Following a surge in new cases in countries including the U.S., China, Germany, South Korea, and Australia, optimism has been replaced by some caution around whether the latest outbreaks can be contained. Or if they are the onset of a “forest fire of cases” as one infectious disease expert in the U.S. has warned.

The possibility of a second wave casts shadows over the much sought after V-shaped economic recovery. As highlighted by comments over the weekend from Boston Fed President Rosengren who said that a second wave would impact the potential for a sound second-half economic recovery and would require more fiscal and monetary support.

The uncertainty created by the second wave and the prospect of more fiscal and monetary support is supportive of the macro narrative surrounding gold, and after a rally this morning, gold is on the verge of confirming that its uptrend has resumed.

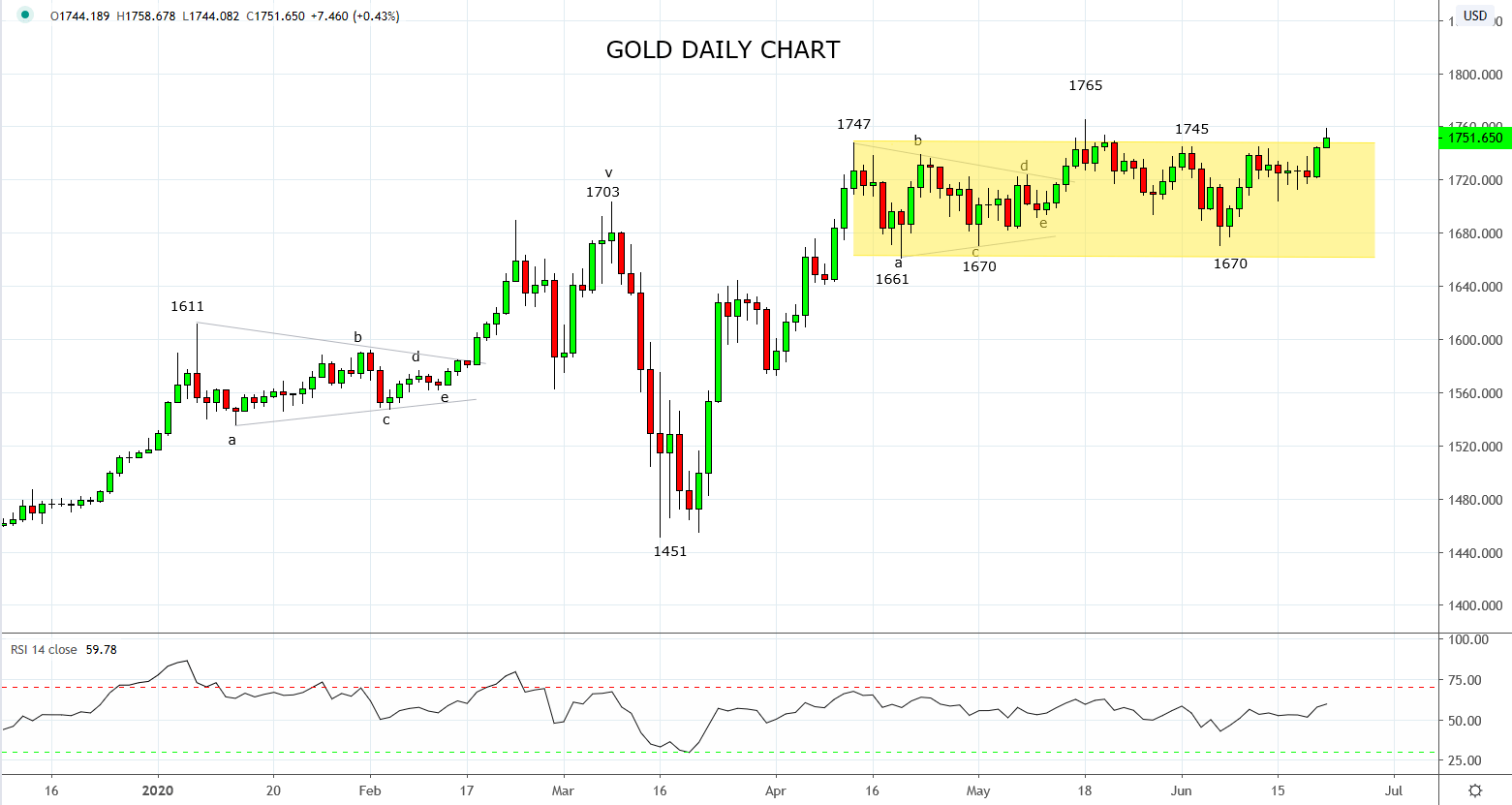

As viewed on the chart below, apart from the brief spike to the $1765 high in mid-May, gold traded sideways between $1660ish and $1750ish for the better part of 2 months. The bounce from the key $1660 support area negated our call for a deeper pullback that we wrote about here.

This morning’s break above the top of recent range highs $1745/50 provides some encouragement the uptrend has resumed. Should gold now break and post a daily close above $1765, it would confirm the uptrend has resumed.

In this context, we favour opening a small long gold position, following this morning’s break above $1750, leaving room to add on a break and close above the $1765 high. The stop loss should be placed initially below $1715 and would then be raised to $1735 should gold trade near to $1785. The target is a move to $1800 and then $1850.

Source Tradingview. The figures stated areas of the 22nd of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation