On that note, it is the COVID-19 recovery that continues to hold global market attention. Supported by a run of better than expected economic data last week that included U.S. ISM manufacturing and a sharp rise in nonfarm employment (2.5 million verse expectations for an 8 million decrease). A combination that awoke U.S. 10 year yields from their six-week slumber, to close almost 25bp higher on the week at 0.90%.

The sharp and earlier than expected rise in yields is likely to have future implications across markets, probably in the equity space but its impact was immediately visible against gold. As highlighted in the past, gold and U.S. 10 year yields are negatively correlated and last week’s rise in yields coincided with a $45.00 fall in the price of gold, back to the U.S.$1685.00 area.

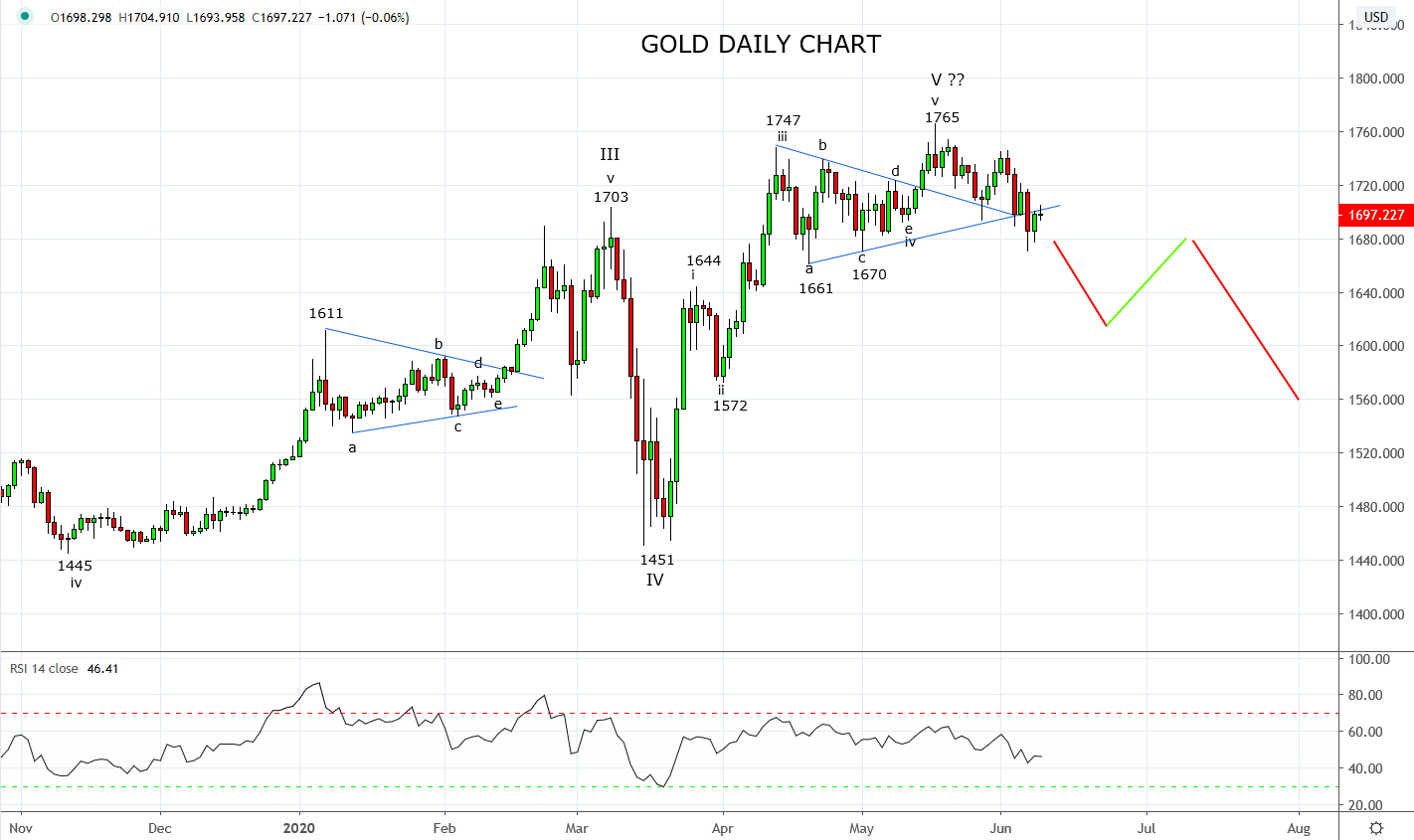

The fall was in line with a warning we included in our last article on gold on the 22nd of May here shortly after gold traded to its $1765 high.

“This raises the possibility that if gold has completed a 5-wave rally at this week’s $1765 high, it is on the verge of a significant corrective pullback. At the minimum, the bearish divergence viewed on the RSI indicator on the daily chart warns that upside momentum is falling and a valid reason to tighten up stops on long gold positions.”

While we will need to keep an eye on U.S. 10 year yields to see if they will consolidate the break higher, from a purely technical perspective, golds move below trendline support at $1694 provides a strong indication that the significant pullback mentioned above is underway, broadly into the $1550/1450 region. Confidence in this view builds on a break of the April 21st, $1661 low.

From a trading perspective, should the pullback play out as anticipated in the coming weeks and with the macro medium term picture remaining supportive, a decline in price would be viewed as an opportunity to rebuild gold longs in anticipation of the next leg higher.

Source Tradingview. The figures stated areas of the 9th of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation