Spot Gold Soars and Stands Above $2,000

Yesterday, spot gold jumped 2.1% with a close price at $2.019, breaking above the psychological level at $2,000 and hitting the all time high. Investors continue to support gold on the uncertainty of economic and geopolitical risk.

In fact, investors continue to wait for the result of the negotiations between Democrats and Republicans on new coronavirus relief measures.

The gold holding of global gold-backed ETF rose to 3,365.6 tons on Monday, up 30.5% this year, according to Bloomberg. The ETF's holding is being the second of the world, surpassing Germany's holding.

Recently, investment bank Goldman Sachs raised the 12-month price forecast of gold from $2,000 to $2,300 on weaker U.S. dollar, rising geopolitical tensions and the U.S. domestic and social uncertainty.

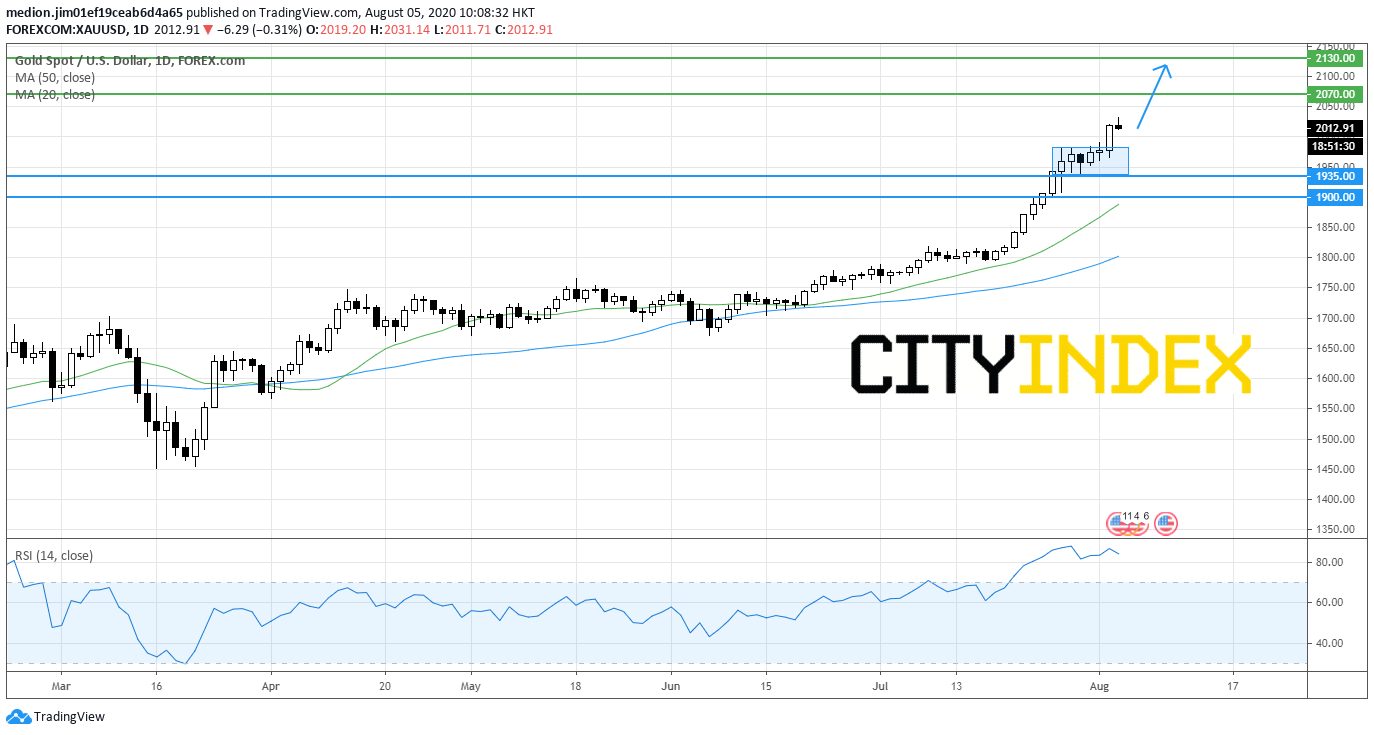

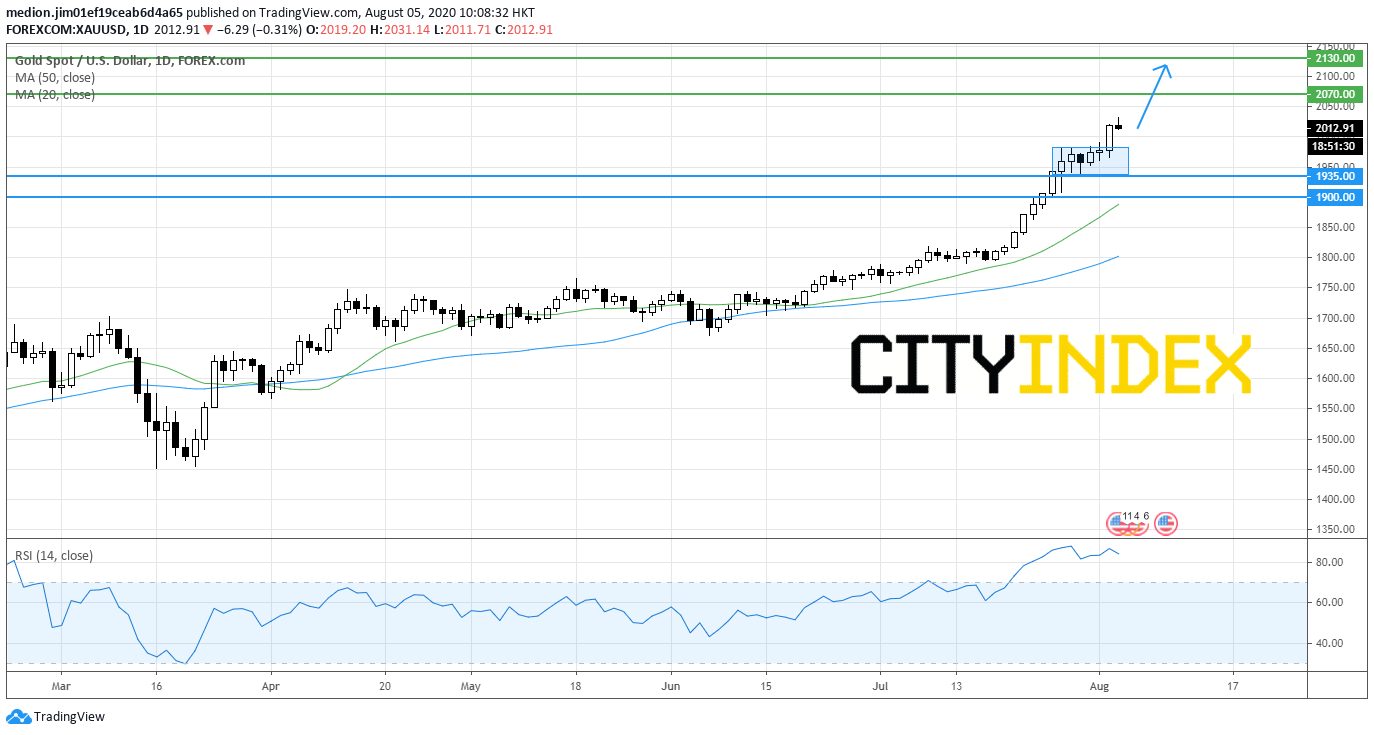

Gold (Short Term): Further upside expected

Source: GAIN Capital, TradingView

On a daily chart, spot gold continues to shoot up after taking a breath for around 1-week.

The relative strength index stayed around its overbought level at 80, suggesting the extreme upside momentum for the prices.

The nearest support level is located at $1,935 (the low of consolidation area), while the resistance levels would be located at $2,070 and $2,130.

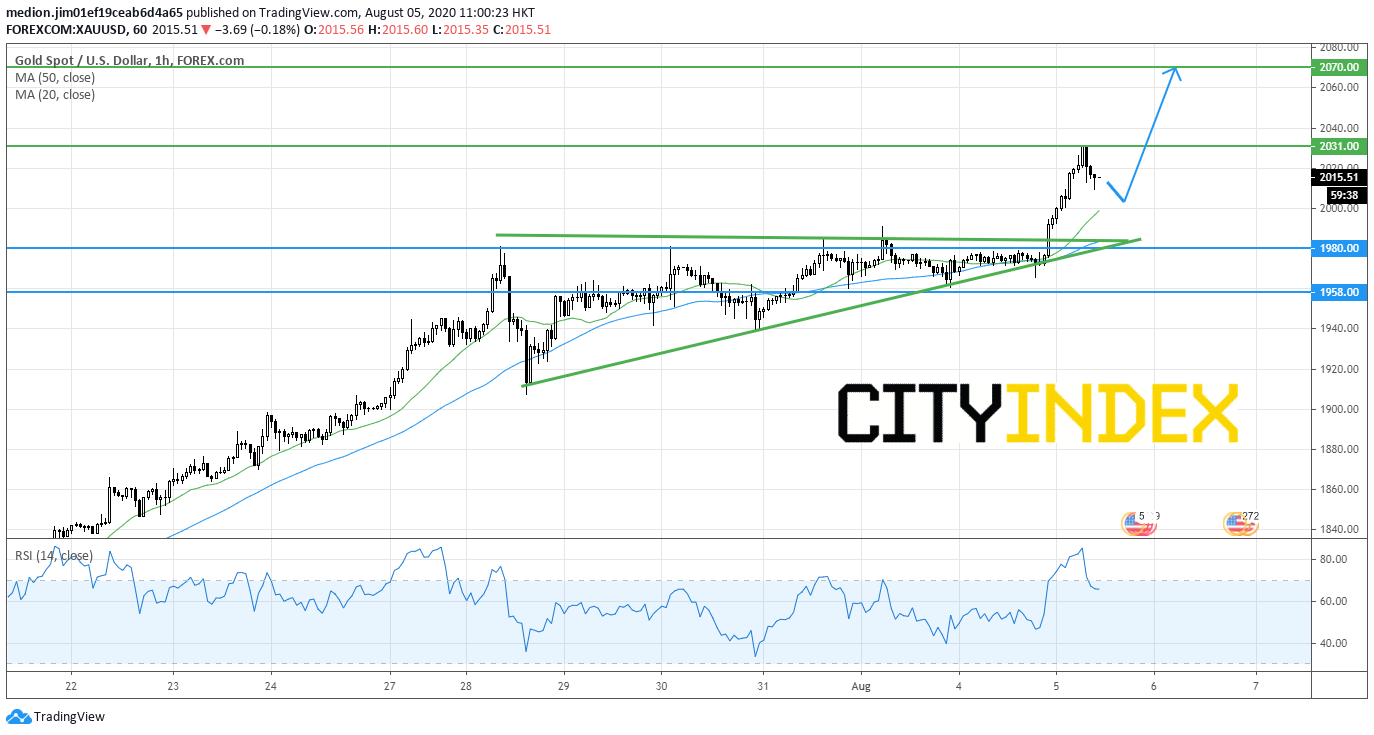

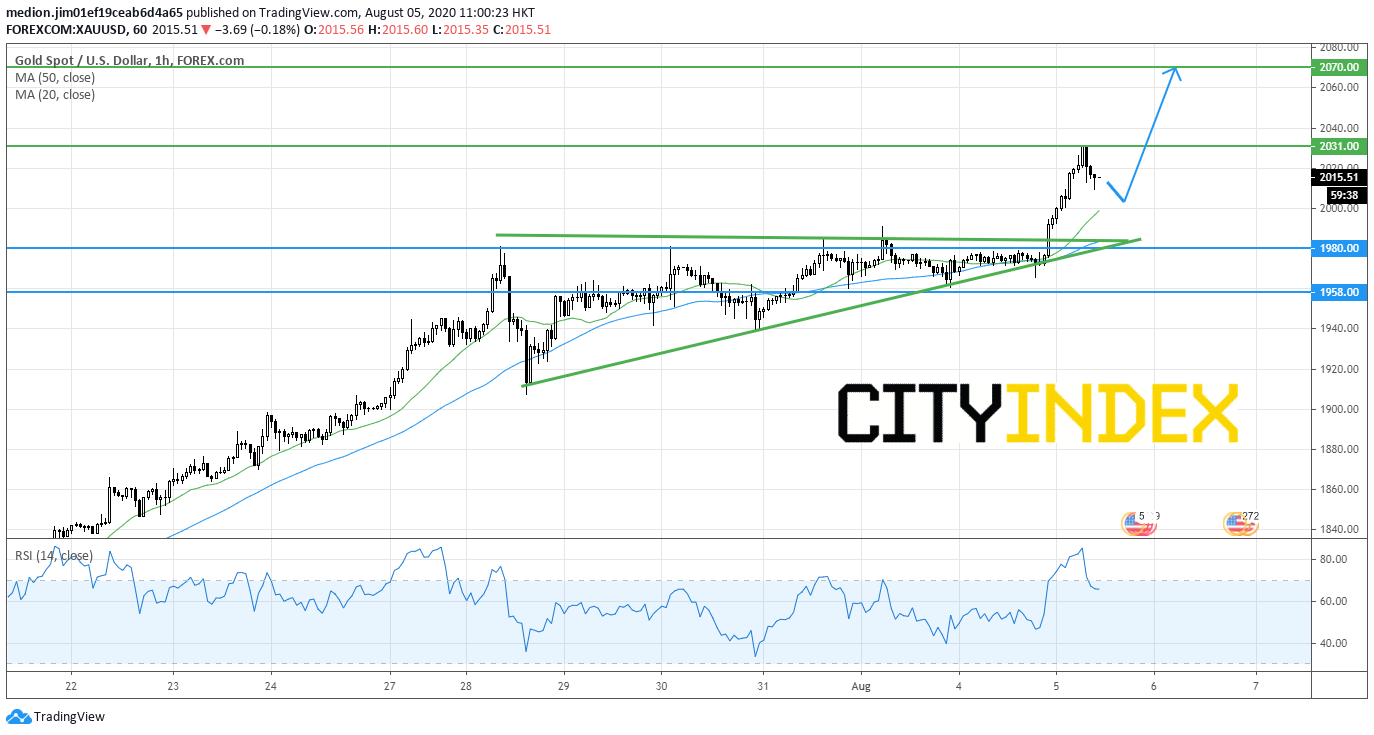

Gold (Intraday): Bullish bias above $1,980

Source: Gain Capital, TradingView

On a 1-hour chart, spot gold confirmed a breakout of the ascending triangle, suggesting the resumption of the recent bullish trend.

Currently, the prices posted a pullback after running up to $2,031, but the prices remain supported by both rising 20-period and 50-period moving averages.

Hence, as long as the support level at $1,980 (around the neckline of ascending triangle) is not broken, spot gold should bring a retest of the previous high at $2,031 before rising to the second resistance level at $2,070.

In fact, investors continue to wait for the result of the negotiations between Democrats and Republicans on new coronavirus relief measures.

The gold holding of global gold-backed ETF rose to 3,365.6 tons on Monday, up 30.5% this year, according to Bloomberg. The ETF's holding is being the second of the world, surpassing Germany's holding.

Recently, investment bank Goldman Sachs raised the 12-month price forecast of gold from $2,000 to $2,300 on weaker U.S. dollar, rising geopolitical tensions and the U.S. domestic and social uncertainty.

Gold (Short Term): Further upside expected

Source: GAIN Capital, TradingView

On a daily chart, spot gold continues to shoot up after taking a breath for around 1-week.

The relative strength index stayed around its overbought level at 80, suggesting the extreme upside momentum for the prices.

The nearest support level is located at $1,935 (the low of consolidation area), while the resistance levels would be located at $2,070 and $2,130.

Gold (Intraday): Bullish bias above $1,980

Source: Gain Capital, TradingView

On a 1-hour chart, spot gold confirmed a breakout of the ascending triangle, suggesting the resumption of the recent bullish trend.

Currently, the prices posted a pullback after running up to $2,031, but the prices remain supported by both rising 20-period and 50-period moving averages.

Hence, as long as the support level at $1,980 (around the neckline of ascending triangle) is not broken, spot gold should bring a retest of the previous high at $2,031 before rising to the second resistance level at $2,070.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM