Spot gold surged pass its high marked in April, showing initial signs of another upside breakout. Federal Reserve Chairman Jerome Powell said in a CBS's interview "it may take a while" for the U.S. economy to recover, where the process "could stretch through the end of next year."

While the debate about negative U.S. interest rates continues, Bank of England Chief Economist Andy Haldane said BOE is looking at monetary policy options, including negative interest rates and purchasing riskier financial assets.

These suggest that the ultra-loose monetary policies of major central banks might at least last for a certain period of time, which is likely to support gold prices.

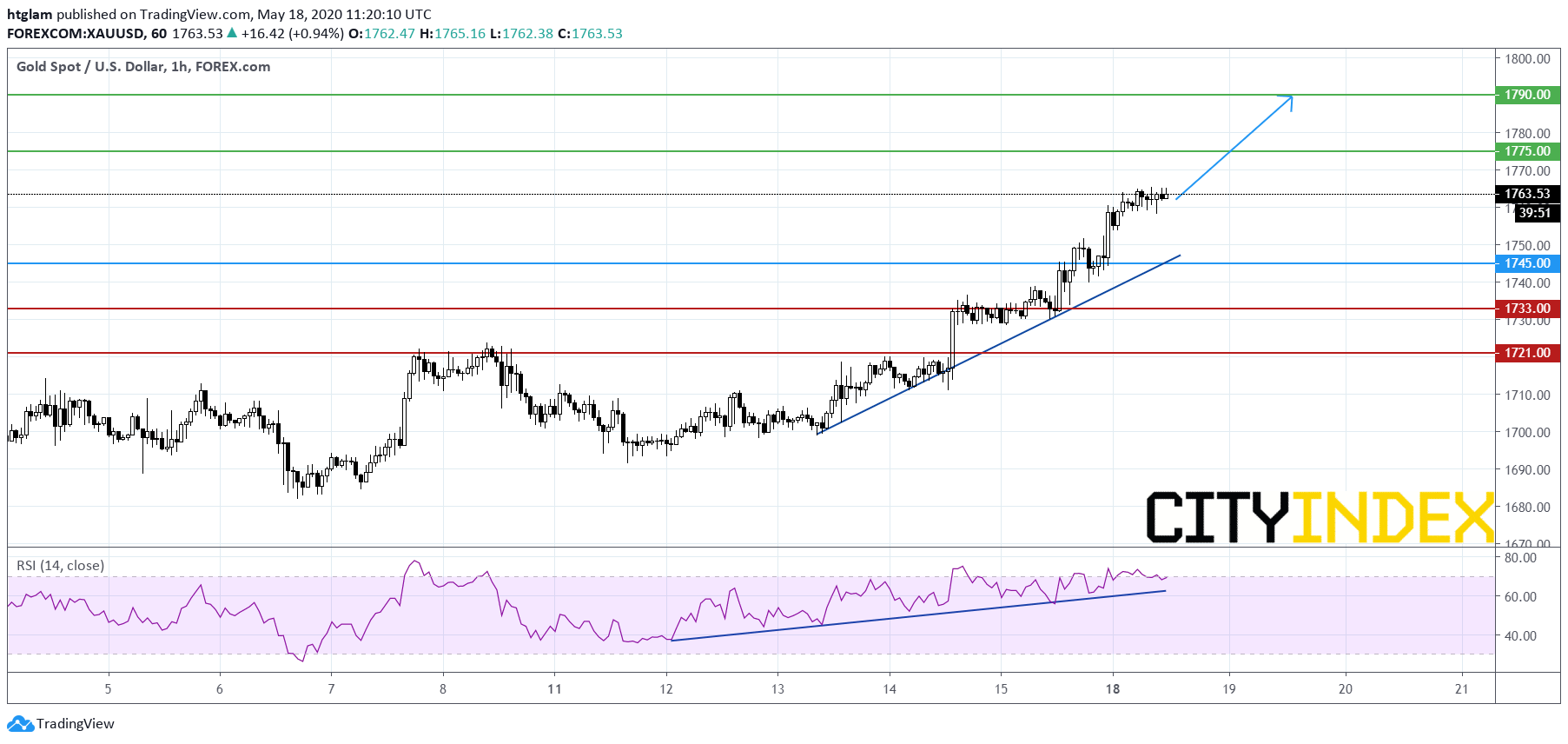

From a technical point of view, intraday spot gold maintains a strong bullish momentum as shown on the 1-hour chart. It is supported by a rising trend line, while the relative strength index stays near 70 without showing a bearish divergence. The level at $1,745 may be considered as the nearest intraday support, with prices likely to test 1st and 2nd resistance at $1,775 and $1,790. In an alternatively scenario, losing $1,745 would indicate that the next support at $1,733 might be threatened.

Source: TradingView, Gain Capital

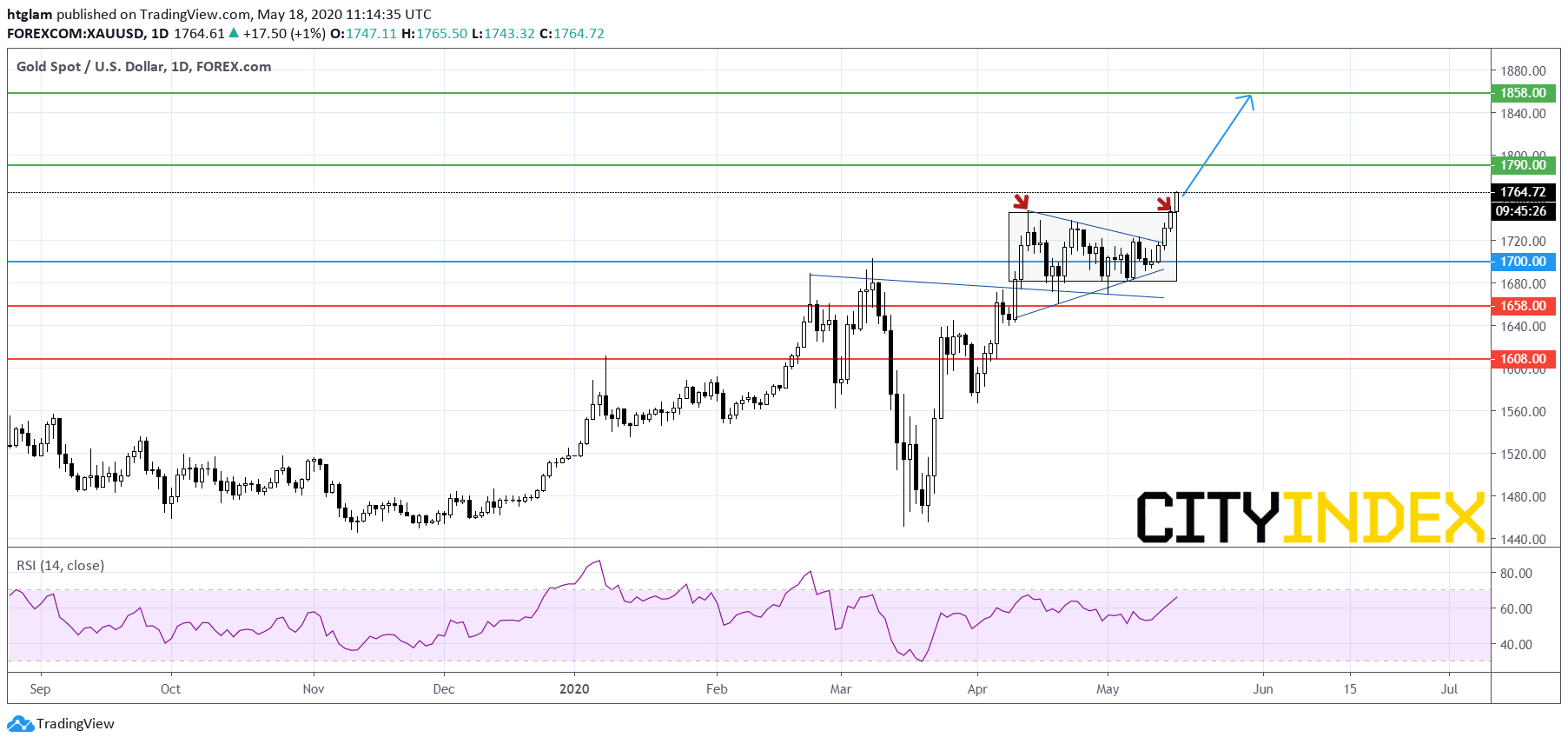

For the longer-term, spot gold has shown a second upside breakout as it has surpassed its April high as shown on the daily chart. In fact, it has broken a bullish flag pattern, signaling an end of consolidation and a resume of bullish trend. Gold would need to stand above its previous high in the next few trading days to confirm that the breakout is solid. For bullish investors, the level at $1,700 might be considered as the nearest support, while 1st and 2nd resistance are likely to be located at $1,790 and $1,858. Alternatively, a break below $1,700 would suggest a loss of momentum and may trigger a pull-back to $1,658.

Source: TradingView, Gain Capital

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM