In fact, investors should focus on the price action after the re-open of the China market as the Hong Kong market should have more trading volume to reflect the sentiment of most market participants.

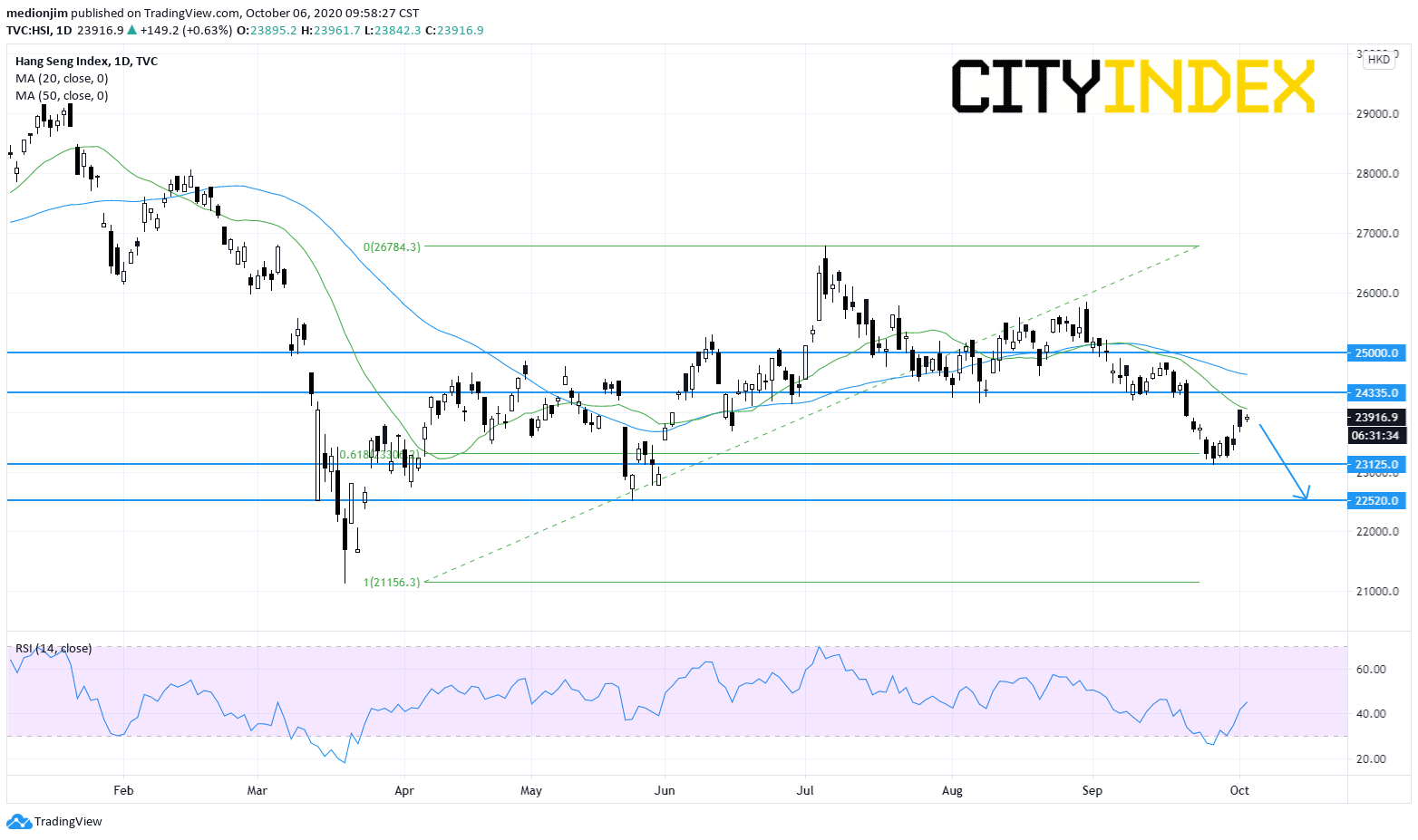

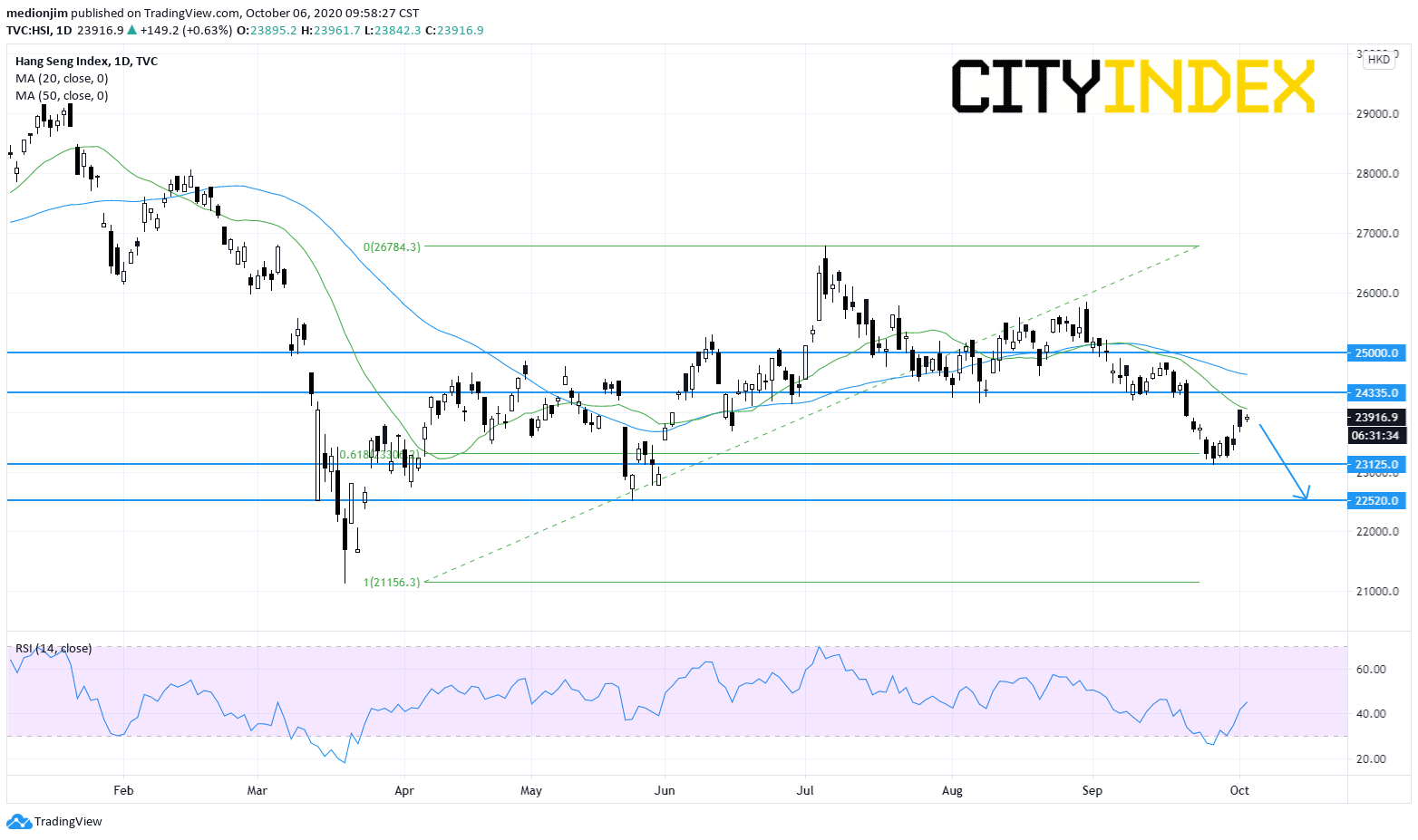

From a technical point of view, the index posted a rebound from 23125 after hitting 61.8% fibonacci retracement level on a daily chart, but it is still capped by a declining 20-day moving average.

As long as the resistance level at 24335 is not surpassed, the index could consider a return to 23125 before dropping to the next support level at 22520. Alternatively, a break above 24335 would call for a stronger rebound to 25000.

Source: GAIN Capital, TradingView

Hang Seng Index: Watch the Key resistance level at 24335

The Hong Kong Hang Seng Index rallied 1.3% yesterday, lifted by heavily weighted stocks, such as Tencent, HSBC, Alibaba and AIA. However, 17 index composite stocks remained down. In addition, the volume of the Hong Kong market is below HK$100 billion, which is relatively low to normal trading days. It suggested that the rise of the Hang Seng Index could not reflect the change of market sentiment.

In fact, investors should focus on the price action after the re-open of the China market as the Hong Kong market should have more trading volume to reflect the sentiment of most market participants.

From a technical point of view, the index posted a rebound from 23125 after hitting 61.8% fibonacci retracement level on a daily chart, but it is still capped by a declining 20-day moving average.

As long as the resistance level at 24335 is not surpassed, the index could consider a return to 23125 before dropping to the next support level at 22520. Alternatively, a break above 24335 would call for a stronger rebound to 25000.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM