Hella shares down after 1Q results

Hella, the automotive part supplier, reported that 1Q adjusted EBIT declined 49.2% on year to 56 million euros on revenue of 1.34 billion euros, down 14.4% (-10.6% currency and portfolio-adjusted). The company said it expects full-year currency and portfolio-adjusted revenue to be in the range of 5.6 billion euros to 6.1 billion euros and "the outlook for the coming months is relatively positive".

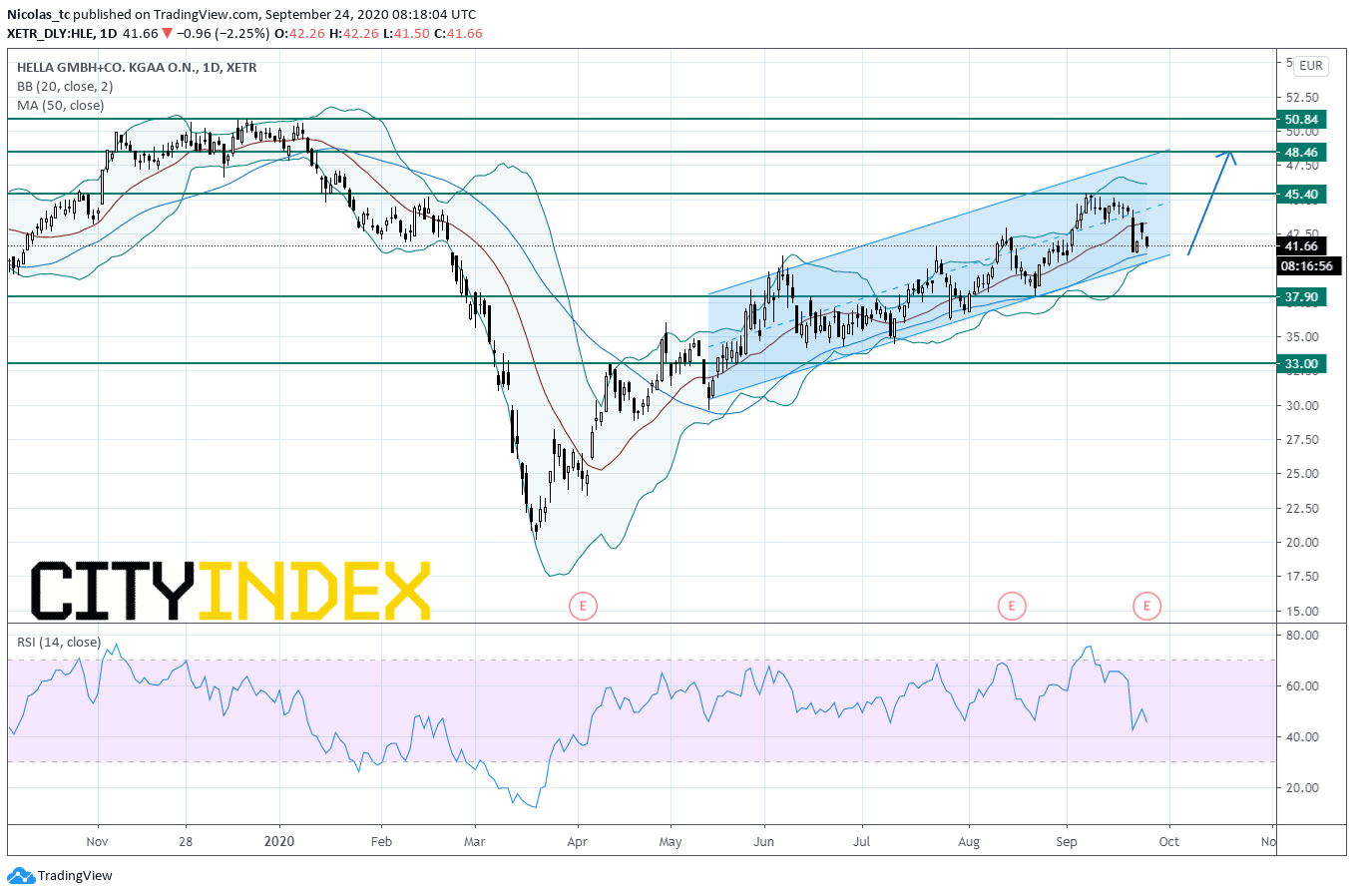

From a chartist point of view, the stock price remains within an upward-sloping channel in place since May 2020, supported by the rising 50-day simple moving average. However, the daily Relative Strength Index (RSI, 14) is losing upward momentum. A continuation of the consolidation move cannot be ruled out. The bias remains bullish as long as 37.9E is support. A break above 45.4E would open a path to see the previous top at 50.84E.

Source: GAIN Capital, TradingView

Latest market news

April 25, 2024 03:09 PM

April 25, 2024 03:00 PM

April 25, 2024 01:12 PM

April 25, 2024 11:14 AM