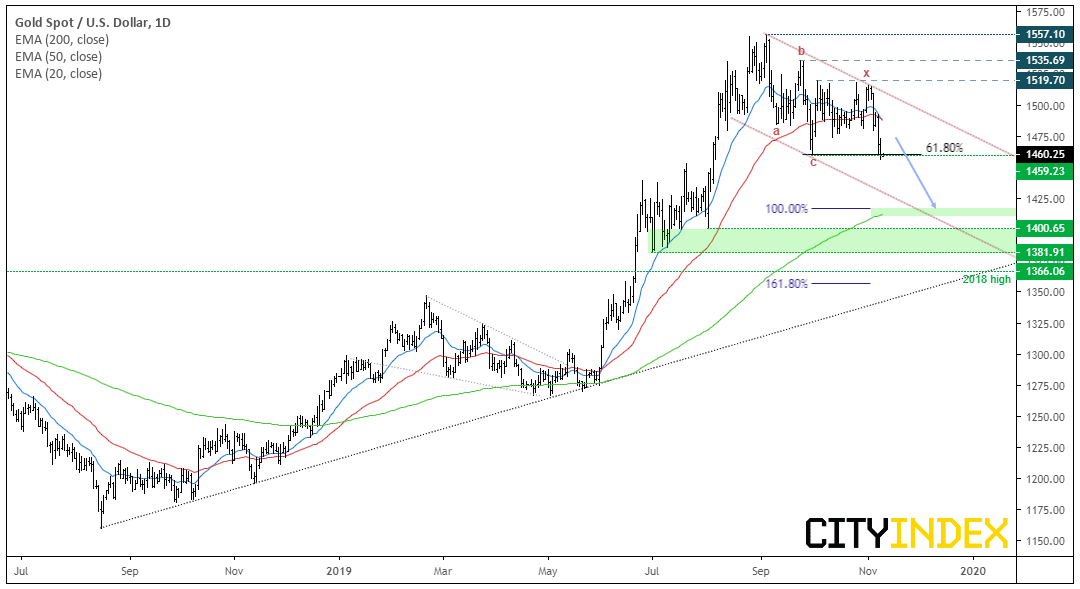

Bulls failed to conquer key resistance at 1519.70 and prices have since rolled over. Given the series of doji’s, hammers and pinbars around this level it was apparent the level was a key focal point. Therefore, we warned that any weak break of this level increased the odds that price action remains in a complex correction. Yet it didn’t even break before bearish momentum returned. Furthermore, the 20-day eMA has crossed below the 50-day eMA and both of them are now pointing lower.

Having suffered its worst week in three years, bears are clearly in charge and momentum suggests we’re now in an impulsive wave lower. As the bias is for an eventual break to new highs, the bearish bias is over the near-term, and will later seek evidence the correction from the 1557.10 high is nearing completion.

- The bearish channel can be used to aid with profit objectives.

- If a double zigzag is presented, the 1411 - 1417 zone could be a viable target as this is around a 100% projection from the initial ABC correction (wave equality) and also near the 200-day eMA.

- If a deeper correction unfolds, we can also use the bullish trendline from the August low. That said, the 1381.91 -1400 zone should also be considered as potential support along the way.

Related analysis:

Gold Perks Up But It’s Not Out Of The Woods | XAU, GDX, KL, AEM, NEM

ASX200: The Long And Short Of It | XJO, NAN, NCM, BOQ, GNC

Weekly COT Report: Trade Optimism Supports CAD and AUD