Gold: Uptrend Intact Despite Coronavirus Treatment Hopes

On Monday, spot gold marked a day-high near $1,962 before ending 0.6% lower at $1,929. The U.S. Food and Drug Administration has given emergency authorization to use blood plasma, from people who have recovered from the coronavirus, to treat severe COVID-19 patients.

On the other hand, Financial Times reported that the U.S. government is considering a fast-track approval of COVID-19 vaccine being developed by AstraZeneca and Oxford University. However, the report was denied by the pharmaceutical giant.

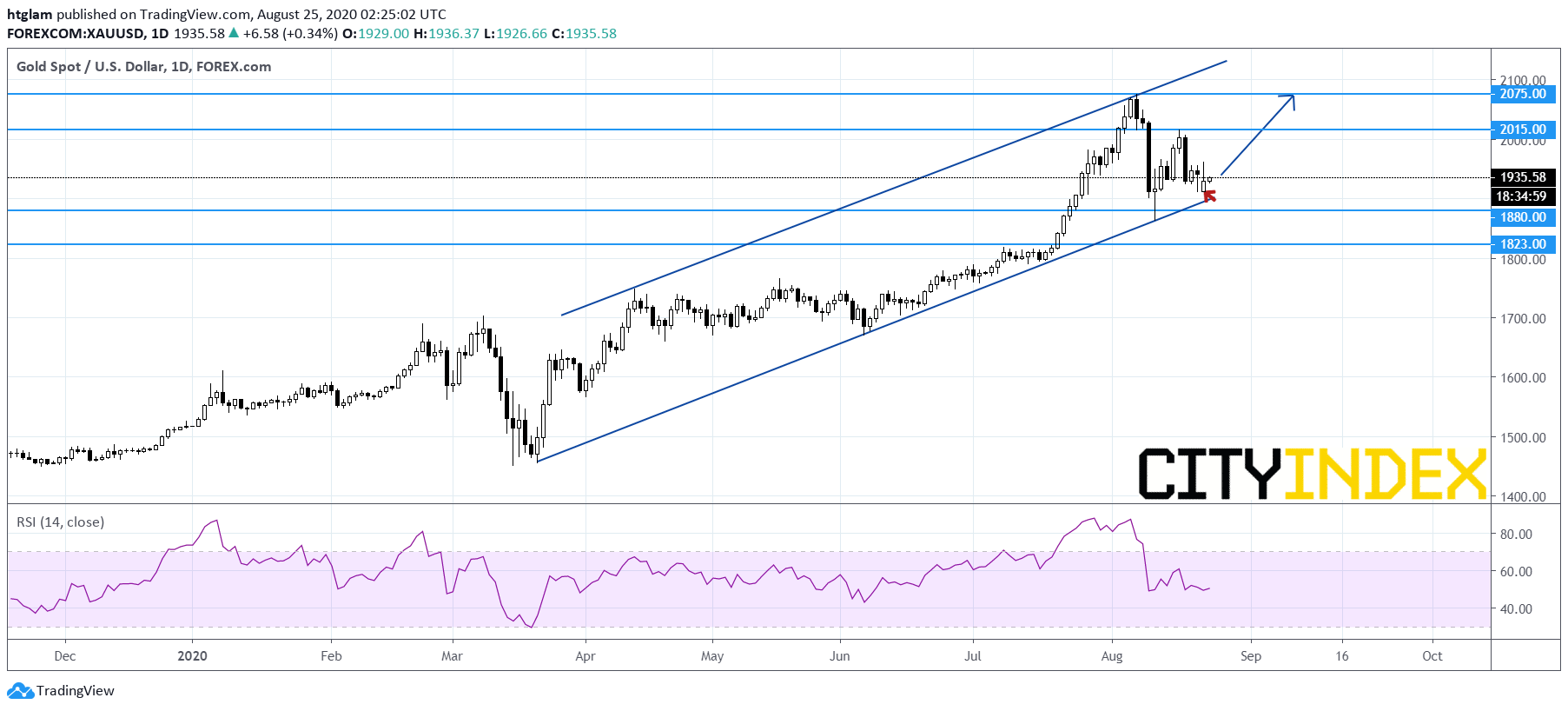

From a technical point of view, spot gold's bullish channel remains intact as shown on the daily chart. In fact, a bullish shooting star candlestick may have formed yesterday, signaling a potential upturn after a recent decline. The level at $1,880 may be considered as the nearest support, with prices trending to test the 1st and 2nd resistance at $2,015 and $2,075 on the upside. Alternatively, a break below $1,880 may flag risks to the downside and the next support at $1,823 might be exposed.