Gold is up over 1.1% in early trade on Monday and has climbed to fresh multi year highs around $1460.

Gold has rallied hard since the FOMC rate cut announcement last week, gaining over 3%. Whilst the Fed’s hawkish cut initially pulled gold lower, increased US – Sino tensions have since offered support.

Today’s extension of last week’s gains comes amid increased flows into safe havens as trade tensions between US & China escalate, driving risk off sentiment.

Last week President Trump increased pressure on China by adding tariffs of 10% on $300 billion worth of Chinese imports, in addition to the existing 25% tariffs on $250 billion.

China retaliated overnight by weakening the yuan to just above 7 vs the dollar. This will have the effect of counteracting the tariffs and is a warning shot that the trade war could become a currency war. This will no doubt be a move that infuriates the US.

Gold levels to watch:

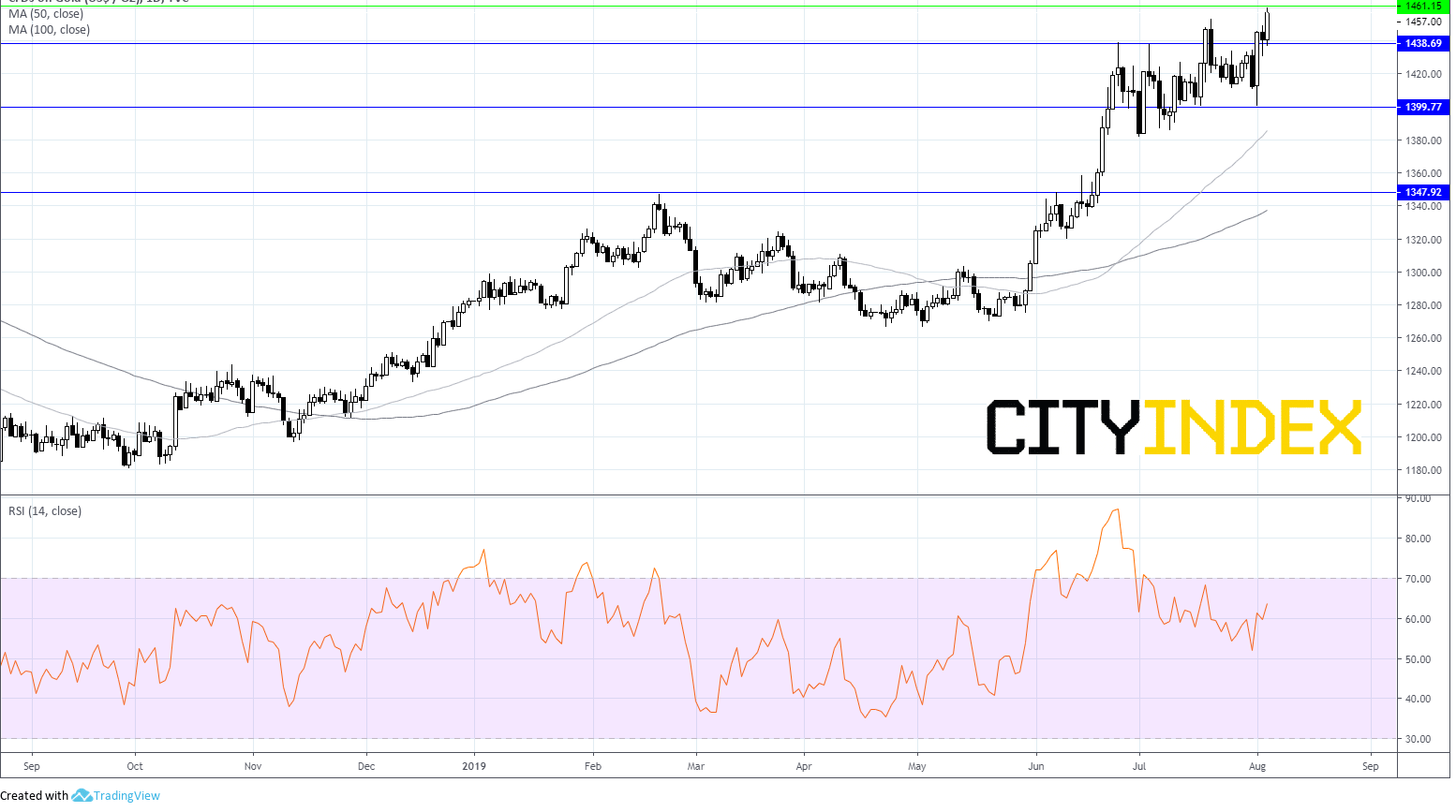

The daily gold chart shows the bulls are firmly in control. Gold trades above its 50, 100 and 200 sma, and is not yet in overbought territory on the RSI. Gold has pushed through $1453 a six year high in early trade. A close above this level could see the yellow metal push on towards $1488, opening the doors to $1550. On the downside support can be seen in the region of $1438 prior to $1400.