Updated 8.07 PM BST

- Property sector falls 5% as non-doms, landlords targeted

- ‘Green’ power generator Drax biggest Budget ‘victim’

- ‘Challenger banks’ netted by surcharge

Major UK housebuilders and estate agents’ shares were among the biggest fallers on London’s stock exchange on Wednesday afternoon as investors reacted to the removal of tax benefits for ‘non-doms’ in the Summer 2015 Budget.

The group is widely seen as being highly active in the property market, particularly in London.

In what may have been a combined policy focus on the ‘Buy to Let’ part of the residential property industry, Chancellor George Osborne also announced a reduction of mortgage interest relief on homes purchased by landlords.

The moves will be phased in gradually from 2017, with the exemption eventually being limited to the 20% rate of income tax.

But the news had an immediate negative effect on the UK homebuilding sector.

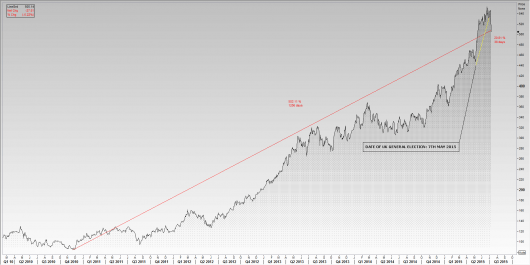

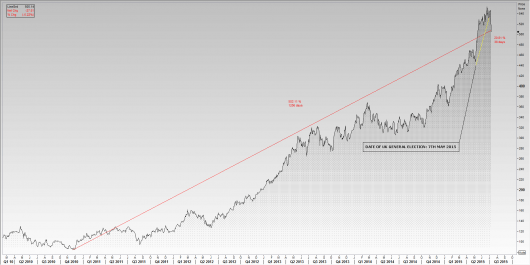

Thomson Reuters’ UK Homebuilding index, which had advanced about 21% since The Conservative Party was returned to government as the single ruling party in May, traded almost 5% lower, wiping out its rise in June.

With many of the sector’s shares having rocketed about 80% in a year, investors were very likely to have already been on the lookout for reasons to reduce.

The index was still more than 502% higher since November 2010, though every stock in the UK sector was trading in the red at the time of writing.

Thomson Reuters UK Homebuilding Index (equity sector index)

Please click to enlarge image

| TICKER |

Name |

Last |

Pct.Chng |

Net Chng |

| BDEV.L |

BARRATT DEVLPMNT |

599.155 |

-4.996 |

-31.5 |

| BWY.L |

BELLWAY |

2279 |

-4.804 |

-115 |

| BKGH.L |

BERKELEY GRP |

3142 |

-5.787 |

-193 |

| BVS.L |

BOVIS HOMES GRP |

1090.78 |

-3.194 |

-36 |

| CWD.L |

COUNTRYWIDE |

524 |

-2.602 |

-14 |

| CRST.L |

CREST NICHOLSON |

521 |

-5.1 |

-28 |

| FOXT.L |

FOXTONS |

211.924 |

-3.984 |

-8.8 |

| GFRD.L |

GALLIFORD TRY |

1692.78 |

-3.136 |

-54 |

| LSL.L |

LSL PROPERTY |

376.75 |

-0.133 |

-0.5 |

| PSN.L |

PERSIMMON |

1886 |

-4.167 |

-82 |

| RDW.L |

REDROW |

444.1 |

-2.801 |

-12.8 |

| RMV.L |

RIGHTMOVE ORD |

3161 |

-0.691 |

-22 |

| TW.L |

TAYLOR WIMPEY |

179.3605 |

-3.288 |

-6.1 |

| SVS.L |

SAVILLS |

954.5 |

-0.934 |

-9 |

| ZPLAZ.L |

ZOOPLA PROPERTY |

226.9 |

-4.544 |

-10.8 |

Data provided by Thomson Reuters

Drax’s climate-change benefits unplugged

Whilst our view remains that the market reaction has been limited, broadly speaking, there have nevertheless been some marked stock market moves, in reaction to specific policy changes announced by the Chancellor today.

The sharpest was a 28% fall of FTSE 250-listed mid-cap Drax Group Plc.

The firm runs a power station of the same name that is the largest in the United Kingdom, producing around 8% of Britain’s electricity.

Drax shares closed at an all-time low of 254p after a climate-change tax exemption was scrapped.

This had an implied taxation impact for Drax that was estimated by traders to be as high as £50m of its operating profit.

The group said in a statement on Wednesday evening that its initial estimate for a reduction in Ebitda was in the region of £30m in its current financial year, but that would spike to £60m in 2016.

“Thereafter we expect impact to reduce” it said.

Whilst virtually all large UK power companies produce some energy from sources that were eligible for climate-related tax relief, Drax Group is thought to make the most, with its eponymous power station the largest coal-fired generator in Western Europe.

Barclays restructures C-Suite

UK Bank stocks were also in focus for most of the day, even before the Chancellor rose to speak.

Barclays hogged the spotlight in the sector with surprise news for many, if not all, that it was dismissing its CEO of three years Antony Jenkins.

It was reported that the bank’s chairman, John McFarlane, who joined the firm three months ago, fired Jenkins due to a loss of support amongst the board, particularly non-executive directors.

McFarlane will assume executive duties until a permanent successor is appointed.

He had signalled his intention when he started work in April, to speed up the pace of Barclays’ transformation that is focused on divestment of non-core assets, improving returns and cutting costs.

Its stock closed 2% higher having risen as much as 3.5%.

Some of that retreat is undoubtedly due to one of the main planks of the economic announcements made in Parliament today which introduced a new tax on banks, even after signalling the abolition of another.

The Chancellor said the UK’s ‘Bank Levy’ would be replaced by a surcharge on profits, a move likely to be welcomed by such global banks as HSBC.

That bank has said the levy was one factor it would take into account when considering whether to relocate its HQ abroad. It is due to announce a decision on the matter by the end of the year.

“I will, over the next six years, gradually reduce the bank levy rate, and after that make sure it no longer applies to worldwide balance sheets,” Osborne told Parliament.

In its place, he said he would introduce an 8% surcharge on bank profits from January 2016.

The surcharge will be somewhat offset by a reduction in corporation tax to 18%, another new Budget measure.

New bank surcharge flattens ‘Challengers’

Whilst the share price impact from the news on FTSE 100-listed banks looked contained, with only Standard Chartered, and Lloyds Banking Group closing lower, shares of newer entrants to the sector fell hard.

Aldermore Group, a small lender based in Reading, Berkshire, lost the most, falling 15%.

Virgin Money and Shawbrook Bank, the latter formerly owned by RBS, both fell 9%.

OneSaving Bank, which essentially put itself ‘in play’ in March, with no takers so far, slid 10%.

For the most part, these relatively small, so called ‘challenger’ banks had been exempt from the UK bank levy, even the milder ‘half-rate’.

But the introduction of the surcharge brings them under the scope of additional government taxation and may even reduce incentives for further new banking industry entrants.

Such an effect, if seen would contrast with one of HM Treasury’s stated policies of enabling more competition.

Most challengers’ stocks have been on the market for less than a year (OneSavings, floated in June 2014, has been listed the longest).

Aldermore rose the most since its March 2015 flotation adding 30% by the beginning of this week.

Shawbrook retains about 7% of gains that stretched above 20% from March to July.

Please click to enlarge image