Guangzhou R&F Properties Slumped on Bad 1Q Result

Guangzhou R&F Properties (2777) slumped around 5.5% after announcing its 1Q result. Meanwhile, the Hang Seng index plunged around 4.0% on the worry of the U.S. - China relationship.

Guangzhou R&F Properties, a real estate group, reported that 1Q net income plunged 83.5% on year to 67 million yuan on operating revenue of 9.79 billion yuan, down 4.9%.

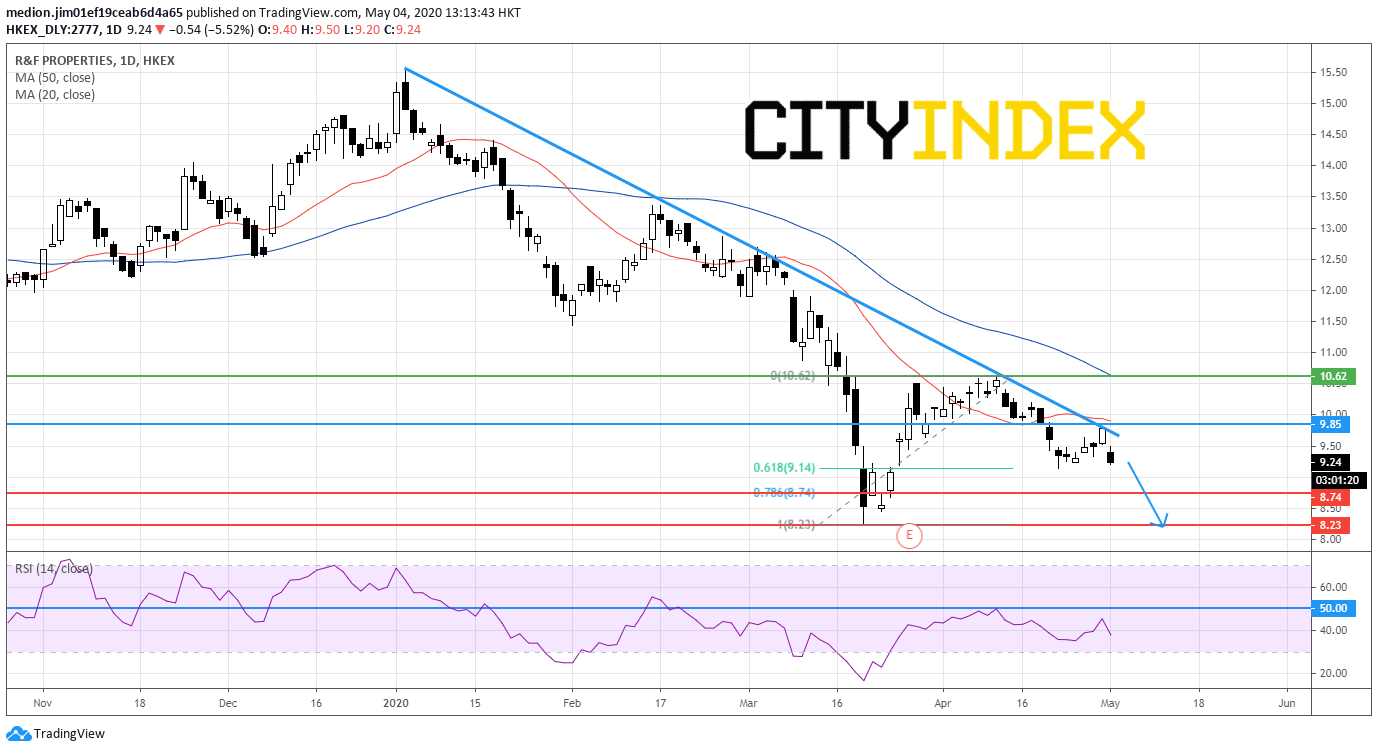

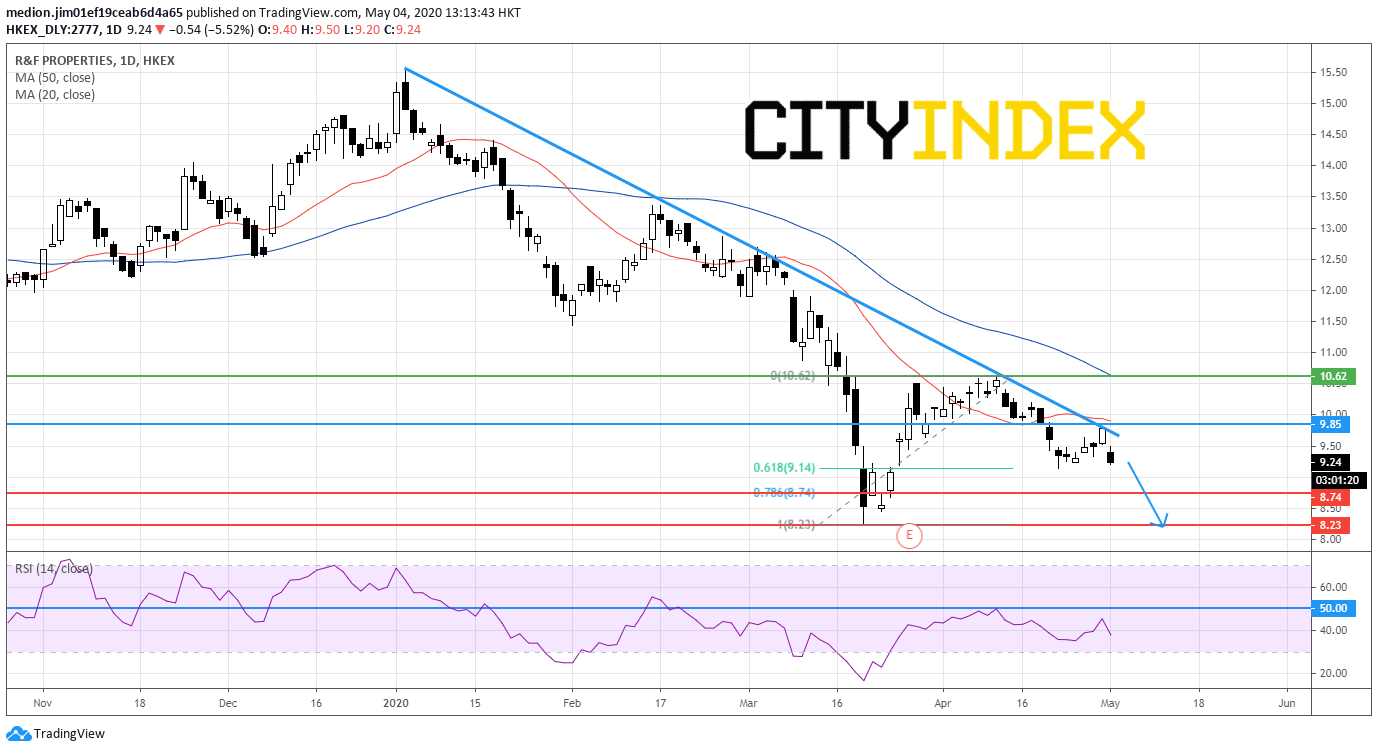

On a daily chart, the technical outlook of the stock would be bearish as the prices are trading below the declining trend line drawn from January top and both 20-day and 50-day moving averages. Currently, the prices are expected to test $9.14 (61.8% retracement level of current rebound and the low of April 22). The RSI has failed to penetrate the neutrality level and is turning downward. It suggests that the downward momentum for the prices remain intact. Therefore, as long as $9.85 is not surpassed, the stock would consider a return to $8.74 (78.6% retracement level of current rebound) and $8.23 (the low of March).

Alternatively, a break above $9.85 would suggest a bullish breakout of the declining trend line and trigger a rebound to $10.62 (the high of April).

Source: GAIN Capital, TradingView

Guangzhou R&F Properties, a real estate group, reported that 1Q net income plunged 83.5% on year to 67 million yuan on operating revenue of 9.79 billion yuan, down 4.9%.

On a daily chart, the technical outlook of the stock would be bearish as the prices are trading below the declining trend line drawn from January top and both 20-day and 50-day moving averages. Currently, the prices are expected to test $9.14 (61.8% retracement level of current rebound and the low of April 22). The RSI has failed to penetrate the neutrality level and is turning downward. It suggests that the downward momentum for the prices remain intact. Therefore, as long as $9.85 is not surpassed, the stock would consider a return to $8.74 (78.6% retracement level of current rebound) and $8.23 (the low of March).

Alternatively, a break above $9.85 would suggest a bullish breakout of the declining trend line and trigger a rebound to $10.62 (the high of April).

Source: GAIN Capital, TradingView

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM