Gold Tracking Toward Its Highest Close in 7+ Years – Can We Break $1700?

Amidst the profound disruptions wrought by the global COVID-19 pandemic, it’s reassuring to see an example of a market reaction that “makes sense.”

That brings us to this morning’s Federal Reserve announcement of an unprecedented new program to provide $2.3 trillion in new loans, including purchases of investment-grade and high-yield bonds in the secondary market. In the words of Fed Chairman Jerome Powell, “The Fed’s role is to provide as much relief and stability as we can during this period of constrained economic activity, and our actions today will help ensure that the eventual recovery is as vigorous as possible.” Whether or not you agree with the latest expansion of the Fed’s stimulus measures, it’s clear that the program injects a massive new dose of liquidity into the economy, and under those circumstances, you would expect so-called “hard assets” like gold to rally, all else equal.

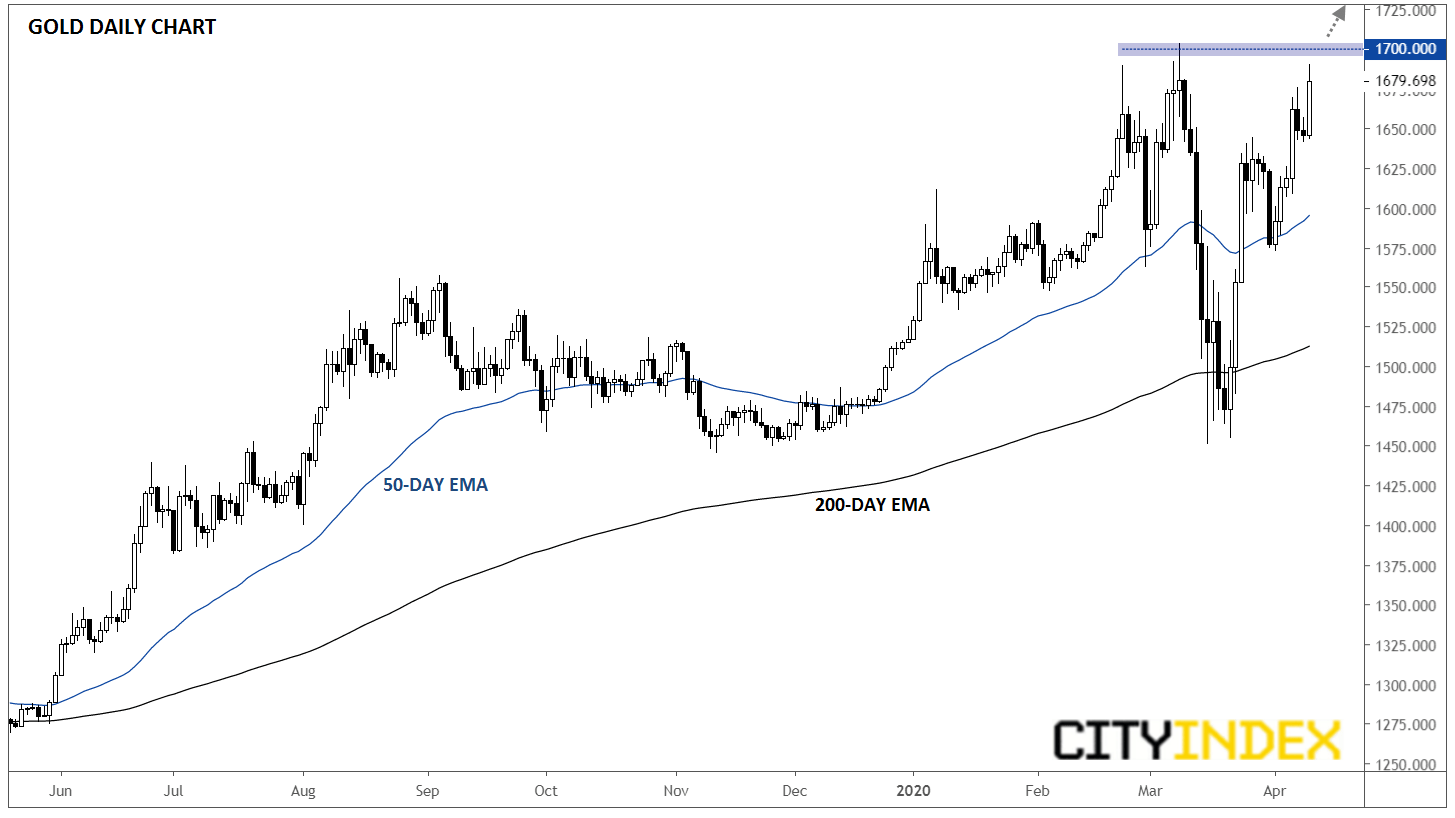

Thankfully for our collective sanity as market participants, that’s exactly what we’re seeing: the yellow metal is poised to close at its highest level in more than 7 years just below the $1700 level. Traders are coming to the realization that US and global policymakers will do whatever it takes to promote economic growth, raising the probability of future inflationary pressures, the exact environment that has historically benefited gold:

Source: TradingView, GAIN Capital

Technically speaking, a close above $1700 would confirm a bullish breakout and clear the way for a potential continuation toward the 2011/2012 highs in the $1800 area, followed by the all-time record higher near 1900. This short-term bullish bias may be called into question on a break below yesterday’s low near $1640, but as long as that short-term low holds, bulls will maintain the upper hand.