As illustrated by the numbers below, November has earned a reputation in recent years for being a challenging month for gold, fractionally behind September as the worst-performing month of the year.

- In November 2020, gold fell -5.42%.

- In November 2019, gold fell -3.23%.

- In November 2016, gold fell -8.14%.

- In November 2015, gold fell -6.77%.

- In November 2013, gold fell -5.27%.

Typically the month of December sees some stabilisation in the gold price before a rally begins in early January, the second-best performing month of the year over the past decade. If traders were to strictly follow golds seasonal patterns then late December is the right time to consider opening gold longs.

However, there is now a combination of reasons outlined below that suggest it might be better to buy some gold now, rather than to wait until the end of December.

From a fundamental perspective:

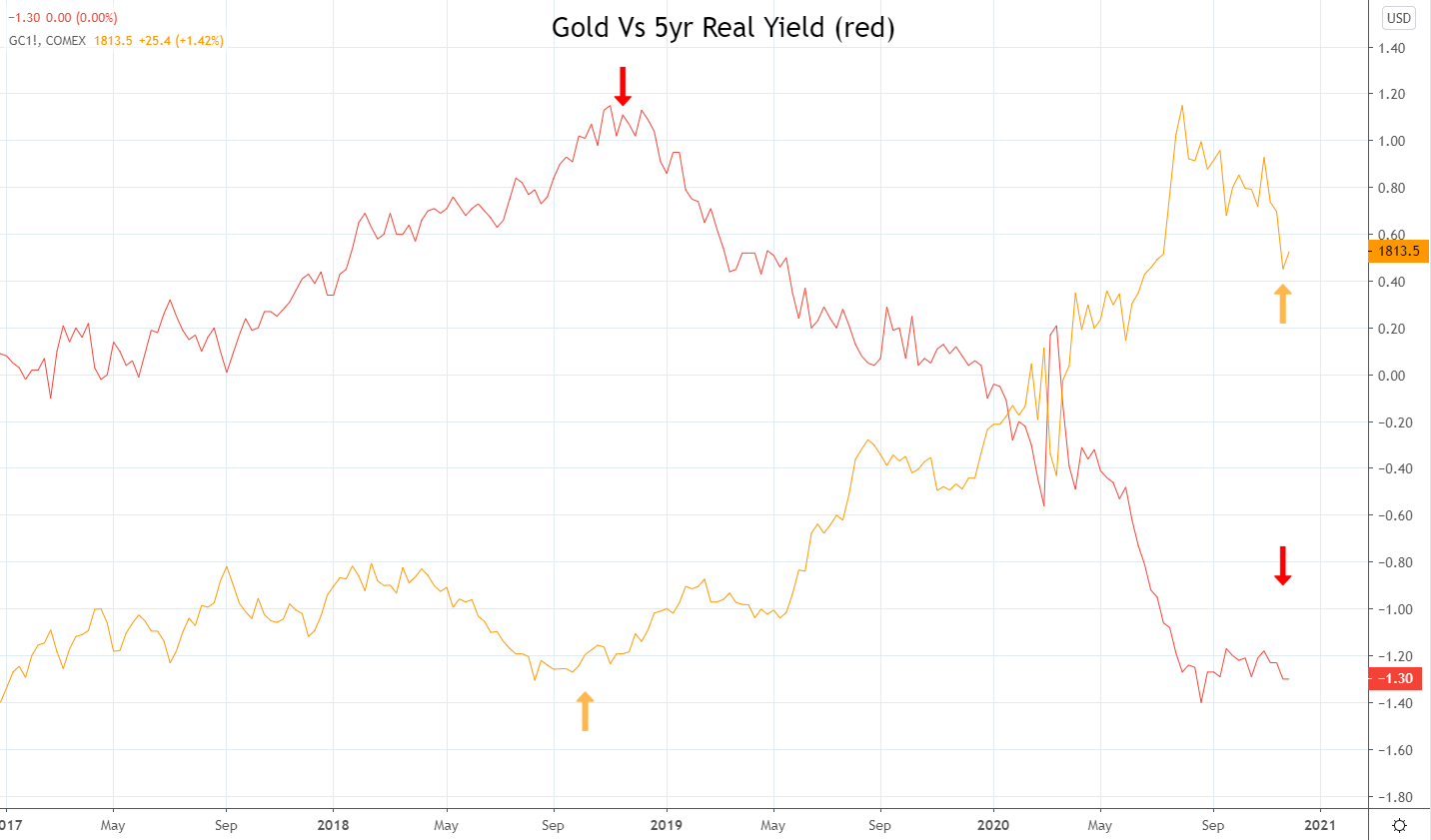

- As illustrated in the chart below it can be observed that falling real rates provide support for gold.

- The U.S. dollar has broken lower. Generally speaking, gold is negatively correlated to the U.S. dollar.

- Renewed optimism of U.S fiscal stimulus overnight, following news that Treasury Secretary Mnuchin and House speak Pelosi had scheduled a call to discuss a new Covid19 aid package.

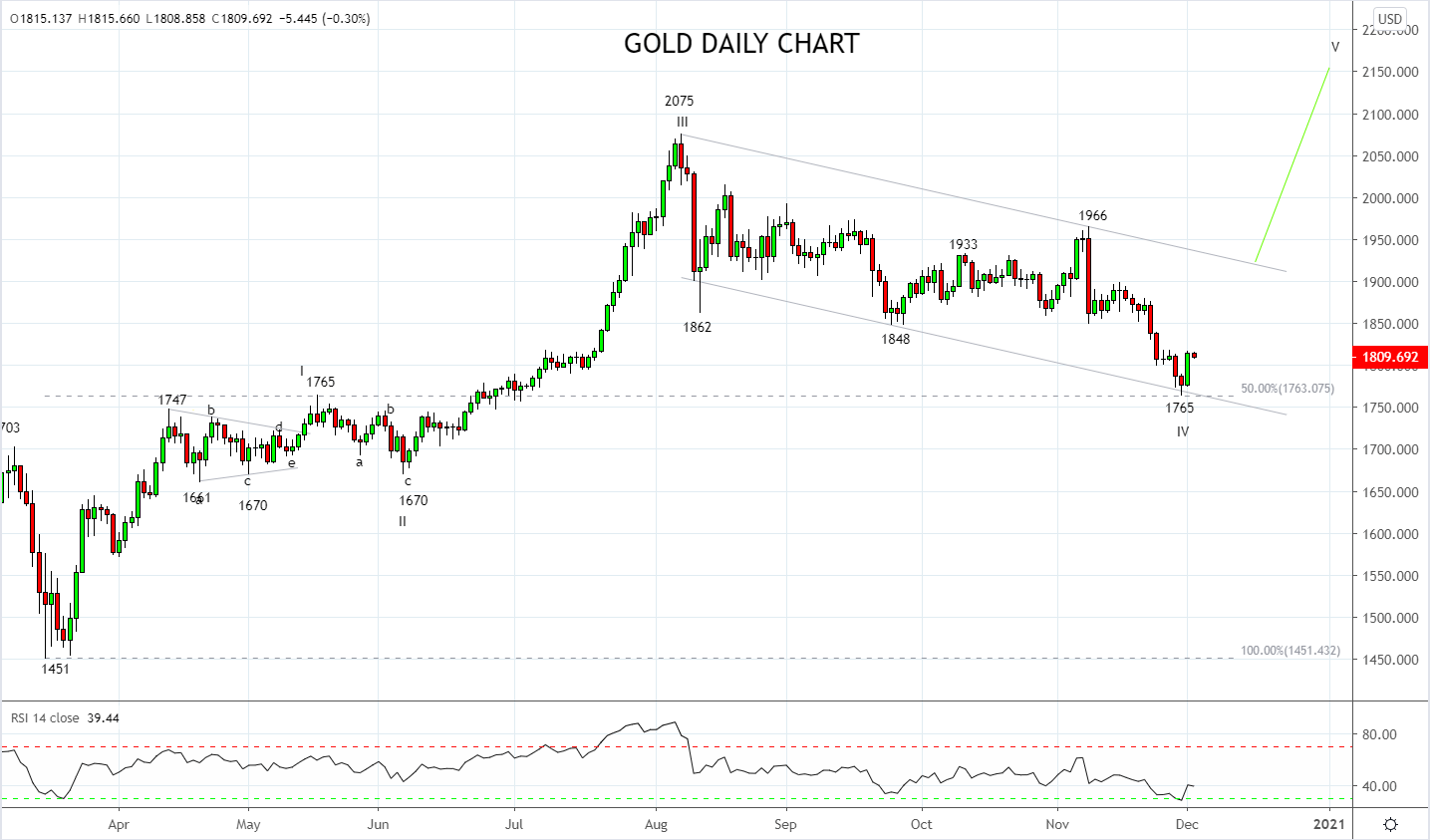

From a technical perspective, In our last update on gold here, we wrote that following the break of the $1850 support we were expecting a move towards $1740.

“From the $1740 area, I will be looking for signs of stabilisation/basing in anticipation of the uptrend resuming and a buying opportunity.”

While gold fell marginally short of $1740, Mondays low near $1765 picked up neatly the 50% Fibonacci retracement (of the March to August rally) as well as trend channel support.

For those who have been waiting for this dip to buy gold and for the reasons outlined above consider opening a small gold position here near $1810, leaving room to add to the position on a break/daily close above $1860. The stop loss should be placed initially below $1750.

A move above resistance at $1860 would provide further confirmation that the uptrend has resumed and that a retest and break of the August $2075 high is underway.

Source Tradingview. The figures stated areas of the 2nd of December 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation