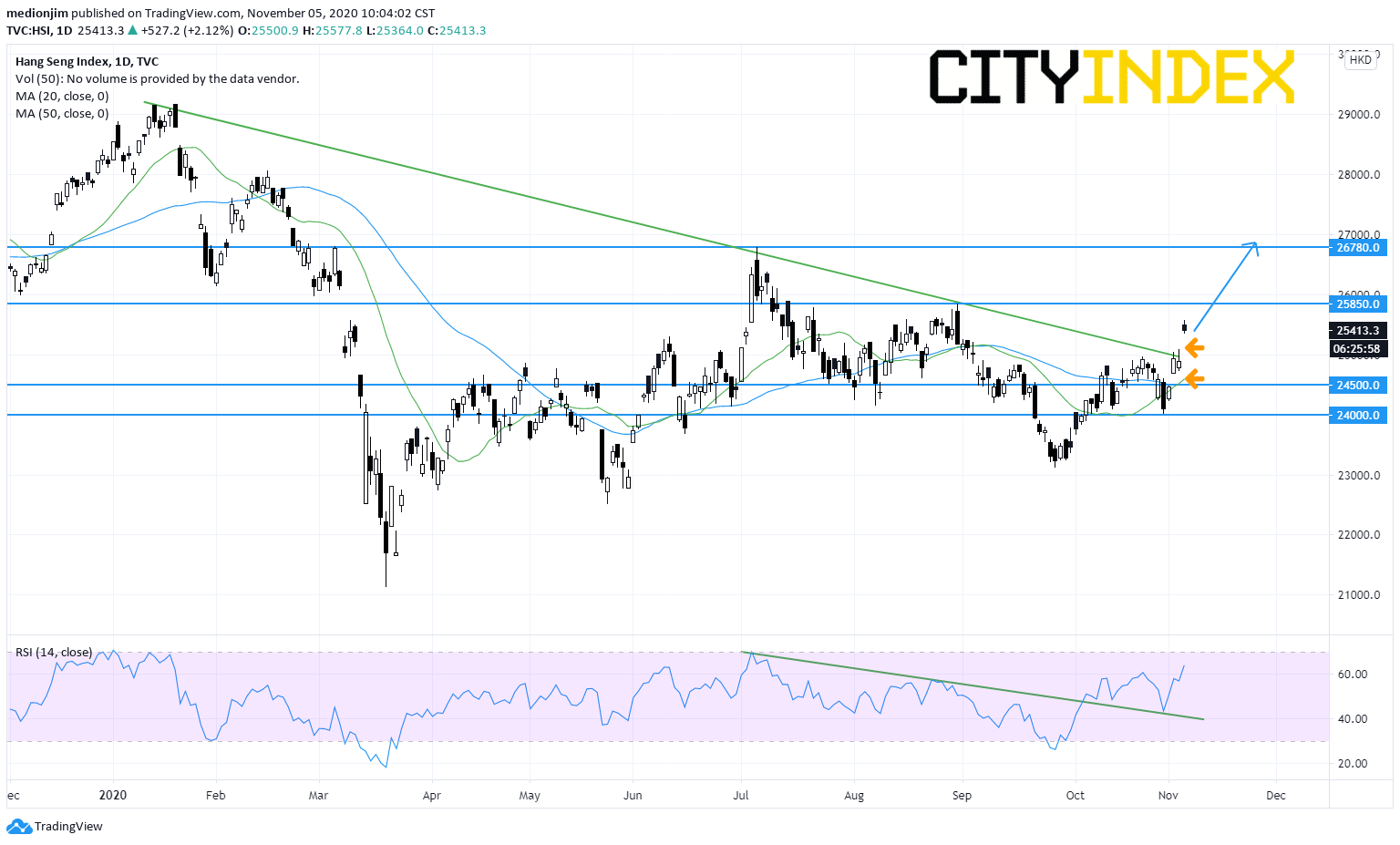

Hang Seng Index: Gap Up and Breaks Above an Important Declining Trend Line

The Hang Seng Index rebounds around 9% from September low, while China's Shanghai Composite Index bounces 3%. It suggests that the short term momentum of the Hong Kong market is stronger than the China's market.

On the economic front, Caixin China Service PMI rose to 56.8 in October (55.0 expected) from 54.8 in September. Key findings included: "Business activity expands at second-steepest rate since August 2010 (...) Total new order growth accelerates despite further dip in export sales (...) Business confidence improves to highest level since April 2012." Besides, China President Xi Jinping said China would be able to double the GDP by 2035.

On a daily chart, the Hang Seng Index opened a second gap and broke above a declining trend line drawn from 2020 top, suggesting a strong bullish reversal signal. The RSI also broke above a falling trend line drawn from July.

Bullish readers could put the nearest support level at 24500 (the gap occurred on November 3), while the resistance levels would be located at 25850 and 26780.

Source: GAIN Capital, TradingView

On the economic front, Caixin China Service PMI rose to 56.8 in October (55.0 expected) from 54.8 in September. Key findings included: "Business activity expands at second-steepest rate since August 2010 (...) Total new order growth accelerates despite further dip in export sales (...) Business confidence improves to highest level since April 2012." Besides, China President Xi Jinping said China would be able to double the GDP by 2035.

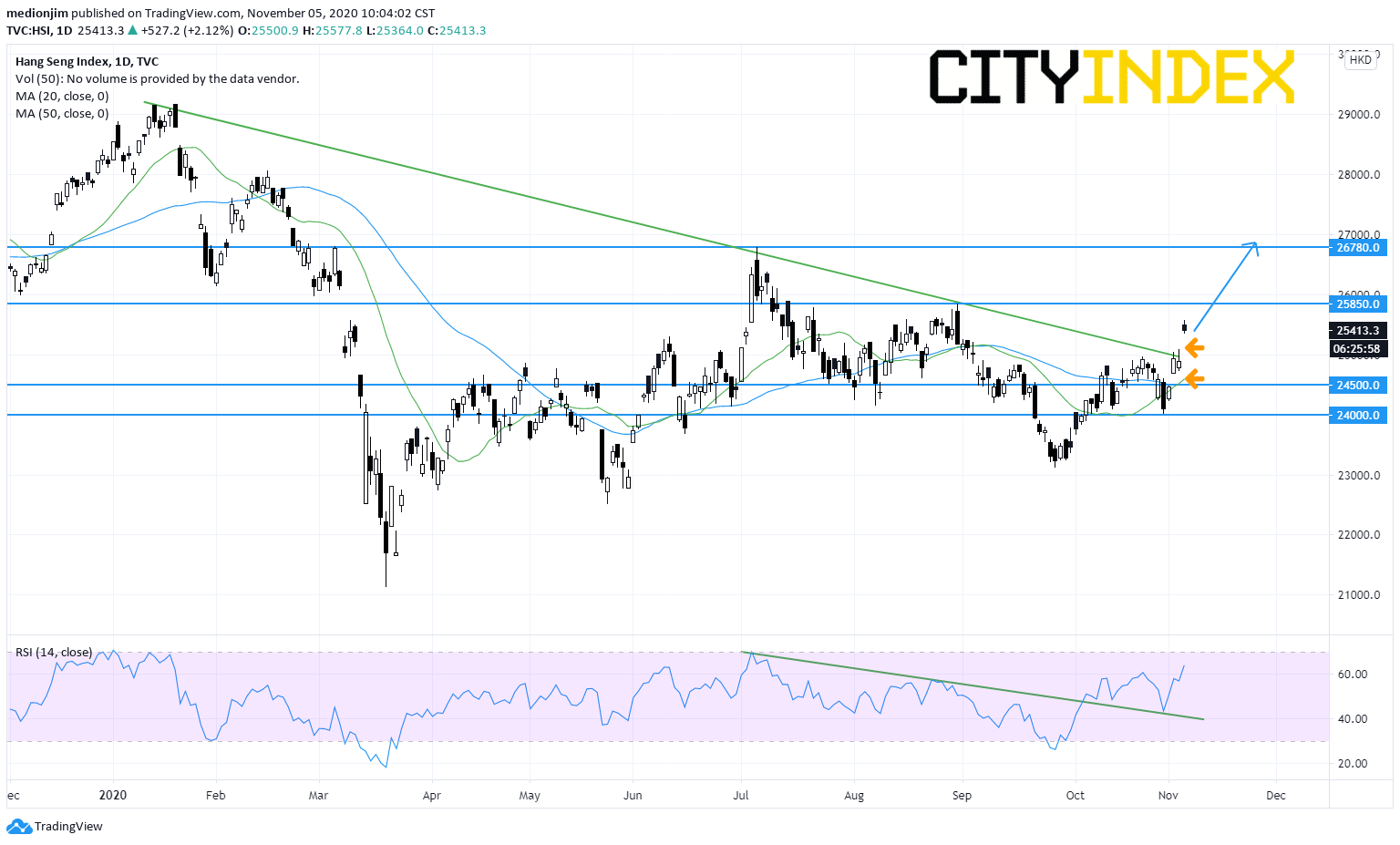

On a daily chart, the Hang Seng Index opened a second gap and broke above a declining trend line drawn from 2020 top, suggesting a strong bullish reversal signal. The RSI also broke above a falling trend line drawn from July.

Bullish readers could put the nearest support level at 24500 (the gap occurred on November 3), while the resistance levels would be located at 25850 and 26780.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM