Good Friday Holiday

Tomorrow, much of the world is on Holiday, celebrating Good Friday. Many stock and bond markets around the world will be closed, such as the US, UK, Germany, France, Spain, Italy, Australia, and Canada. Therefore, one may expect that with many market players taking the day off, that the FX markets should be quiet. That has traditionally been a reasonable assumption over a long global holiday weekend. However, in these unprecedented times, any news that may come out tomorrow could also accompany extremely volatility. As participation will be low, there will not be as many resting buy or sell orders in the FX market.

There are 4 events to look for tomorrow which may cause volatility in the fx space:

- The Data

China is due to release their CPI and PPI data tomorrow. Expectations are for 4.8% (YoY) and -1.1% (YoY), respectively. If the data comes out dramatically different than expected, USD/CNH may have a large move. In addition, although the US is closed tomorrow, they are expected to release their own CPI and Core CPI data. Expectations are for -0.3% (MoM) and 0.1% (MoM), respectively. Also, the Federal Reserve’s Mester and Quarles are both expected to speak tomorrow. After today’s Fed moves, any “less dovish” comments could cause the US Dollar to spike higher vs any of its counter currencies, on very light volume.

2 .OPEC+ Comments

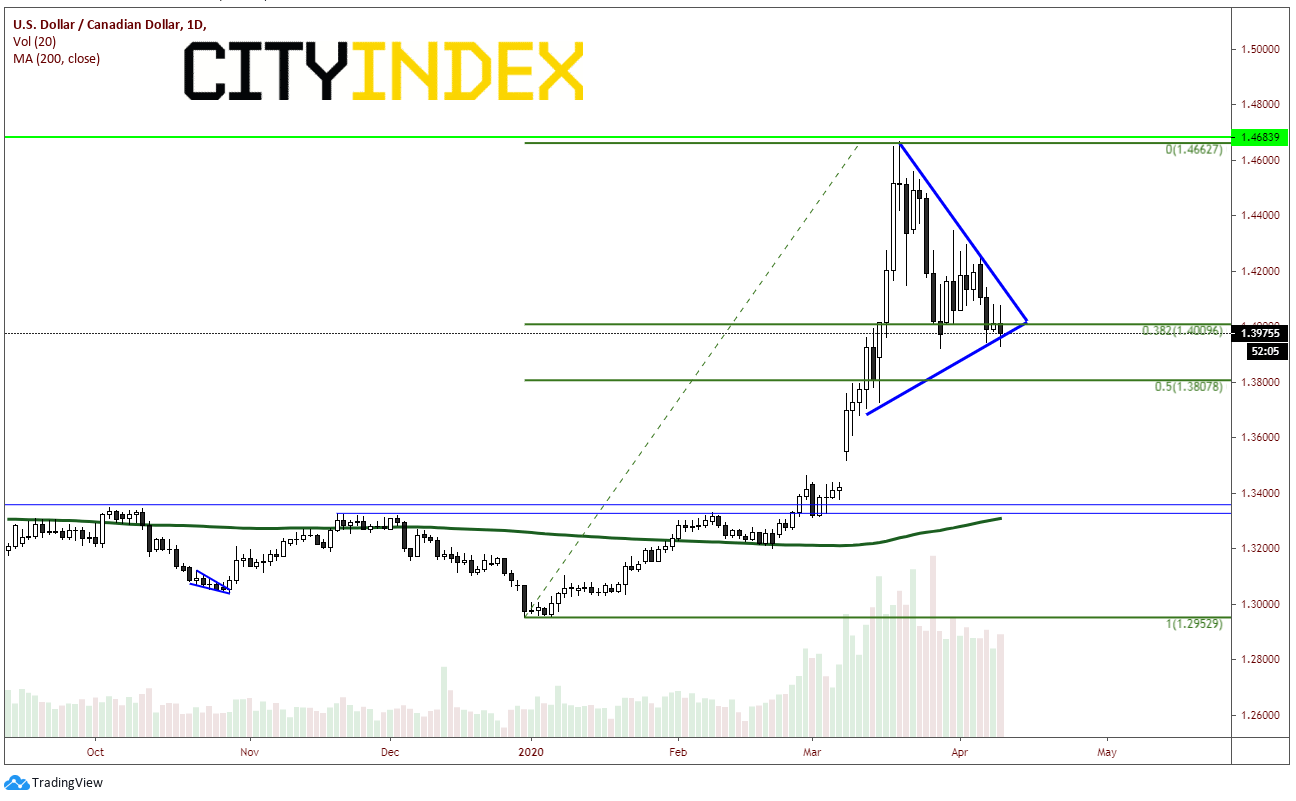

At the time of this writing, OPEC++ have agreed to cut back in production of 10 million bpd through July, then 8 million bpd from July to December, followed by 6 million bpd from January 2021 through April 2022. WTI Crude oil had been going bid into the announcement, however, has sold off from 28.21 to as low as 22.48 after the deal was announced. (May have been “buy the rumor, sell the fact”). However, if the deal does not go through, or if there are negative comments tomorrow, crude could sell off even further. This would cause crude sensitive currencies to move as well, such as USD/CAD, USD/NOK, and USD/MNX.

Source: Tradingview, City Index

3. European Rescue Plan

As of the time of this writing, EU finance ministers have reached an agreement on a European Rescue Plan, (the actual amount has not been provided yet), plus other guaranteed programs. Positive or negative comments regarding this deal could affect Euro pairs. (No mention yet of the words “Coronavirus bonds”)

4. Coronavirus Updates

Although many world markets are closed, the coronavirus does not take the day off. Over the weekends when updates are given, the markets can’t move because they are closed. However, with fx markets open tomorrow, there is the possibility of volatility around the updates.

Although tomorrow is a holiday for most of the world, traders must be careful when placing new trades and where to put stop placements. With light market participation, there is the possibility of some violent fx moves if there are any surprises in the market.