Has Gold Moved Too Far, Too Fast?

As funds move out of risky assets, such as stocks, one of the asset classes that tend to benefit the most is precious metals. With the recent onslaught of negative data (such as the recent PMI data or the ZEW data released in Europe) and negative news from around the world (including the China-US trade war, the outcome of the primary elections in Argentina, or the protest situation in Hong Kong), one of the precious metals that tends to be most attractive is gold. Simply put, gold is considered a “flight to safety” asset.

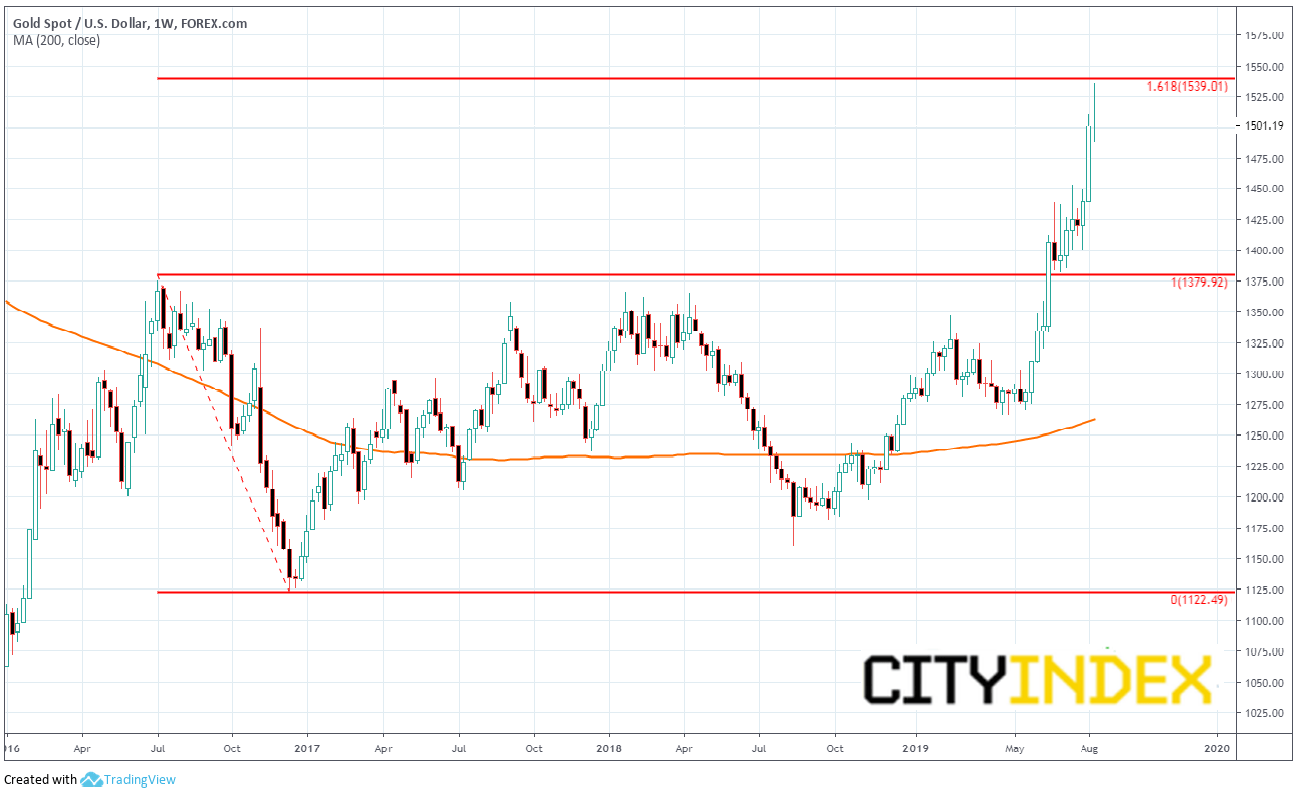

From July of 2014 to June of this year, gold traded in sideways channel between 1122.50 and 1380. However, recently, Gold broke out of that channel and has traded as high as 1531. In less than 2 months, gold has moved over 150 points!

But why has Gold halted its ascent here at 1531? One fundamental reason is that the US said today that it will delay tariffs on some items until December 15th. However technically, we can see on a weekly chart that Gold is very close to Golden Fibonacci ratio of 161.8% of the move from the highs to the lows of the trading channel of the last 5 years.

Source: Tradingview, FOREX.com

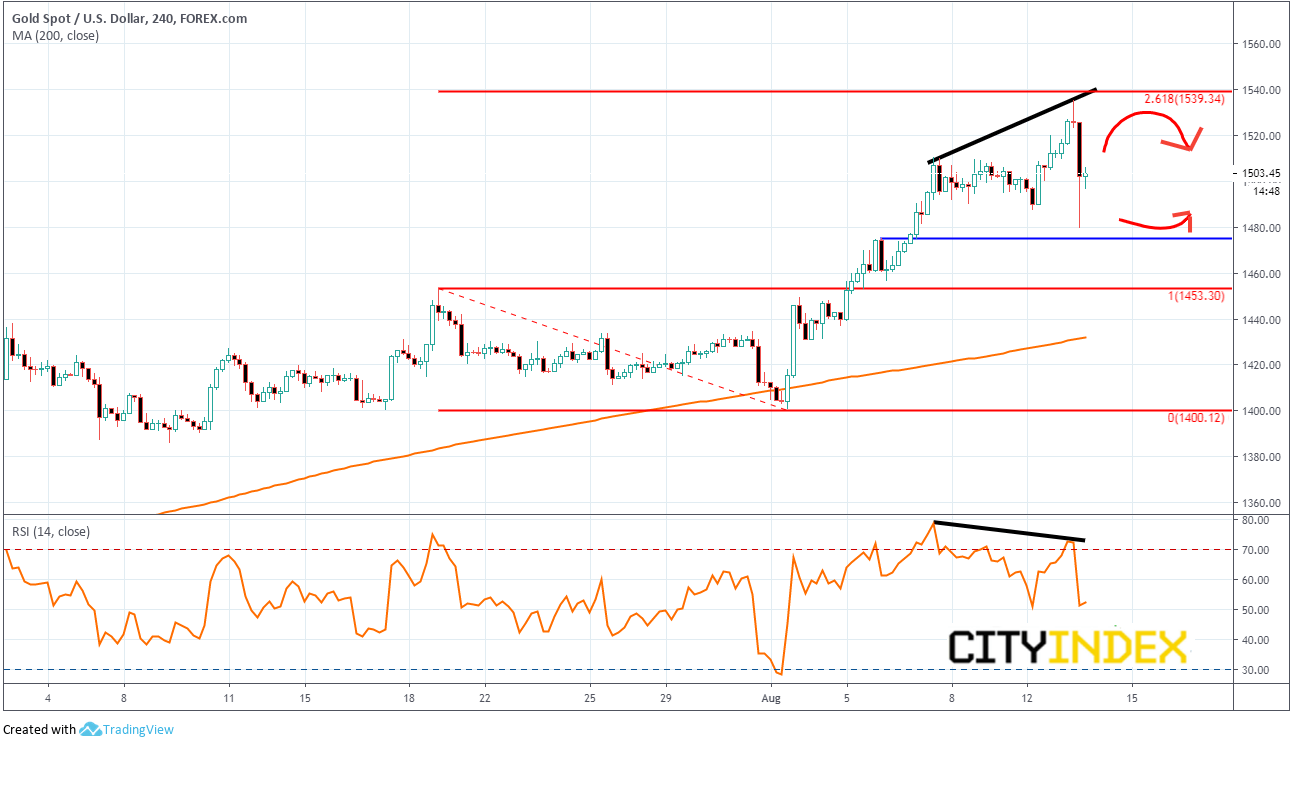

If we zoom in and take a look at a 240 minute chart, this makes our case more compelling:

- Gold has reached the 261.8% Fibonacci ratio of the move of the channel Gold was in from July 18th to August 5th.

- Gold was near the top of the rising trendline

- Gold has been diverging from the RSI since August 7th

- The RSI is in overbought territory

- At the highs, gold put in a shooting star candle, often indicative of a reversal.

Source: Tradingview, FOREX.com

As gold sold off, it did manage to hold horizontal support at 1474.2 and bounce back above 1500. China data out later and the ongoing geopolitical events need to be carefully monitored for direction. However, well defined support and resistance levels sit at 1474.2 and 1539.3.