1) Cover margin2) To rotate into US dollar amid sell everything mode and “cash is best” .

However, there is a good chance that this is a dead cat bounce as the rush for cash pauses, so buying into gold to hedge any weekend risk is not on this occasion a sensible strategy.

There will not be a quick bounce back here. In parts of Europe and US we are just at the start of what could be a long social distancing, isolation and possible lock down phase. The situation in US and Europe is expected to get worse before it gets better. There is a good chance that we haven’t seen the end of the run to cash.

And if risk sentiment improves?

Even if risk appetite does increase, thanks to huge stimulus you don’t stay in safe havens. The UK rolled out a £330 billion bailout package, with more to come this afternoon. US is debating a $1 trillion dollar rescue package. Stocks are moving higher. Should risk sentiment show a meaningful improvement, traders would usually look to riskier assets rather than gold.

Levels to Watch

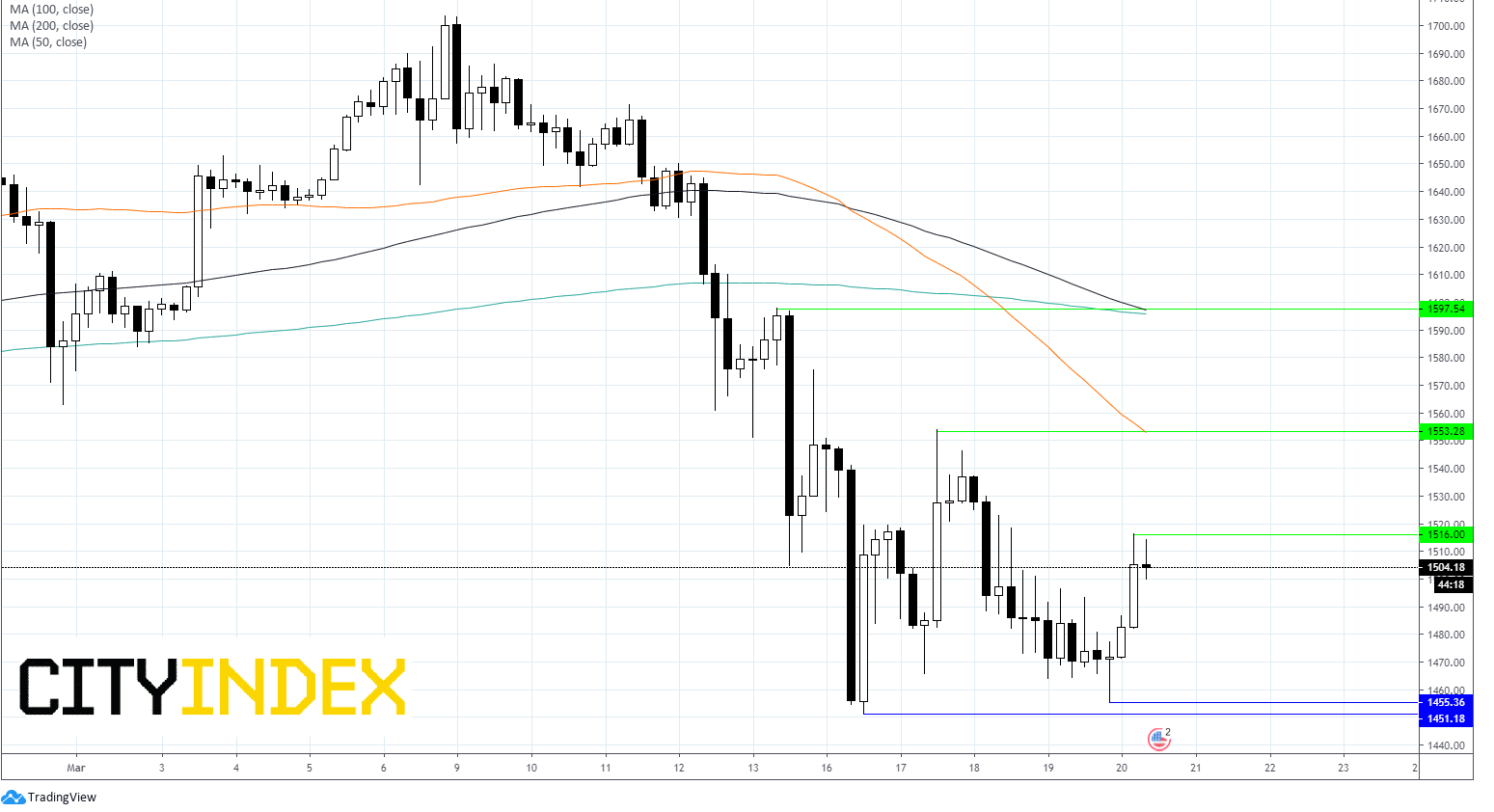

Despite Gold trading up 2% so far today, the technical picture remains negative. A close above its 200 sma could tempt more bulls in.

Immediate resistance can be seen on 4 hour chart at $1516 (today’s high) followed by strong resistance at $1555 (200 sma & high 17th March).

On the downside, support can be seen at $1455 (today’s low) followed by $1451 (16th March low) before opening the doors to $1437 (low 5th Aug 2019).