Greek Pin Action Will GBP Take on CHF s Safe Haven Mantle

As Greece’s debt negotiations deteriorated this weekend, traders piled in to buy the “safe-haven” Swiss franc. In turn, the rapid appreciation in the value of […]

As Greece’s debt negotiations deteriorated this weekend, traders piled in to buy the “safe-haven” Swiss franc. In turn, the rapid appreciation in the value of […]

As Greece’s debt negotiations deteriorated this weekend, traders piled in to buy the “safe-haven” Swiss franc. In turn, the rapid appreciation in the value of the franc prompted the Swiss National Bank (SNB) to intervene in the FX market to stabilize the gains in its currency. In explaining the move, SNB Chairman Thomas Jordan stated, “We have always said that we are active in the foreign exchange market if necessary…[a] situation like we experienced over the weekend is a situation which warranted this need and we went in to stabilize the market,” though he declined to provide details on the intervention. He went on to note that the central bank is “observing developments very closely.”

In our view, the SNB’s determination to prevent excess appreciation in the franc may limit the long-term safe-haven appeal of the Swiss currency, though it could still see short-term bouts of strength if alarming Greek headlines continue to hit the wires.

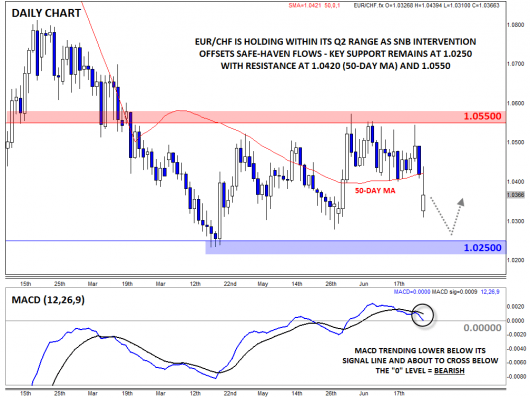

Technical Outlook: EURCHF

From a technical perspective, the SNB’s actions have clearly stabilized EURCHF, which remains within its three-month, 300-pip range from 1.0250 to 1.0550. In the immediate term, previous support at the 50-day MA (currently at 1.0420) could now provide resistance and cap any rallies. The established downtrend in the MACD indicator bolsters the bearish case. That said, the SNB does not appear comfortable with the EURCHF below 1.0250, so any downside could be limited to that area for now.

Technical Outlook: GBPCHF

By contrast, the technical outlook for GBPCHF is relatively constructive. In fact, the pair peeked out to a new 3-month high earlier today before reversing to trade back down below the 1.4700 level on the franc’s strength. Bulls will note that the daily MACD is still trending higher above its signal line and the “0” level, but the pair itself is trading below a short-term rising wedge pattern, which could lead to a near-term pullback toward the 50-day MA at 1.4460.

Fundamentally speaking, pound sterling may attract safe haven flows of its own if Greece moves further along the path toward default, so GBPCHF may resume its rally sooner rather than later; a close above 1.4800 in the next week or two would open the door for a potential move up toward 1.50 next.