Where next for Greggs share price?

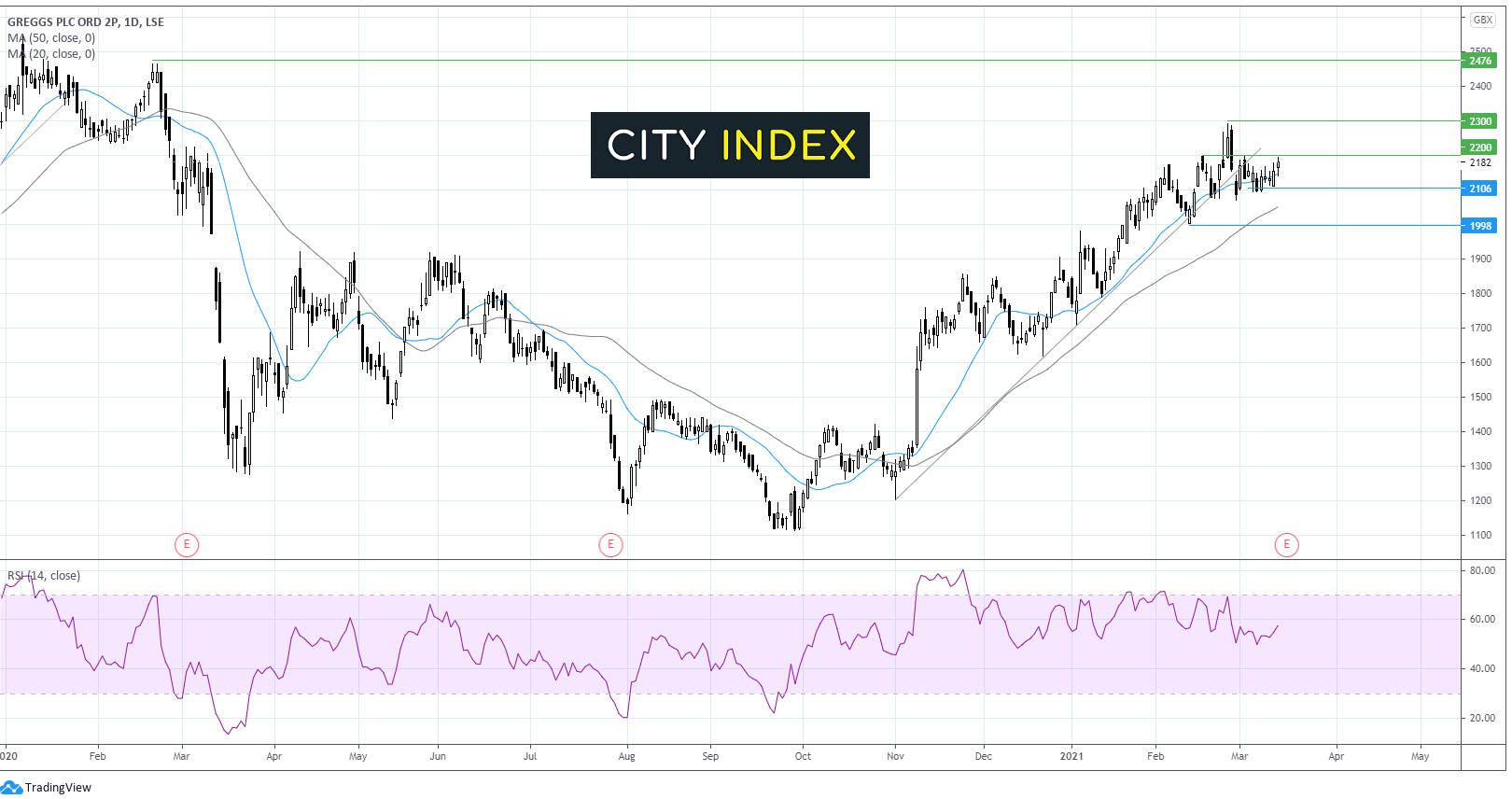

Greggs has traded in a firm uptrend since early November, although the rally appears to have run out of steam since the start of the month.

The share price has slipped below its three month ascending trendline after failing to push beyond 2200. The price has traded in a tight range of around 100 points since the start of the month capped on the upper side by 2200 and on the lower side by 2100.

The bias is very slightly tilted towards the upside, with the share price trading above the 50 sma and just above the 20 sma, whilst the RSI remains in bullish territory.

However, with results due tomorrow it could be prudent to wait for a breakout trade. A solid update and forward guidance could see the bulls push above 2200 to target near term resistance at 2300. A brea above this level would bring 2475 the pre-pandemic February high into play.

On the flip side. Disappointing numbers could see the bears take control. Sellers will be looking for a break below 2100 before support is tested at 2000 round number and February ’21 low. A breakthrough this level could negate the current bullish trend.

Learn more about trading equities