Gold: Will Nonfarm Payrolls Change Gold Technical Outlook?

Yesterday, spot gold showed resilience after posting the largest daily decline in a month on Wednesday. Despite a stronger-than-expected U.S. ADP private jobs report for May and a steady decline in initial jobless claims, the precious metal was lifted by the European Central Bank's decision to expand its pandemic emergency purchase programme by 600 billion euros.

Some investors doubted that the ADP report may have over-estimated the labour market condition and waited to confirm with the official jobs data due later in the day. Nonfarm payrolls are expected to drop by 7.5 million in May (compared with a 2.76 million private job losses estimated by ADP) and jobless rate is anticipated to jump to 19.1% from 14.7% in April, according to Bloomberg's survey estimates. Nevertheless, investors would have to be cautious that there are growing signs of economic recovery, which could be negative to gold prices.

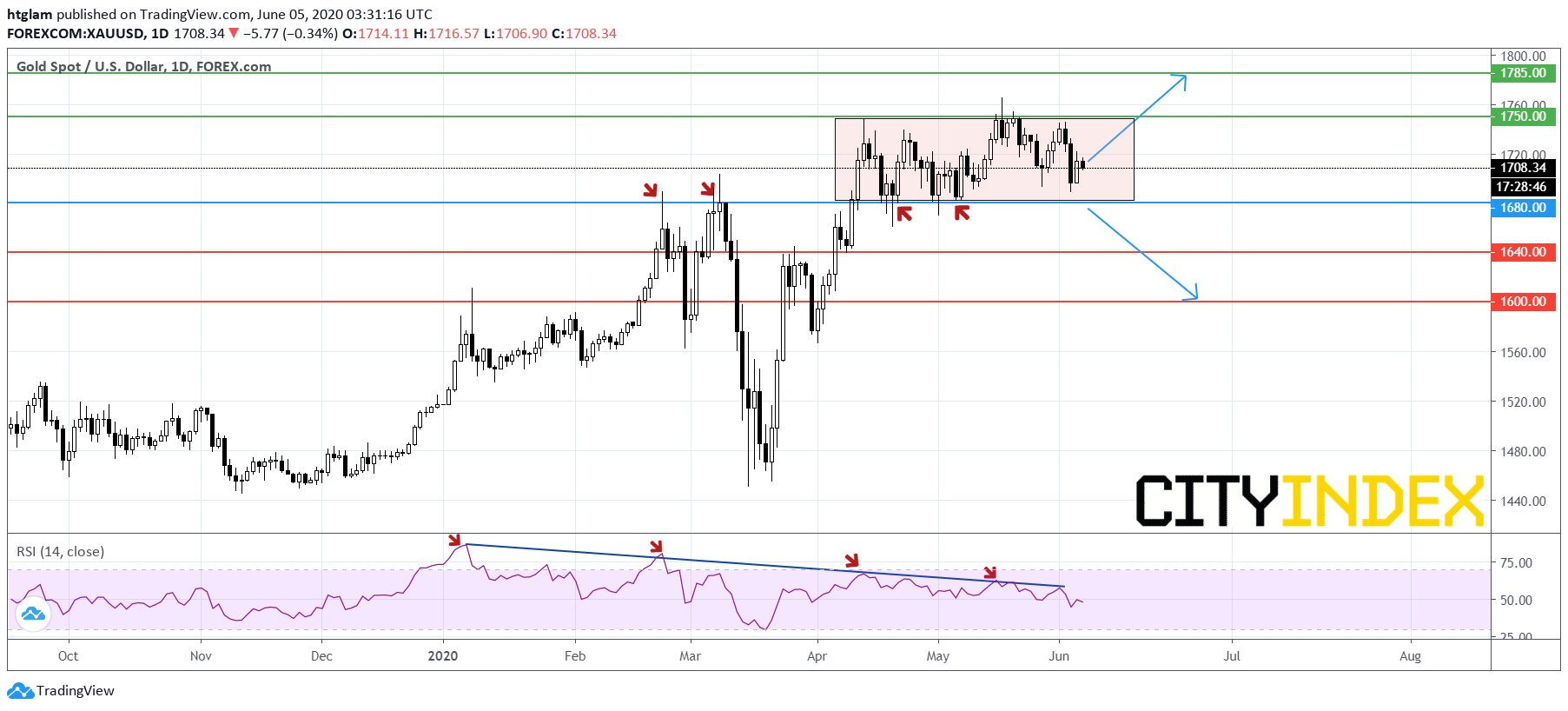

Previously, we questioned whether the precious metal is losing momentum on an intraday basis. From a technical point of view, spot gold remains trading within a consolidation range as shown on the daily chart. Even though it still maintains a bullish bias in the short term, investors have to be alerted that the relative strength index keeps showing a bearish divergence.

The level at $1,680, a previous resistance which now acts as a support, is still expected to be the nearest support. On the upside, a clear break above the nearest resistance at $1,750 is needed for gold to advance further to test the next resistance at $1,785.

In an alternative scenario, losing $1,680 would change the technical outlook and suggest that gold may be due for a deeper correction. The next supports at $1,640 and $1,600 might be exposed.