Short-term technical outlook on Hang Seng Index (Hong Kong 50)

click to enlarge charts

Key Levels (1 to 3 days)

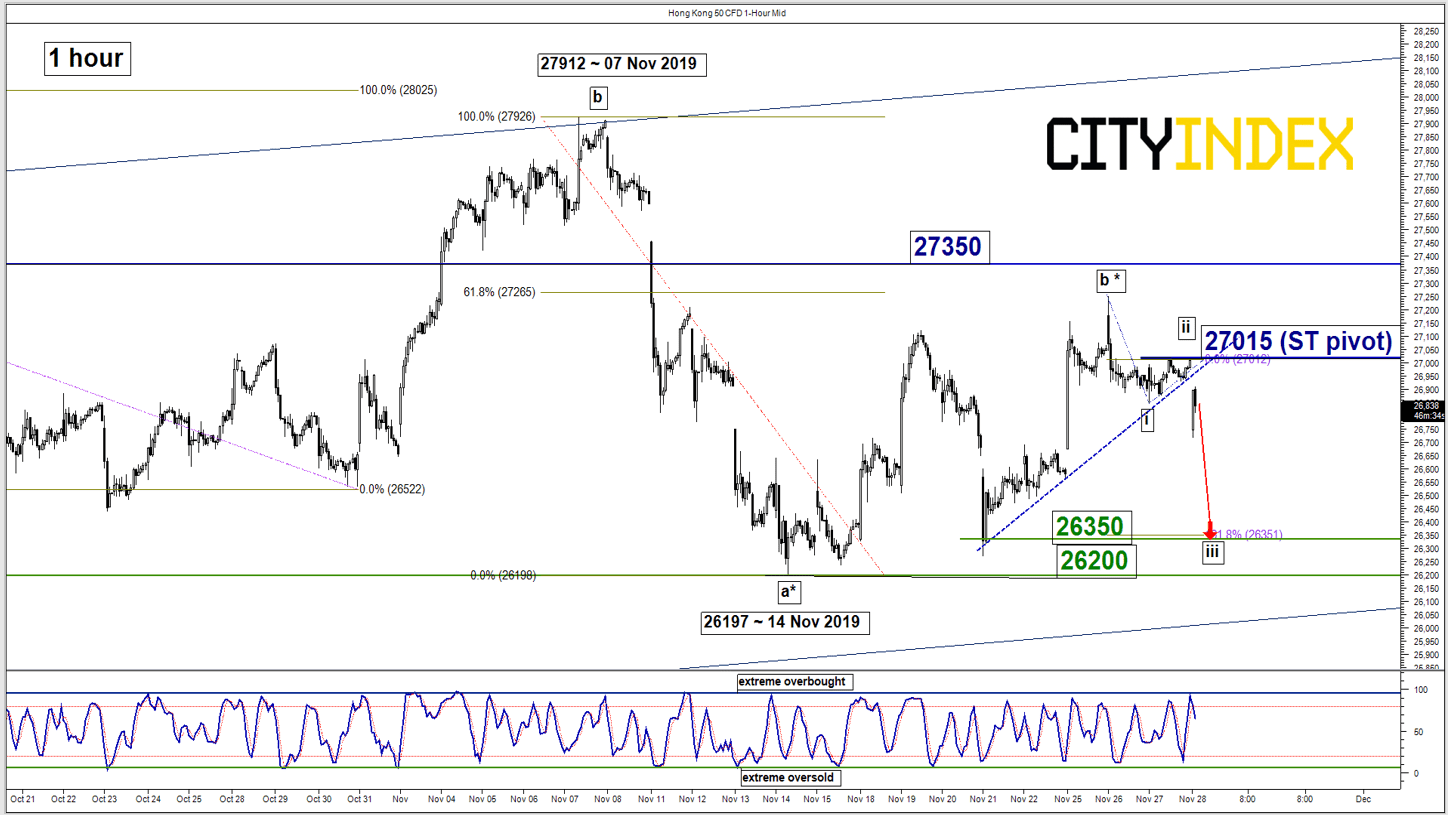

Pivot (key resistance): 27015

Supports: 26350 & 26200

Next resistance: 27350 (MT pivot)

Directional Bias (1 to 3 days)

Bearish bias below 27015 short-term pivotal resistance for the Hong Kong 50 Index (proxy for Hang Seng Index futures) for further potential drop towards the next significant near-term support at 26350 (the lower limit of a minor range configuration in place since 14 Nov 2019).

However, a break with an hourly close above 27015 negates the bearish tone for a squeeze up towards the 27350 medium-term pivotal resistance as per highlighted earlier in our weekly technical outlook report.

Key elements

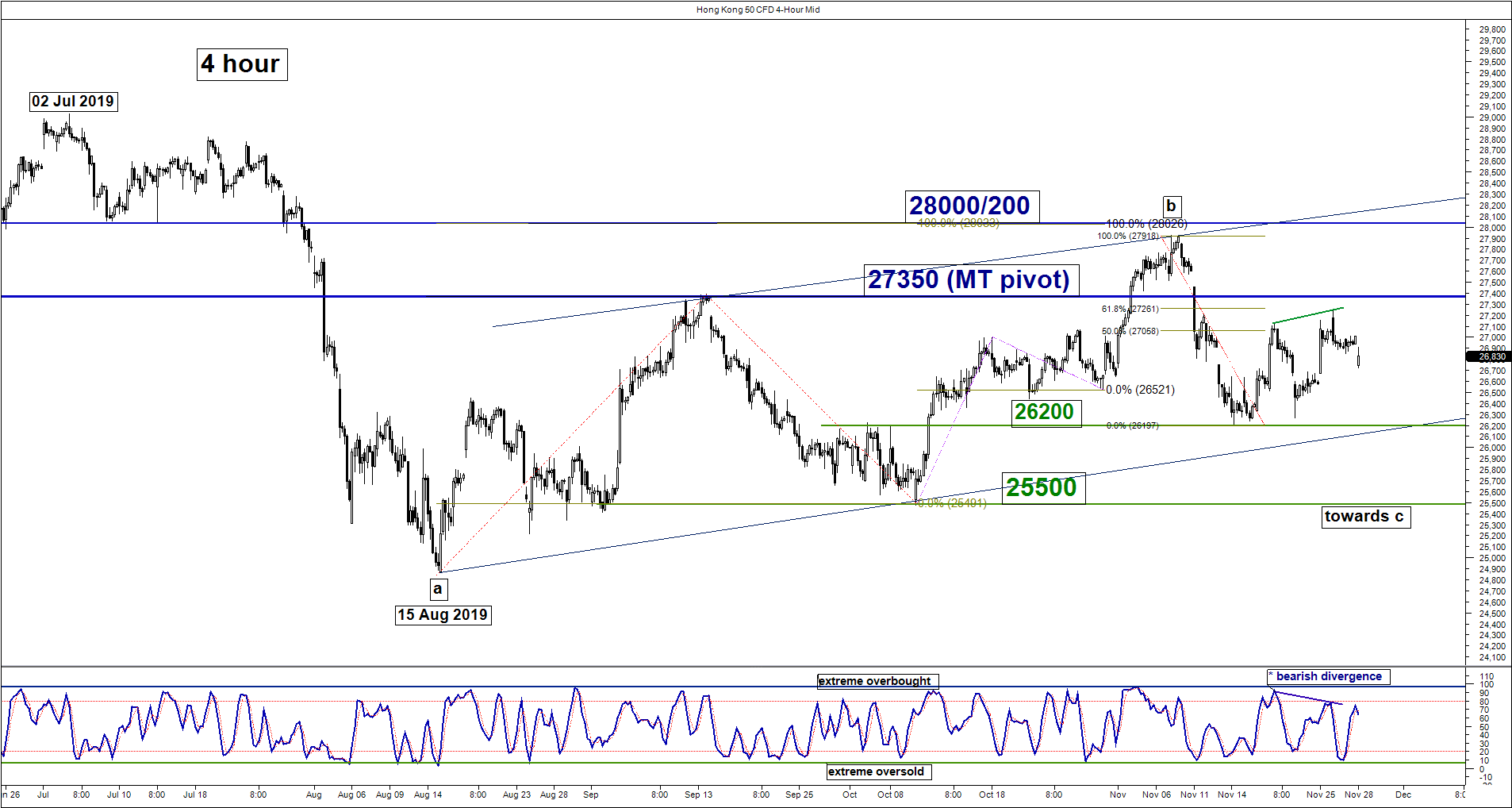

- The recent rebound from 21 Nov 2019 low of 26271 to 26 Nov 2019 high of 27250 has been accompanied by a bearish divergence seen in the 4-hour Stochastic oscillator at its overbought region which indicates that upside momentum of price action has started to ease. Thus, the rebound is likely to be more corrective in nature (dead cat bounce) rather than an impulsive up move sequence.

- The push up to 26 Nov 2019 high of 27250 also coincides with the 61.8% Fibonacci retracement of the prior slide from 07 Nov high to 14 Nov 2019 low and the 1.00 Fibonacci expansion of the recent rebound from 14 Nov low to 19 Nov high projected from 21 Nov 2019 low. These observations indicate a potential minor bearish reversal point at the 26 Nov 2019 swing high of 27250.

- The significant near-term support of 26350 is defined by the swing low areas of 15/21 Nov 2019 and the 1.618 Fibonacci expansion of the last push down from 26 Nov high to 27 Nov low projected from yesterday, 27 Nov U.S. session high of 27013.

Related analysis:

Trump Bumps Risk Appetite By Signing Hong Kong Bill

Stock Indices Weekly Technical Outlook: Key Decision Time For The Weary Bulls