Gold Surging as Refiners Have Trouble Meeting Physical Demand

Gold futures (GC) are screaming higher this morning as demand is surging. The Exchange for Physical (EFP) market is having difficulties meeting the demand for gold for their clients, and therefore spreads between the futures market and the physical markets are blowing out.

According to Investopedia, an EFP is a private agreement between two parties to trade a futures position for the basket of underlying actuals, which in this case is gold. Consider a case where gold refiners are shutting down, producing less. In addition, they can’t move their products because of the shutdowns. As a result, people who want to participate in the EFP market are dealing with much wider spreads between the futures contract price and the physical gold price. In addition, market-makers who had gone short gold EFP positions are failing. The net result is higher gold spot prices, higher gold futures prices, and higher gold spreads between spot and futures contracts.

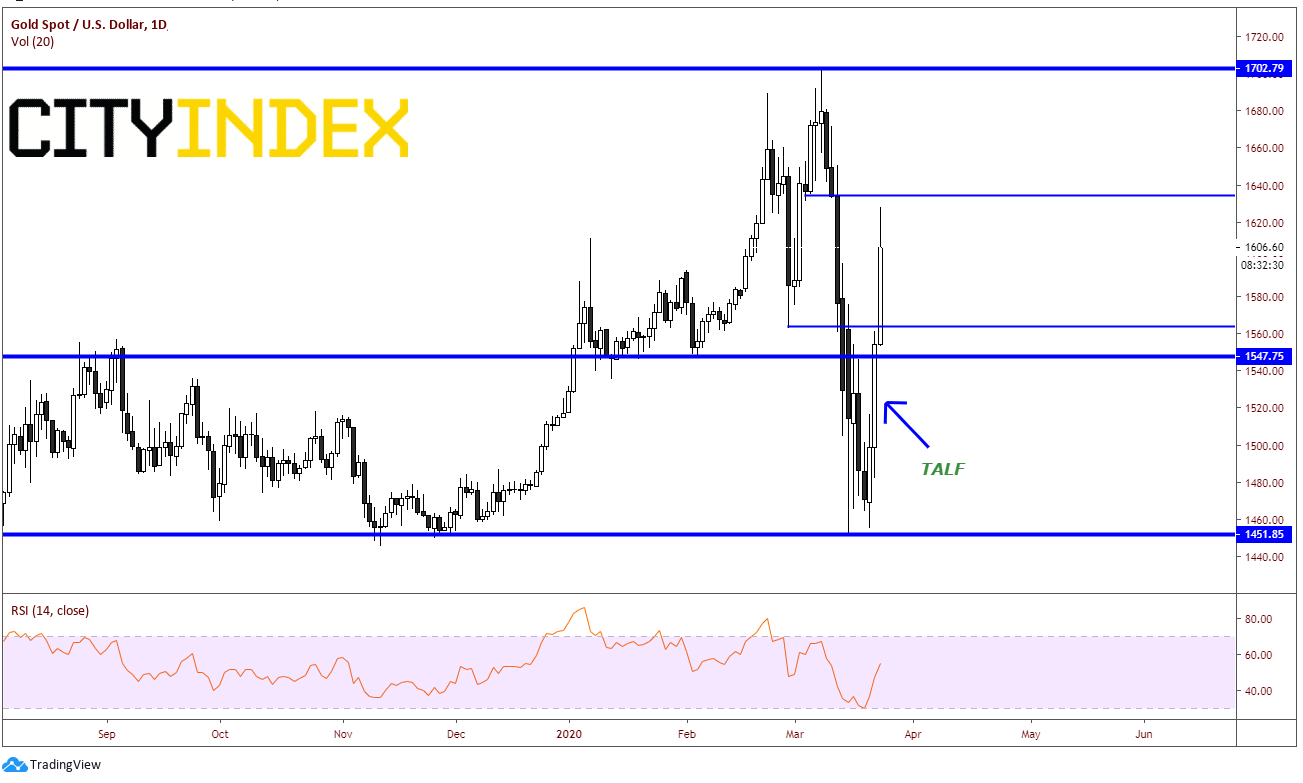

In addition, yesterday we discussed how the new influx of US Dollars into the economy from TALF will push the price of gold higher, just as it did after TARP was announced in 2008. This was the initial reason for gold to move back to its flight to safety status.

Over the last 3 days, spot market gold is from a low of 1455.4 to a high of 1627.7, an increase of 11.8% from low to high. Yesterday, we posted this chart and noted resistance at 1547.75, 1632 and the year highs near 1702 as resistance. Price has held 1632, for now. Support is at the psychological area near 1600, then yesterday’s nights near 1561.

Source: Tradingview, City Index

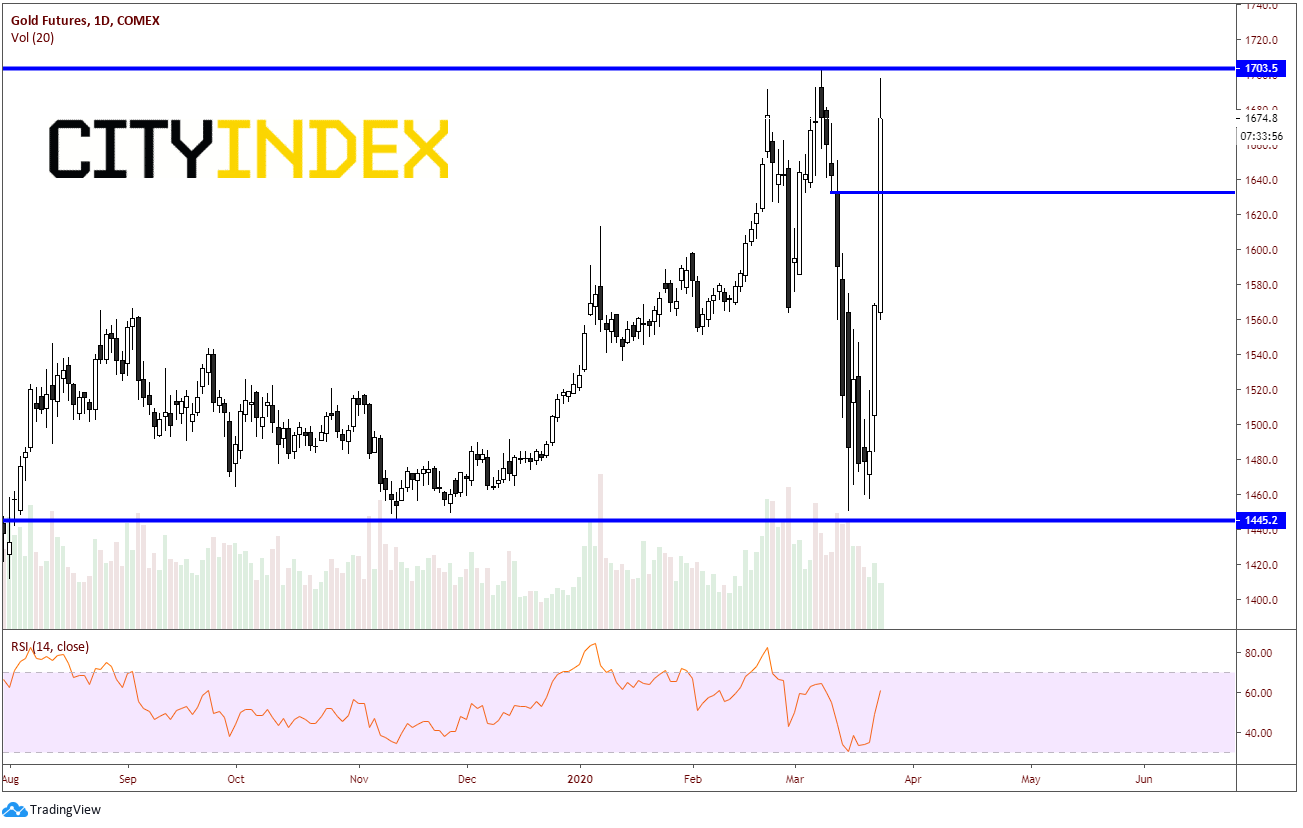

The front month gold futures contract has been even more volatile than in the sport market over the last 3 days, trading from a low of 1484.6 to a high of 1698, or 14.4%. The futures markets have to take time and interest rates into account when trying to determine a fair value for the contract, therefore futures markets usually trade at a higher price than spot. Notice how price took out the resistance at 1632.4 and is trading need the years highs of 1704. We can look at the previous horizontal resistance at 1632.4 as the first support level.

Source: Tradingview, Comex, City Index

With the flood of US Dollars into the markets, firms won’t need to sell as many assets to raise cash for margin (as they can borrow more Dollars), as we saw with the selling of gold last week. As firms use this new cash as a backstop, there is also new cash to flow into gold. With the large demand, especially in the EFP market, gold should continue to push even higher. All-time highs in gold prices could be in the cards over the next few months, above 1912!