Electric vehicles are one of the hottest topics in the financial market during 2020. GreatWall Motor (2333.HK) soars 160% in 2020, while Hang Seng Index is down 6%.

Recently, the company announced that the auto sales volume grew 26.1% on year to 142,200 units, while production volume increased 23.1% on year to 146,200 units. Besides, Credit Suisse retained "Outperform" on the company at the target price HK$17.5, up from HK$16.0.

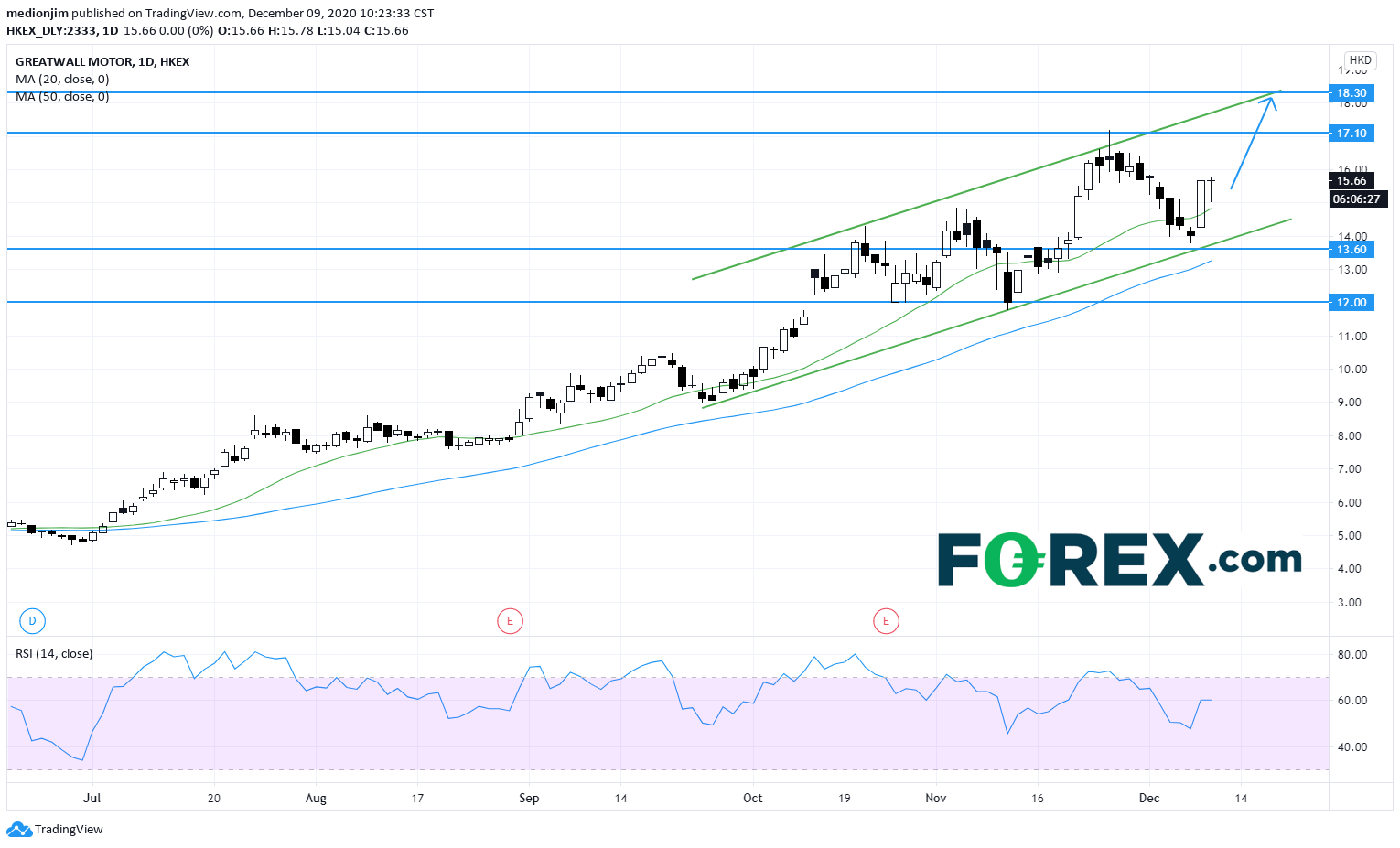

From a technical point of view, the stock is trading within the rising channel on a daily chart, indicating a bullish outlook. Currently, the prices stay above the 20-day and 50-day moving averages. Bullish readers could set the support level at HK$13.60, while resistance levels would be located at HK$17.10 and HK$18.30.

Source: GAIN Capital, TradingView

Recently, the company announced that the auto sales volume grew 26.1% on year to 142,200 units, while production volume increased 23.1% on year to 146,200 units. Besides, Credit Suisse retained "Outperform" on the company at the target price HK$17.5, up from HK$16.0.

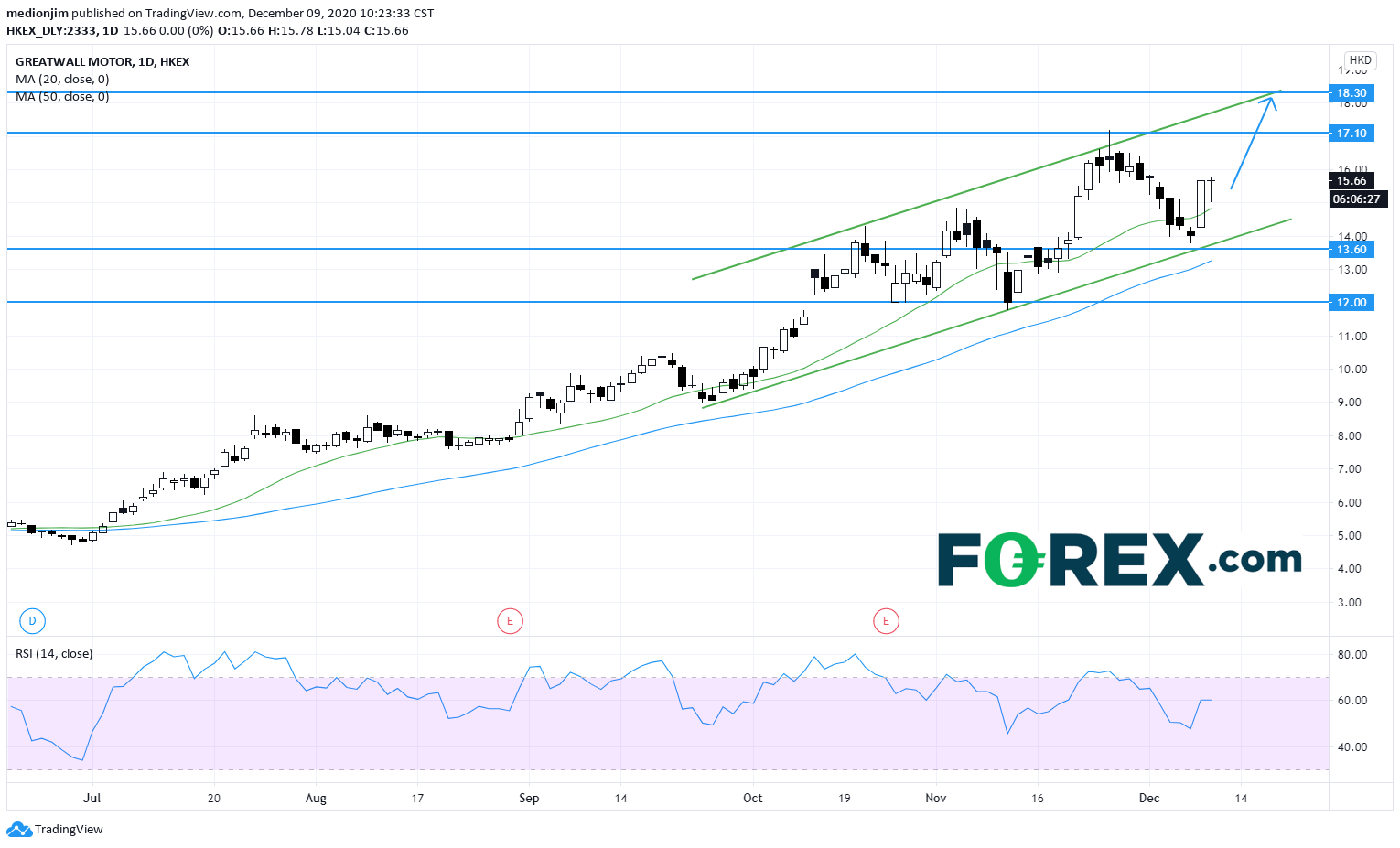

From a technical point of view, the stock is trading within the rising channel on a daily chart, indicating a bullish outlook. Currently, the prices stay above the 20-day and 50-day moving averages. Bullish readers could set the support level at HK$13.60, while resistance levels would be located at HK$17.10 and HK$18.30.

Source: GAIN Capital, TradingView