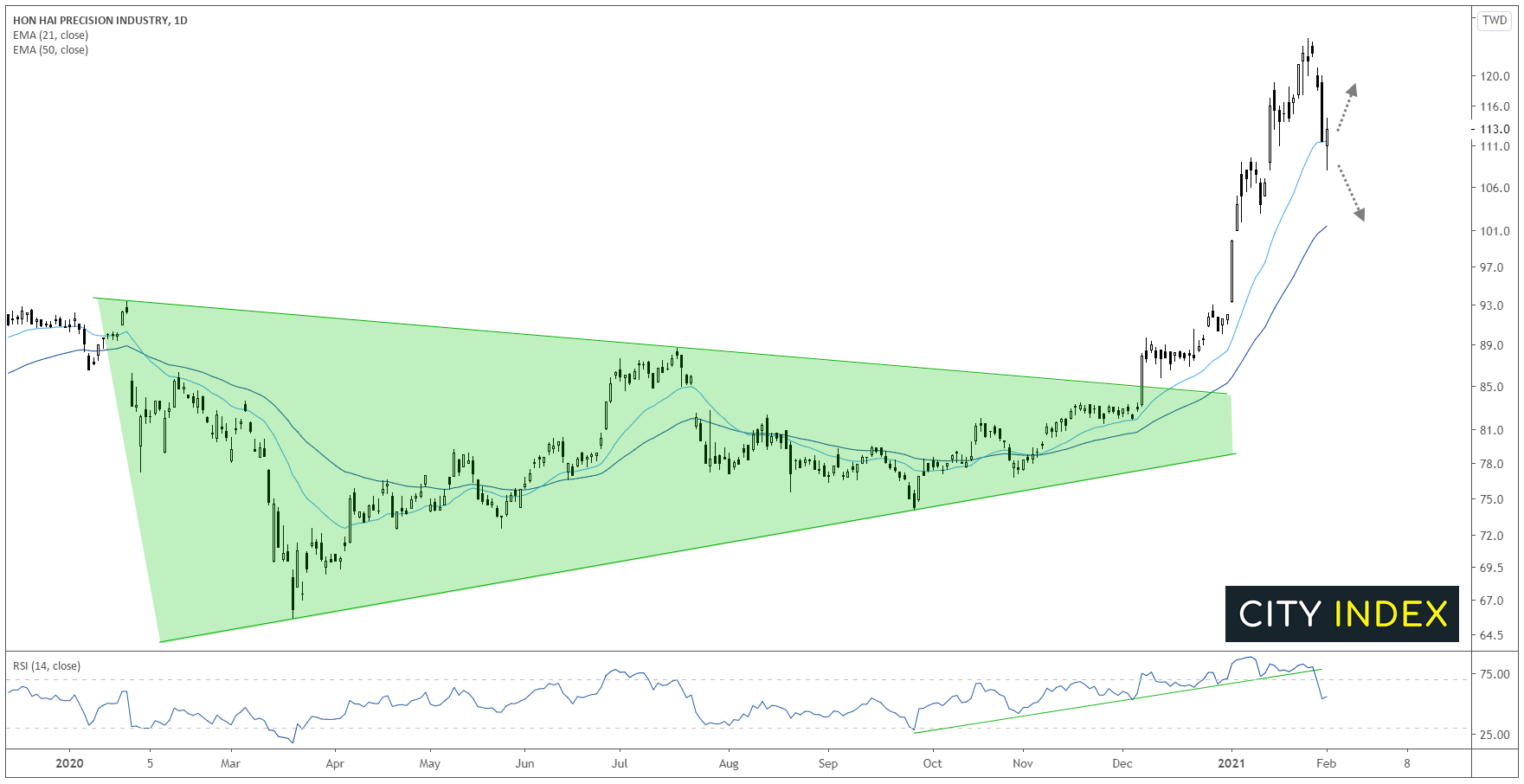

As the chart below shows, the stock spent the first 11 months of 2020 in an ever-tightening “symmetrical triangle” pattern. Following the breakout from this pattern on 7 December, the stock embarked on a high volatility rally all the way up to $125 by the middle of last week before pulling back to the 20-day EMA to close the week.

Moving forward, bulls are looking to make their stand near current levels. As long as the stock holds above its rising 21-day EMA, the path of least resistance will remain to the topside, with potential for a retest or break above the 3-year high near $125. On the other hand, a break below this support level would point to a deeper retracement toward the 50-day EMA near $100 next:

Source: TradingView, GAIN Capital

Learn more about equity trading opportunities.