Friday’s NFP adjusted market expectations of a rate cut by the Fed. Job creation smashed expectations raising questions over whether the US economy was as weak as the market feared.

What to expect from Powell?

Investors will be looking to Fed Powell for guidance as to whether a July cut is necessary at all given the health of the labour market. Gold bears are optimistic that a rate cut will be pushed out until September or that Jerome Powell will indicate that a rate cut in July will be a one and done job. An optimistic sounding Powell could see gold dive as investors push back a rate cut.

Gold bugs will be looking for more understanding as to why the Fed went from talking about tightening monetary policy in February to 8 FOMC members voting for a rate cut this year in the most recent meeting. There is a good chance that Powell will focus on the risks facing the US economy. Let’s not forge that Jobs are a lagging indicator.

Should Fed Chair Powell focus on the risks ahead then gold could quickly push back above $1400 back towards $1440 as investors put the rate cut firmly back on the table.

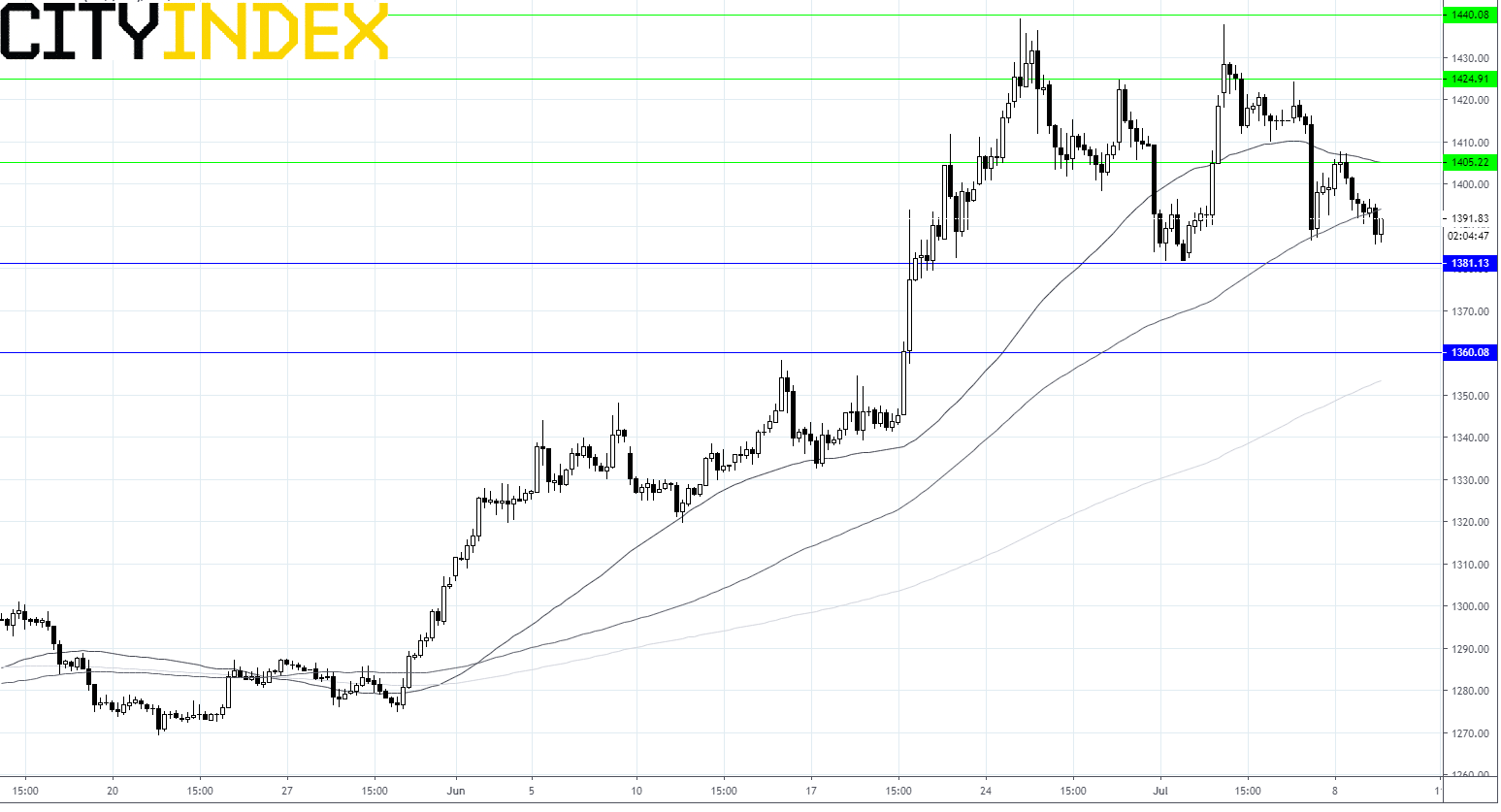

Gold levels to watch:

Gold is currently testing support at $1390 after falling for 4 consecutive session. It is below its 100 sma on the 4 hr chart. A breakthrough $1390 could see gold test last week’s low around $1380 before is tests $1360.

On the upside resistance can be seen at $1405, prior to $1425 and then on to the year to date high around $1440.