Gold: Rebound on its way

On Thursday, spot gold jumped 2.5% to a more than one-month high, as the ICE Dollar Index dropped for a third straight session. Investors expect that even if Joe Biden won the election, a large scale of stimulus package is still needed for the US, which would be negative to the U.S. dollar.

Meanwhile, investors would focus on the U.S. non-farm payrolls for October due later today, with a growth of 593,000 and unemployment down to 7.6% expected.

Meanwhile, investors would focus on the U.S. non-farm payrolls for October due later today, with a growth of 593,000 and unemployment down to 7.6% expected.

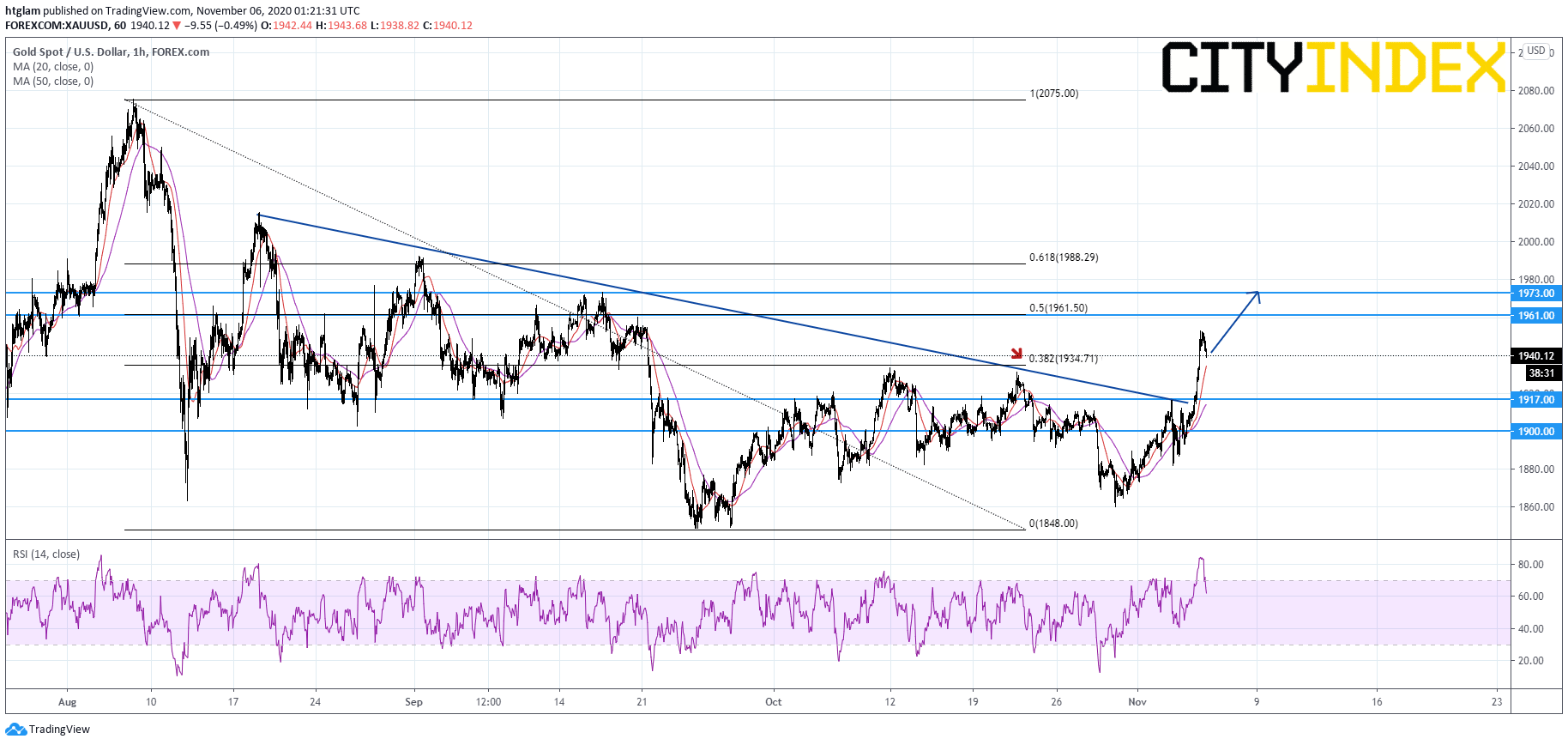

From a technical point of view, spot gold's upside momentum remains strong as shown on the 1-hour chart. It has surpassed a bearish trend line drawn from August and the 38.2% Fibonacci retracement resistance of the decline started from August's high. The level at $1,917 may be considered as the nearest intraday support, while the 1st and 2nd resistance are expected to be located at $1,961 and $1,973 respectively.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM