Gold Regains Momentum on Reignited US-Iran Tension

Gold bulls had the upper hand on Wednesday, as the precious metal advanced 1.7% to $1,714, the largest daily gain in nearly two weeks. U.S. President Donald Trump tweeted that he has "instructed the United States Navy to shoot down and destroy any and all Iranian gunboats if they harass our ships at sea", which seems to have reignited the tensions between the two nations. It is worth remembering that U.S. forces killed Iranian major general Qassem Soleimani in January. In fact, hours before Trump's tweet, Iran's Revolutionary Guard Corps said the country has successfully launched its first military satellite into orbit. Such a move could advance the Tehran's long-range missile program.

Meanwhile, the increase in investors' demand for the bullion shows no signs of stopping. Total holdings in bullion-backed ETFs rose for a 23rd straight session on Wednesday, according to Bloomberg data.

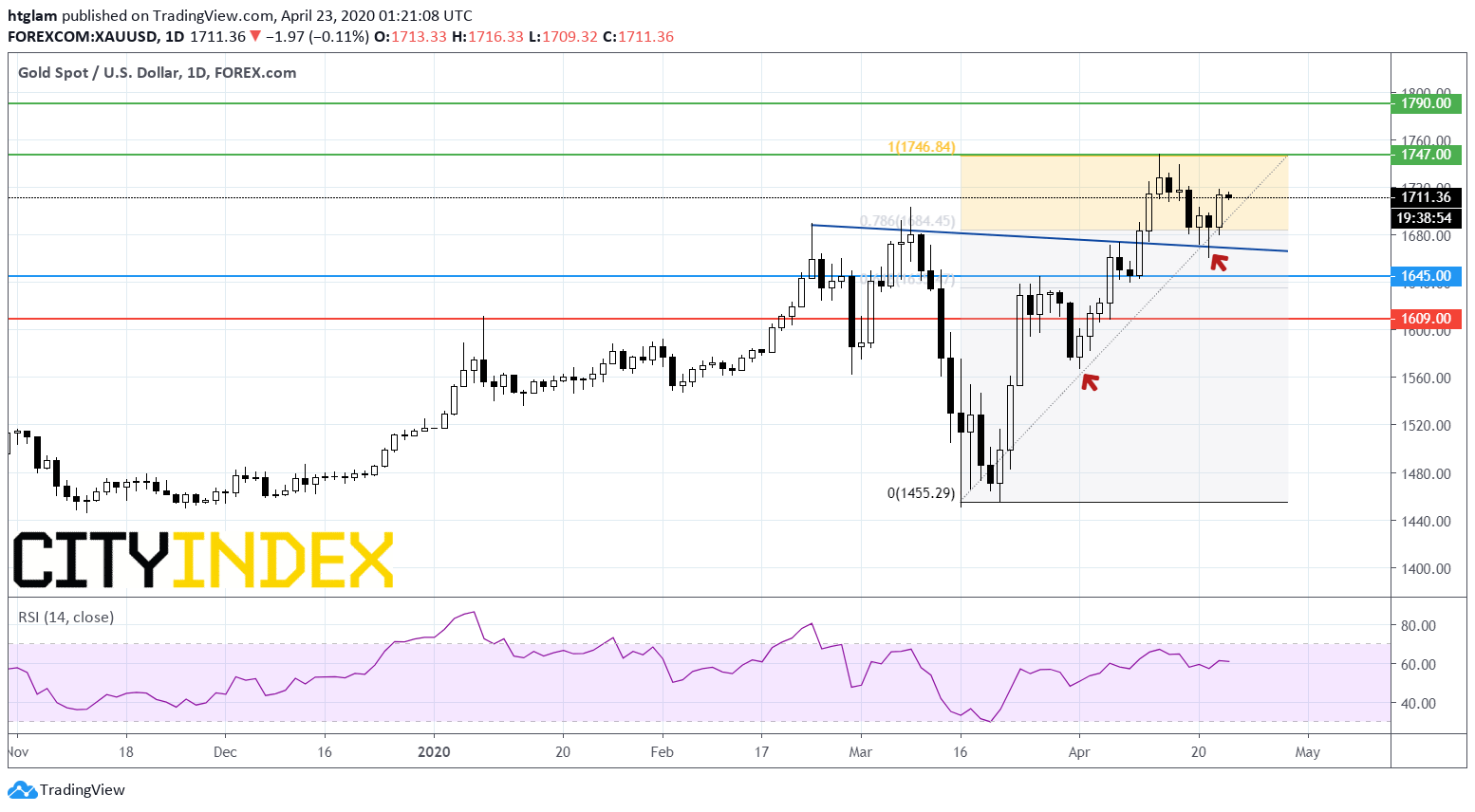

From a technical point of view, gold maintains bullish momentum in the short term as shown on the daily chart. Prices rebounded after retreating to its previous top, which should now provide support and potentially formed another high-low. This level is also a 78.6% Fibonacci retracement support of the rally started in late March. Bullish investor might consider $1,645 as the nearest support, while the 1st and 2nd resistance are likely to be located at $1,747 and $1,790 respectively. In an alternatively scenario, a break below $1,645 is likely to open a path to the next support at $1,609.