This included the formal announcement of Average Inflation Targeting (AIT) as well as the Feds lukewarm enthusiasm for Yield Curve Control (YCC), based on their view that in the current environment the use of YCC would have only limited impact and be costly.

Overnight a speech by Fed Vice Chair Clarida has refocussed the market's attention on the possibility of YCC being used by the Fed in the future.

“Yield caps and targets were not warranted in the current environment but should remain an option that the committee could reassess in the future if circumstances changed markedly.”

Assuming the Fed is determined to boost inflation expectations and to let the economy run hot, real interest rates need to remain pinned deeply in negative yield territory. YCC is an effective way to do this and this realisation has caused gold, one of the chief beneficiaries of negative real rates to spring to life this morning.

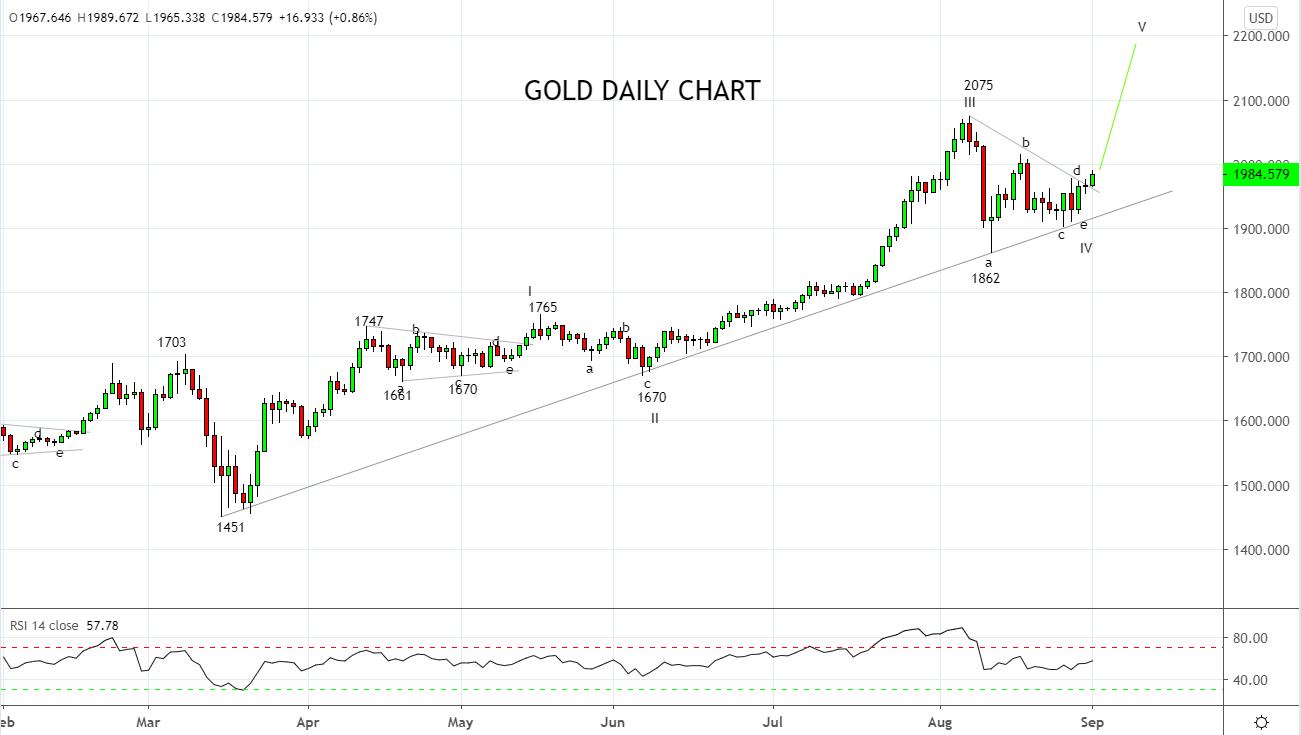

As noted in the Week Ahead video on Monday at around the 6 minute and 30-second mark, should gold break above recent highs $1980 it would be initial confirmation that the correction from the $2075 high is complete at the $1862 low and that the uptrend has resumed.

The key technical reasons to support this:

- The dip to $1862 picked up trendline support from the March $1451 low, keeping golds uptrend intact.

- Over the past three weeks gold appears to have traced out another 5 wave (abcde) triangular corrective pattern. This type of pattern was also evident before strong rallies in January and April this year.

- A break and daily close above the downtrend line from the $2075 high would be further confirmation the uptrend has resumed.

In a nutshell, post the break of resistance this morning and following the Clarida speech overnight, we favour re-opening longs in gold, leaving room to add should gold post a daily close above $1980. The target is a retest and break of the $2075 high. The stop loss should be placed $5 below interim support $1950. Or even better, below the uptrend support currently at $1915.

Source Tradingview. The figures stated areas of the 1st of September 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation