On Wednesday, spot gold rose 0.8% to $1,809, surpassing $1,800 for the first time since 2011. Investors' demand for the precious metal has been consistently rising, Bloomberg data showed that total holdings in gold-backed ETFs increased 655.6 tons so far this year, more than 2009 full-year record growth.

Meanwhile, the impacts of vaccine progress last week on gold prices proven to be short-lived, and investors are turning their focus on the resurgence of coronavirus cases.

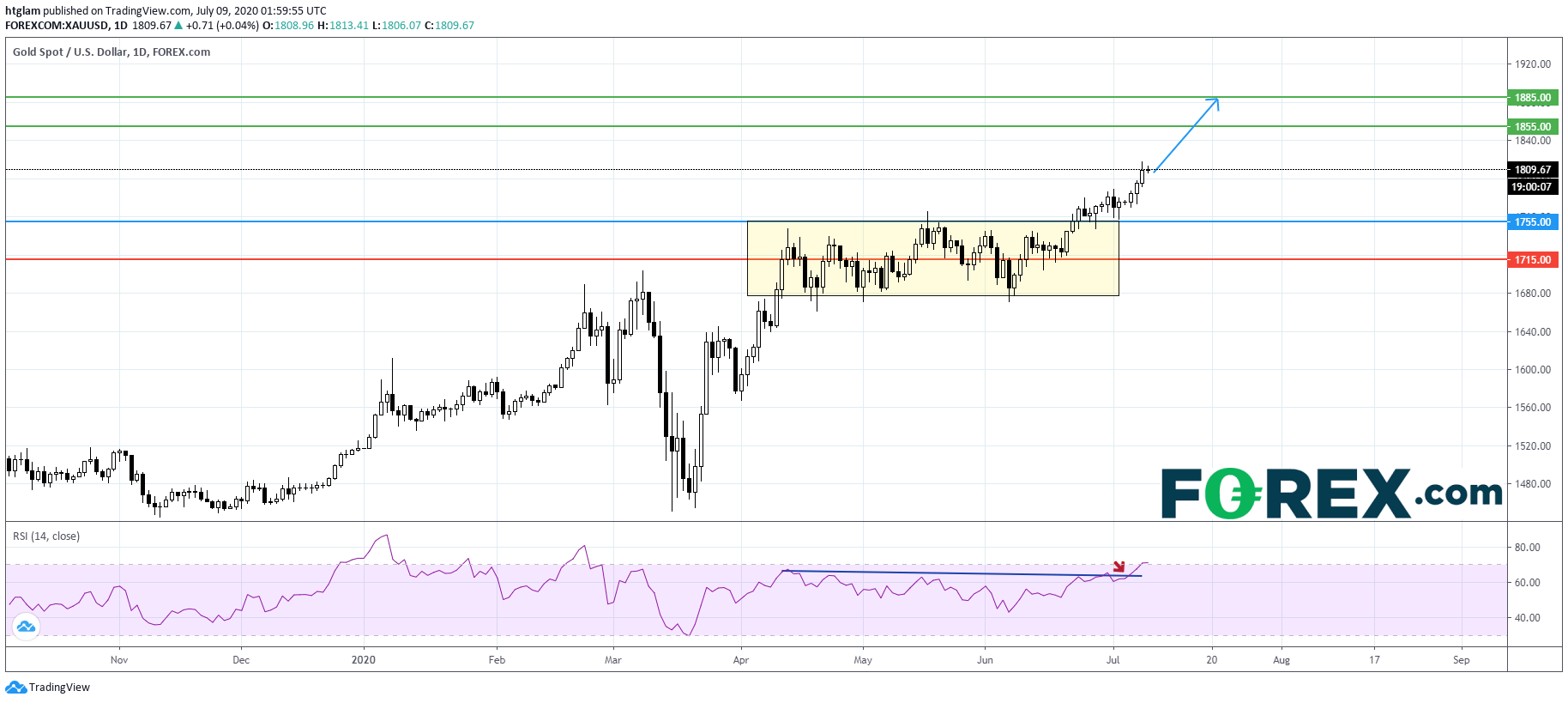

From a technical point of view, gold is gaining traction as shown on the daily chart. It has marked a new high without showing a RSI bearish divergence. As prices approaching the 1st level of our previous forecast, we are lifting our projections. The level at $1,755 might be considered as the nearest support level, with prices trending to the 1st and 2nd resistance at $1,855 and $1,885 respectively. Alternatively, losing $1,755 would suggest that the next support at $1,715 is exposed.