Last week following dovish comments from New York Fed President Williams gold prices traded above U.S.$1450. Less than a day later a spokesman for the New York Fed “clarified” Williams comments saying they were not about immediate policy direction.

If you found last week’s dovish Fed message followed by the back tracking in follow up news articles confusing you are not alone.

Possibly the mixed messages are a reflection that not all Fed members agree with the need to deliver an aggressive 50bp rate cut at this point of time. It probably also reflects a concern that following the Williams comments which resulted in the market pricing a 70% chance of a 50pb cut, the actual impact upon delivery of 50bp would be underwhelming.

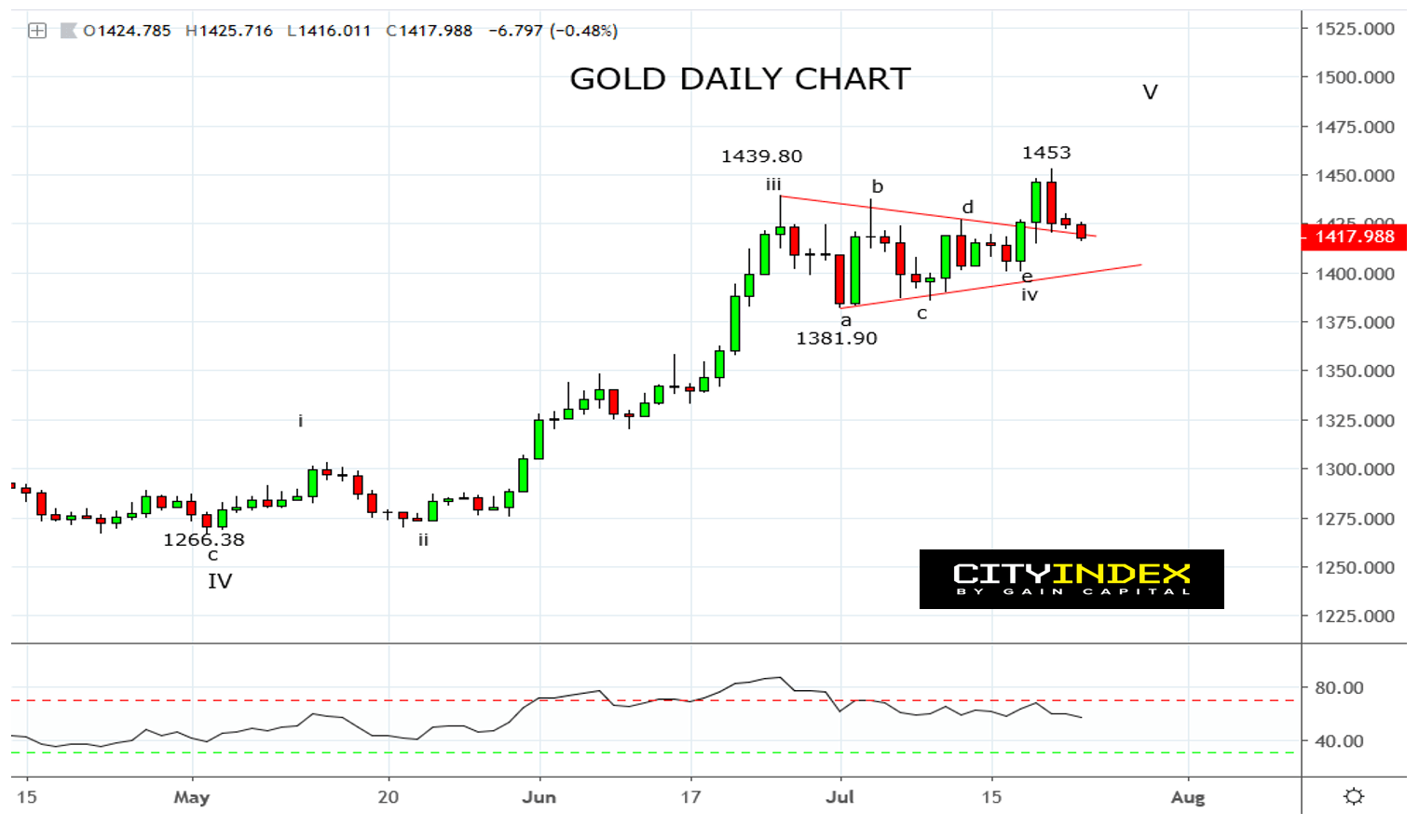

Technically the same confusion is evident in the gold chart.

After completed a five-wave “abcde” triangle type corrective sequence at the 17th July, U.S. $1400 low and surging through the top of the triangle pattern last Thursday, the signs were promising. However, the rejection candle that occurred on Friday from the $1453 high combined with the bearish divergence evident on the RSI has been a set back to the bullish case. In normal times, I would be thinking long and hard about cutting long gold exposure in expectation of a short-term retracement back towards the 1375/1355 support and bullish reassessment zone.

Making the decision less clear cut, tensions between the U.S. and Iran continue to escalate, and with market pricing set at more reasonable levels, there is room for both the ECB and FOMC to deliver a dovish surprise at their upcoming meetings.

In summary, despite the possibility that the current pullback has further to go, I feel that the uptrend in gold is likely to re-establish itself with potential towards the next upside target of U.S. $1480/1500.

Source Tradingview. The figures stated are as of the 23rd of July 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.