Gold fell in the previous session, not owing to Jerome Powell’s well-rehearsed, cautiously optimistic assessment of the US economy but more likely owing to the fact that he showed few signs of being moved by the outbreak of coronavirus.

On the economy

Jerome Powell said that that he though the US economy was in a good place; he highlighted the strong labor market and consumer spending. He added that he could not see any reason why the current expansion of the US economy couldn’t continue, and that monetary policy was appropriate at its current level. His comments meant that near term expectations of a rate cut were slightly reduced, which would have added some pressure to non yielding gold.

Powell undeterred by coronavirus

However, possibly of more interest to goldbugs, was that Powell said that the outbreak of the virus has done little to alter the expected path of US interest rates. Whilst the Fed will keep an eye on the outbreak and its impact on the Chinese economy and the economies of its trading partners, the Fed doesn’t see it the baseline outlook of the US economy or interest rates changing.

Risk appetite is also on the up on Wednesday as the number of new cases of coronavirus in the Hubei province, the worst affected area, was at the lowest level for a month. Additionally, top medical expert Zhong Nanshan has speculated that the virus could peak this month. The markets have responded optimistically. Riskier assets are back in favor whilst safe haven gold is declining.

Gold Levels to watch

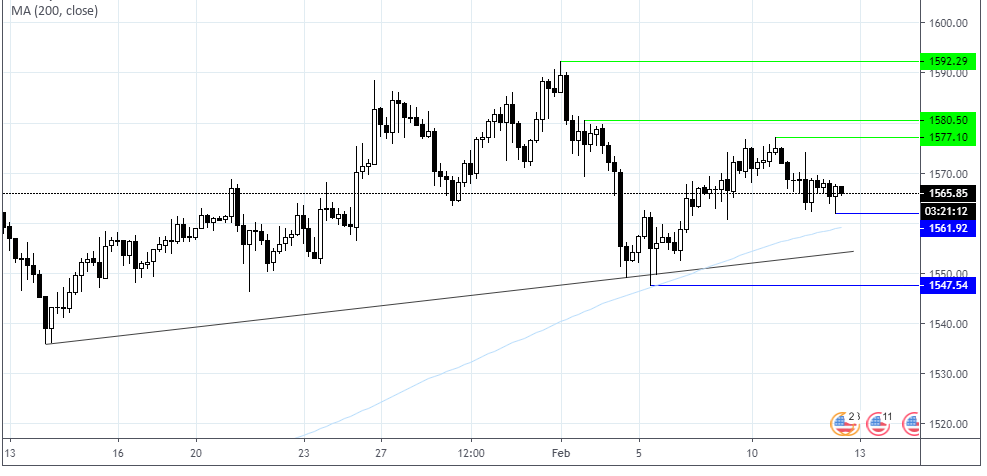

On the hour hour chart, the uptrend in gold is still intact. There is trend line support at $1555-8 which coincides with the 200 sma.

Immediate support can be seen at $1562 (today’s low) prior to $1558 (200 sma) and $1555 (trend line support).

On the flipside a move above resistance at $1577 and $1580 could confirm the bullish trend remains intact.