Gold Largest Monthly Decline in 4 Years, DJIA Strongest Rally Since 1987

In November, spot gold dropped 5.4%, the biggest monthly decline since May 2016. At the same time, the Dow Jones Industrial Average Index jumped 11.8%, the largest monthly advance since January 1987. The S&P 500 Index rallied 10.8%, matching the previous largest monthly increase in October 2011. It appears that the relatively positive correlation between gold and US equities, seemingly since the launch of expansive fiscal and monetary policies in major countries to compact the coronavirus, begins to fade.

In fact, Federal Reserve Chair Jerome Powell said on Monday that "recent news on the vaccine front is very positive for the medium term", though he did not provide guidance on how the Fed would respond. The Fed will hold its FOMC meeting on December 15-16. Nevertheless, according to gold ETF holdings data, investors’ demand for gold appears to be easing amid Covid-19 vaccine breakthrough.

Spot Gold: Downside Pressure Persists

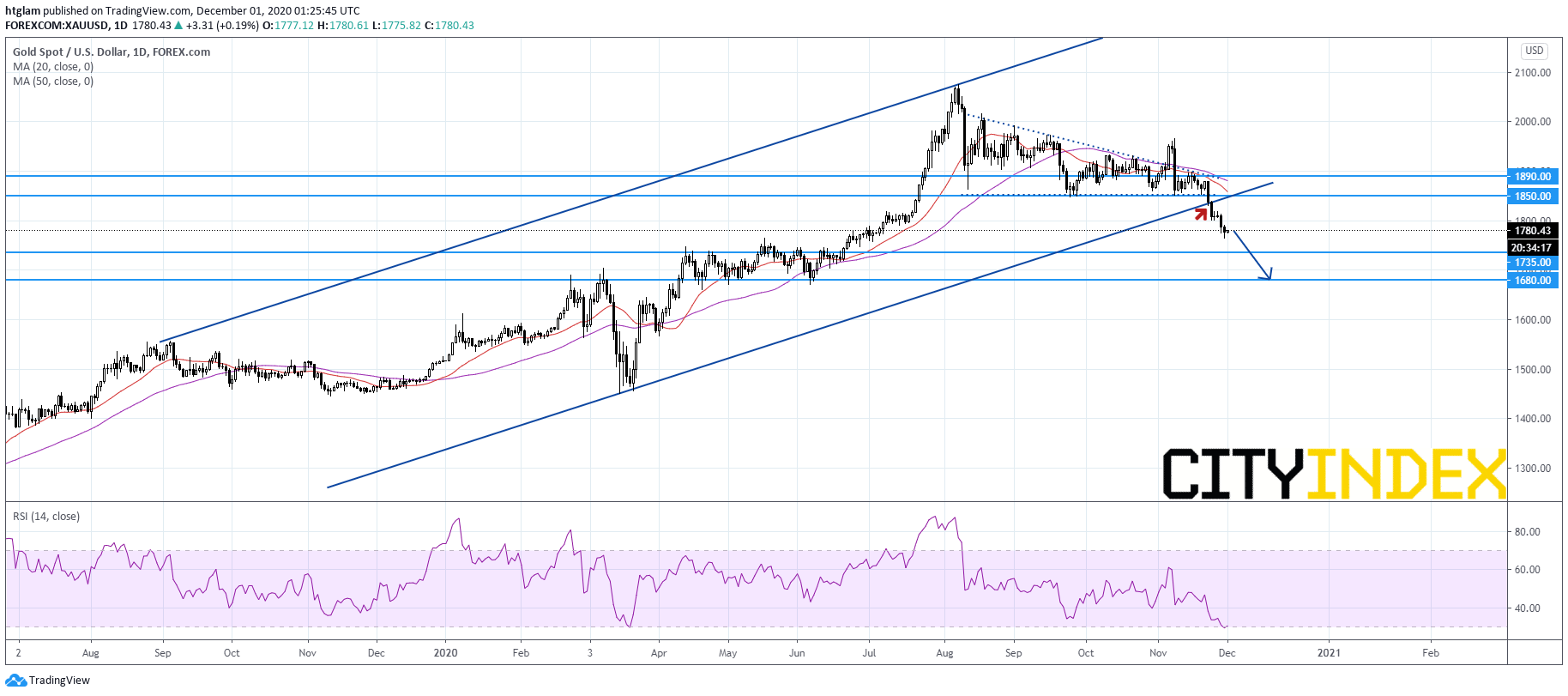

Sources: GAIN Capital, TradingView

On a daily chart, spot gold remains under pressure after breaking below a long term bullish channel. Currently, it has dropped further below both the 20-day and 50-day moving averages, while the relative strength index has yet shown bullish divergence. The level at $1,850 may be considered as the nearest resistance, while the 1st and 2nd support are expected to be located at $1,735 and $1,680 respectively.

Latest market news

Today 08:33 AM

Yesterday 11:48 PM

Yesterday 11:16 PM