Investment bank Goldman Sachs, has thrown its weight behind the mining sector, a sector which it believes will recover more quickly than other sectors in the FTSE thanks to rebounding commodity prices.

The mining sector has so far managed to avoid an extreme downturn to the levels last seen in 2008 or 2015, an encouraging sign, particularly given that some sectors in the UK index, such as the travel and tourism sector are experiencing their worst downturn ever.

Chinese metal demand ramps up

Increasing demand from China, the world’s largest consumer of metals is expected to support the sector. Recent data has revealed that the Chinese economy is starting to reignite, albeit slowly. Foreign demand remains weak; yet, as economies across the globe continue to reopen, demand is expected to start recovering.

Goldman Sachs also believe Beijing will use tried and tested measures of stimulating the Chinese economy. These measures are likely to include credit easing, in addition to boosting construction projects such as infrastructure and property, which are expected to be strong demand drivers in the second half of the year.

Increasing demand from China, the world’s largest consumer of metals is expected to support the sector. Recent data has revealed that the Chinese economy is starting to reignite, albeit slowly. Foreign demand remains weak; yet, as economies across the globe continue to reopen, demand is expected to start recovering.

Goldman Sachs also believe Beijing will use tried and tested measures of stimulating the Chinese economy. These measures are likely to include credit easing, in addition to boosting construction projects such as infrastructure and property, which are expected to be strong demand drivers in the second half of the year.

Metal prices jump

Goldman Sachs predicts that iron ore prices will remain elevated after reaching a fresh record high earlier in the week. Steel consumption in China is ramping up to record levels whilst concerns are growing over Brazilian supply amid the covid-19 outbreak. This is resulting in supportive supply demand fundamentals for a rising price.

Copper, which dropped sharply yestersay following the Fed’s gloomy outlook had just recovered losses for the year climbing 20% in just 3 months. Chinese demand is expected to limit any further downside. The metals are certainly in a very different position now than they were in March when the coronavirus lockdown was creating fears of a glut in the metals market.

Goldman Sachs predicts that iron ore prices will remain elevated after reaching a fresh record high earlier in the week. Steel consumption in China is ramping up to record levels whilst concerns are growing over Brazilian supply amid the covid-19 outbreak. This is resulting in supportive supply demand fundamentals for a rising price.

Copper, which dropped sharply yestersay following the Fed’s gloomy outlook had just recovered losses for the year climbing 20% in just 3 months. Chinese demand is expected to limit any further downside. The metals are certainly in a very different position now than they were in March when the coronavirus lockdown was creating fears of a glut in the metals market.

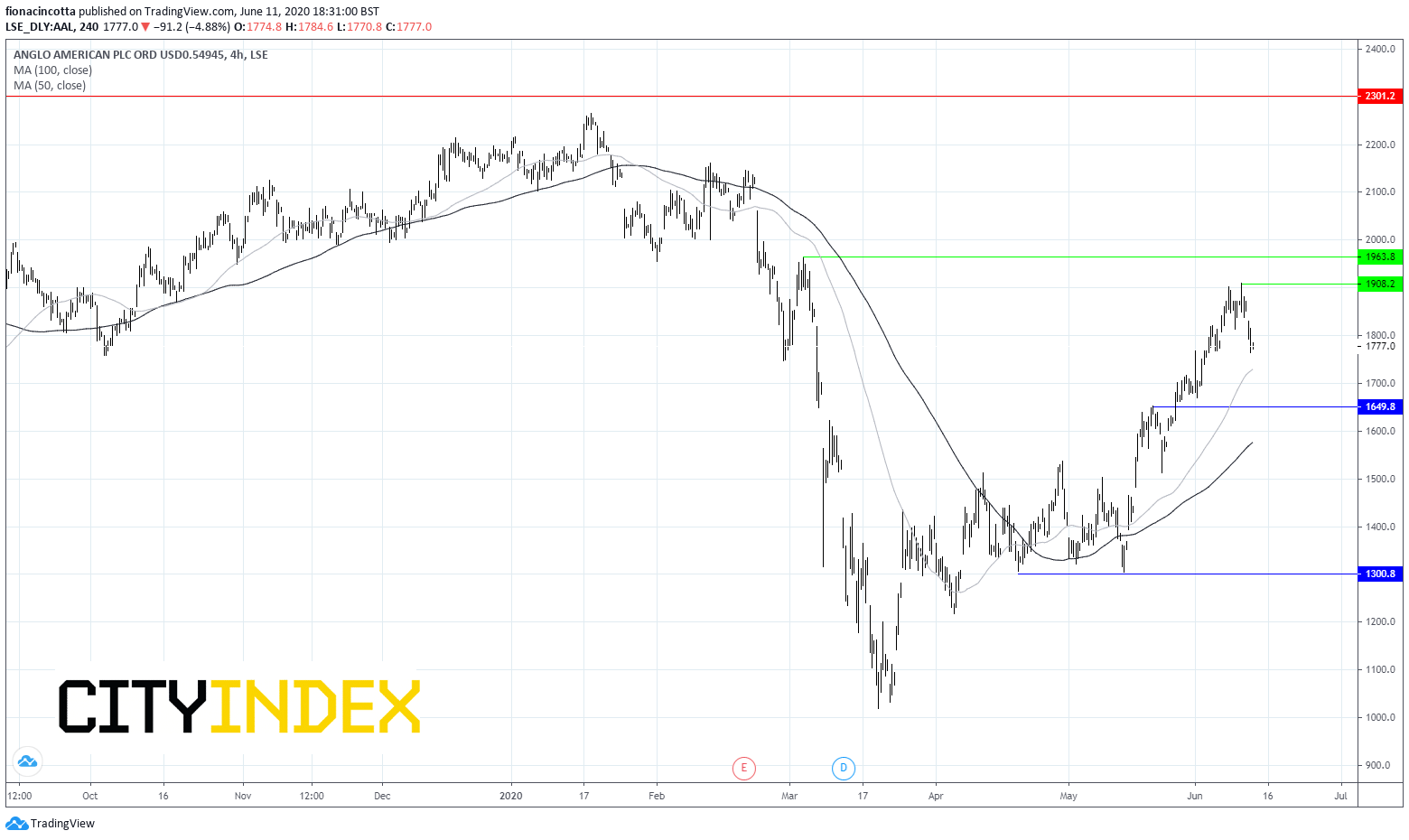

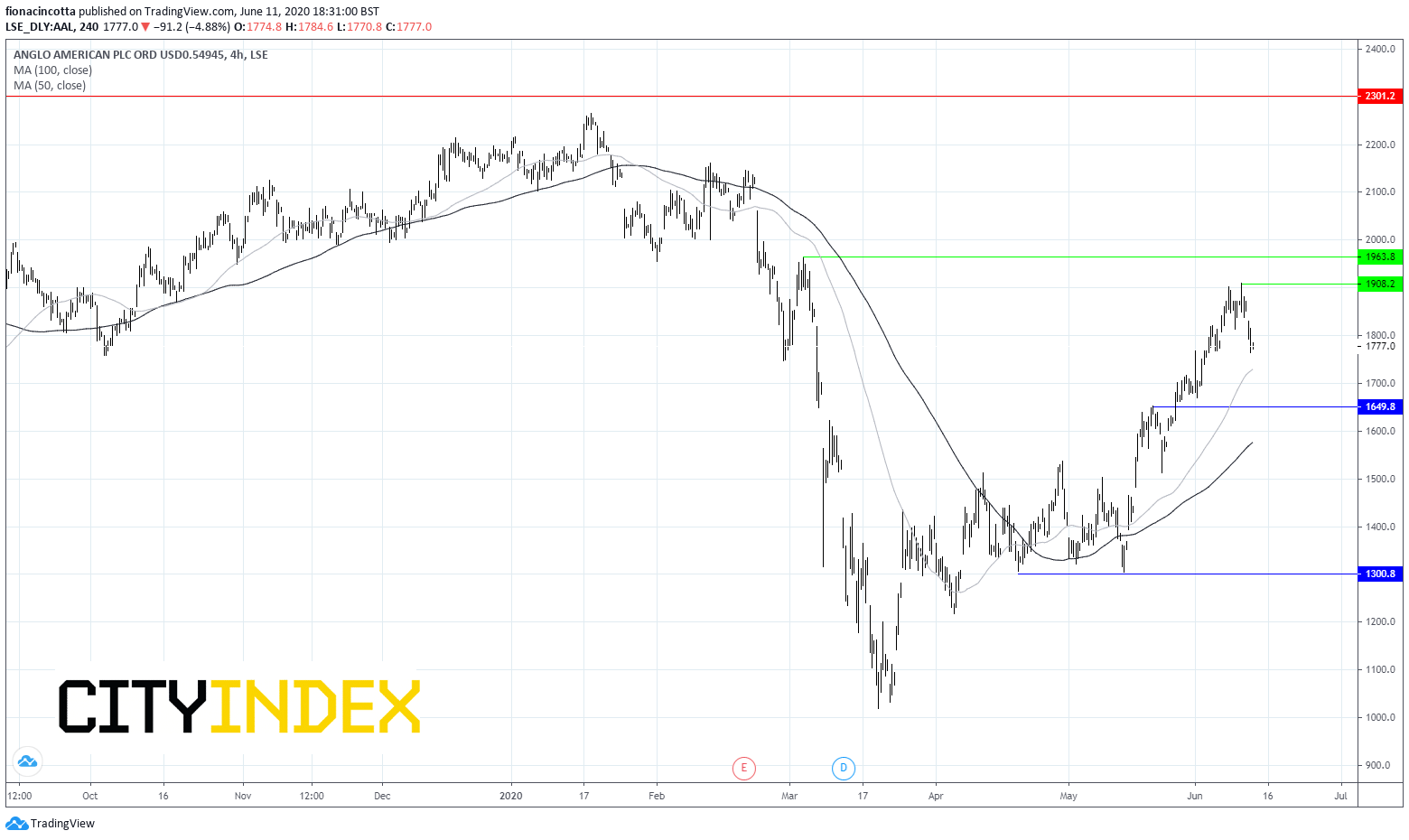

Anglo American

The stock is up 36% in the past month, currently trading at 2250p. EBITDA has increased consistently since 2015. Costs have been successfully brought down, as have the number of mines being operated, although revenue has increased. Debt, which had been a big problem previously, is down too from $12.9 billion in 2015 to $4.4 billion

Anglo American had its price target raised by Goldman Sachs to 2300p from 2150p.

The stock continues to trade above its 50, 100 & 200 sma on bullish chart, despite 4% selloff yesterday.

The stock is up 36% in the past month, currently trading at 2250p. EBITDA has increased consistently since 2015. Costs have been successfully brought down, as have the number of mines being operated, although revenue has increased. Debt, which had been a big problem previously, is down too from $12.9 billion in 2015 to $4.4 billion

Anglo American had its price target raised by Goldman Sachs to 2300p from 2150p.

The stock continues to trade above its 50, 100 & 200 sma on bullish chart, despite 4% selloff yesterday.

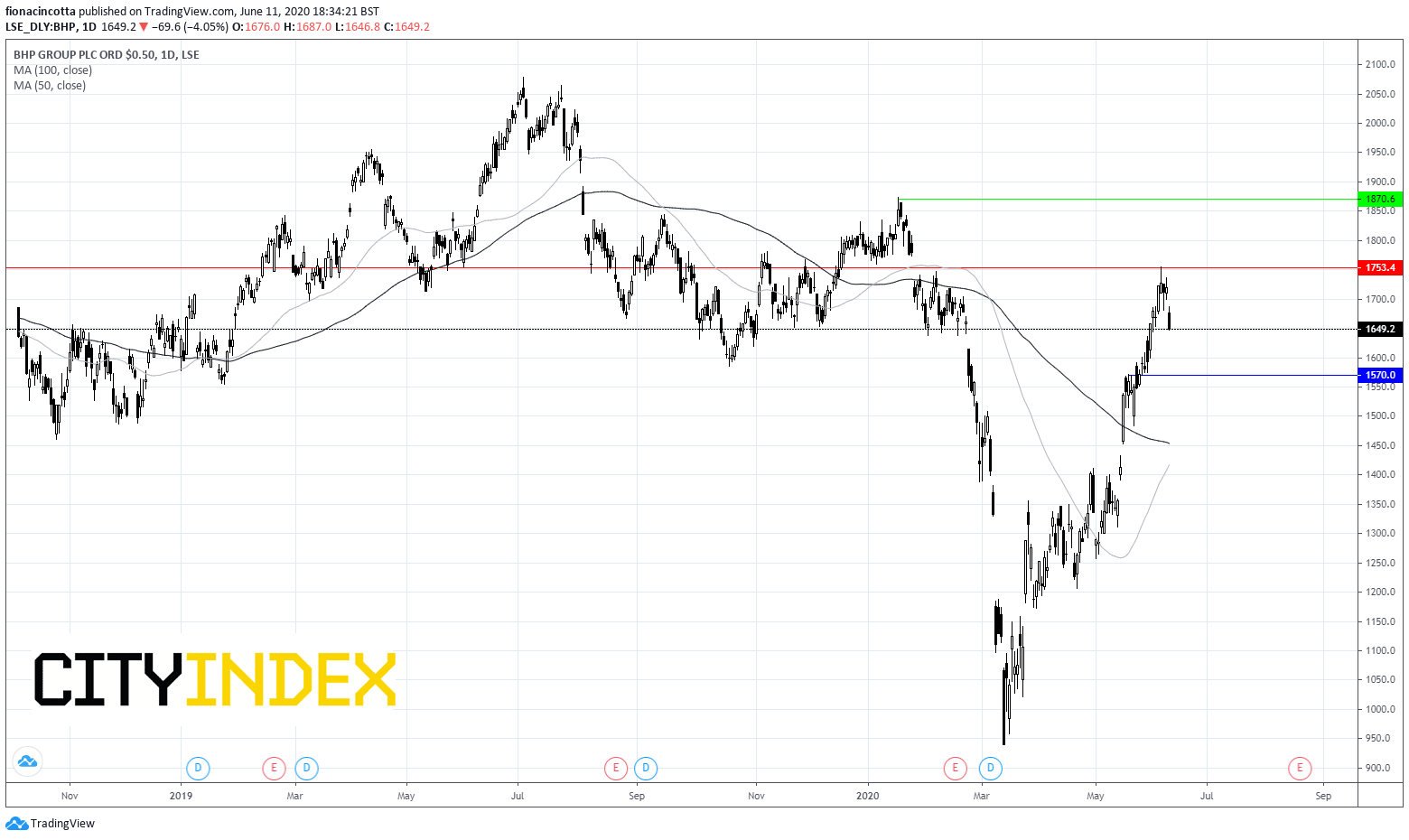

BHP Billiton

Iron ore and copper are BHP Billiton’s biggest earners. In the 9 months to 31st March BHP Billiton had hit record production in iron ore. Copper is also a good earner of Billiton although less influential.

BHP Billiton’s rebound has been nothing short of impressive. The stock trades back close to levels last seen pre-covid-19. The stocks remains above its 50, 100 and 200 sma.

BHP Billiton’s price target was increased to 1750p from 1450p