Gold: Signs of a Downturn as Investment Demand Cools

On Monday, spot gold marked a day-low near $1,883 before bouncing back to $1,912, still down 2.0%. Surprisingly, the plunge in U.S. stock markets failed to spur safe-haven demand for the precious metal. In fact, the correlation between the two types of assets have been fairly positive since March.

Investment demand has been one of the factors that pushed gold price to historical high, however it appears to be slowing. Bloomberg data showed that total known ETF holdings of gold increased just 0.9% in August (+0.8% up to last Friday for September), compared with 2.8% to 5.7% growth in March to July. On the other hand, total known ETF holdings of silver (spot silver slumped 7.7% yesterday) is on track to post its first monthly decline this year.

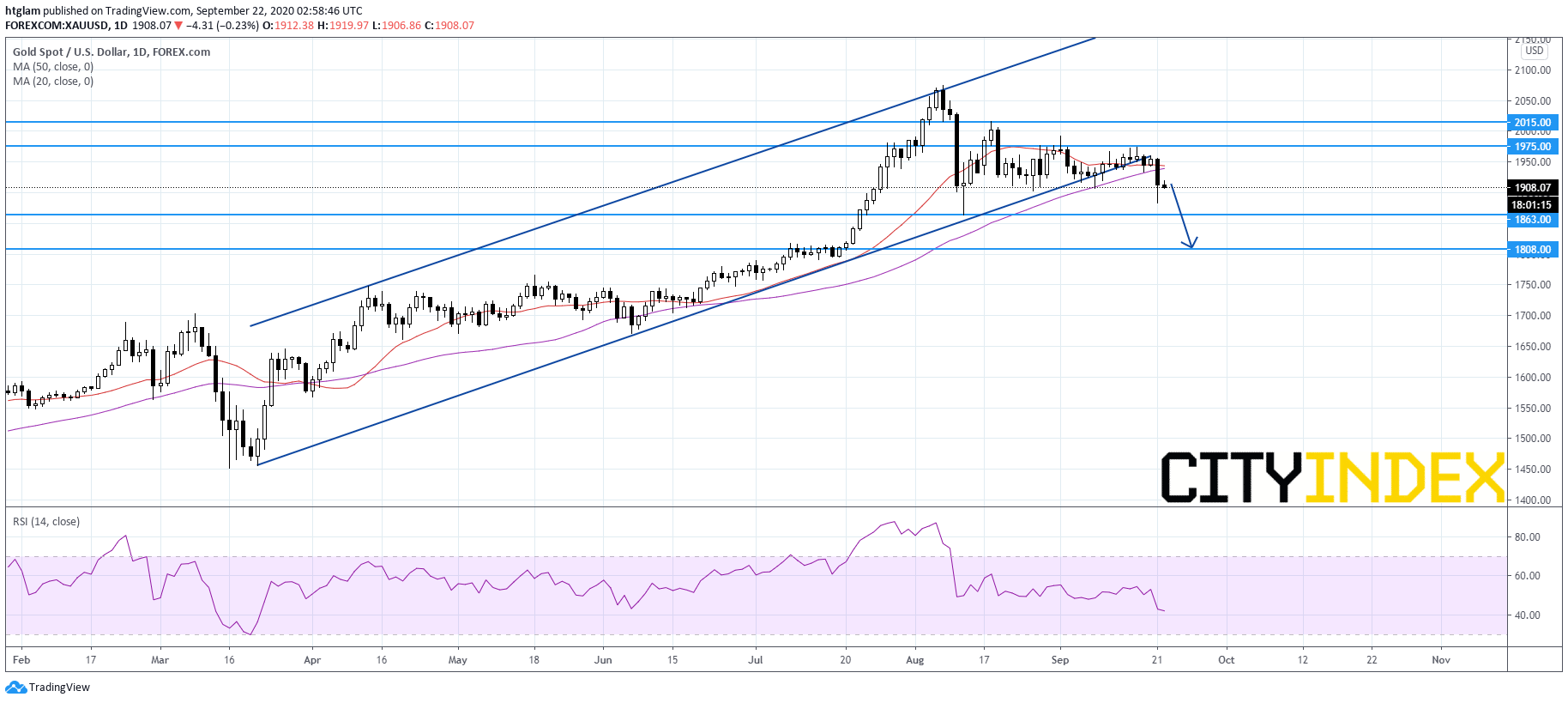

From a technical point of view, spot gold has broken below a bullish channel drawn from March, signaling more downside risks. It has also breached below the 50-day moving average, while the 20-day one is skewing downward. The level at $1,975 might be considered as the nearest resistance, with prices likely to test the 1st and 2nd support at $1,863 and $1,808. Alternatively, a break above $1,975 would suggest that gold has stabilized and open a path to re-test the next resistance at $2,015.