Gold has given back some of its sharp gains over the past day and a half. At the time of writing, the precious metal was trading flat on the week, hovering just above the $1400 level, at $1402. The precious metal has weakened in part because of fresh comments from Fed’s Powell and Bullard, which were a lot less dovish than expected, enabling the dollar to find some much-needed support and undermining buck-denominated precious metals. What’s more, equities managed to rebound sharply this morning, thereby reducing the appeal of safe haven gold, after Steven Mnuchin, Secretary of the US Treasury, said a trade deal with China is 90% complete. Stocks found additional support after Bloomberg reported that the US is willing to suspend the next round of tariffs on an additional $300 billion of Chinese imports while Beijing and Washington prepare to resume trade negotiations. Bloomberg cited people familiar with the plans, although it added that the decision, which is still under consideration, may be announced after a meeting between the two Presidents at the G20 summit.

Expect more of such headlines ahead of G20 meeting, but ultimately no deal is complete until it is signed. We are a bit sceptical at this stage. But this is all it took to wipe out yesterday’s losses in equity markets, which is why it so important for speculators to remain nimble. As far as gold’s retracement is concerned, this could turn out to be a small hiccup in what is becoming a strong bullish trend for the metal. With central banks across the developed economies being extremely dovish amid trade and growth concerns, yields are likely to remain depressed for a while yet, allowing gold to shine. Even if there is a positive resolution in the US-China trade spat at the G20 meeting, this may not be so bad news for gold as it will boost the demand outlook from China, one of the top gold consumer nations.

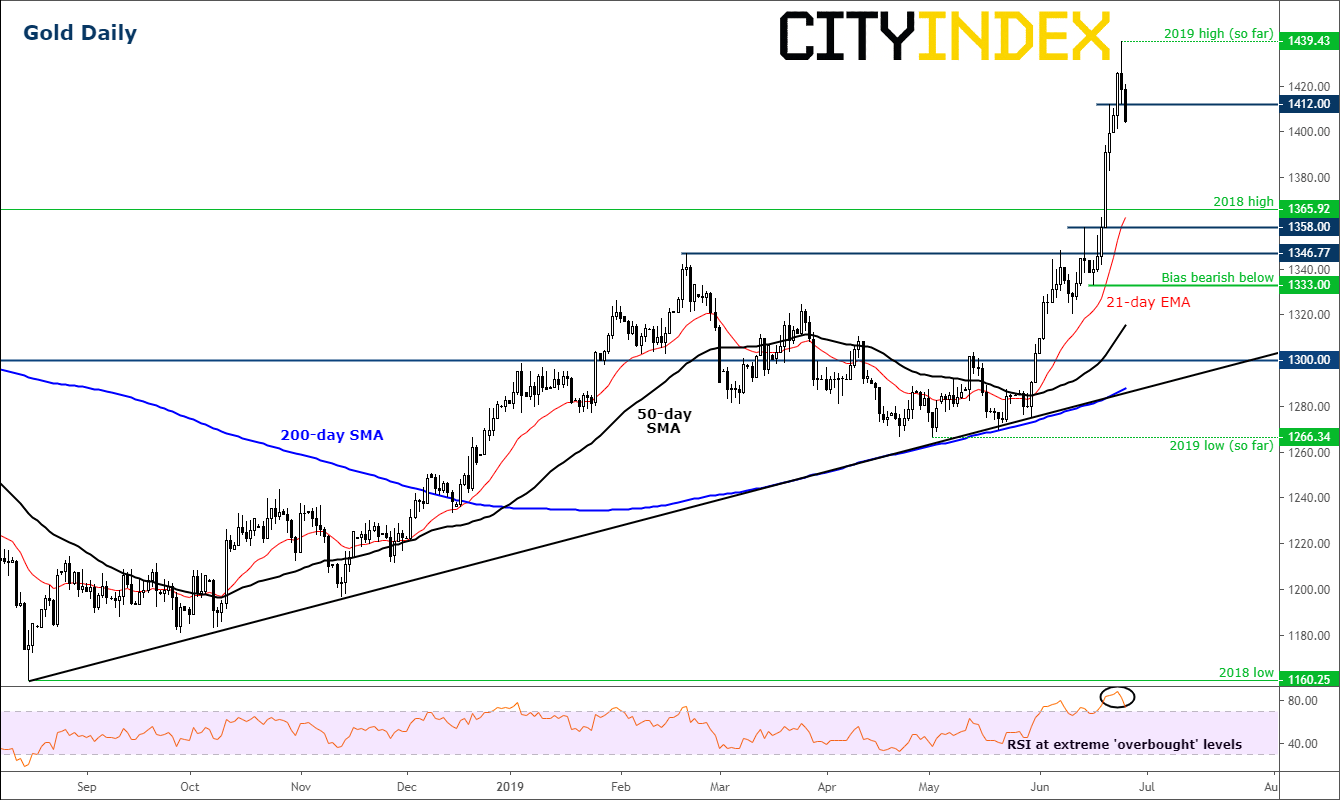

Finally, the pullback in gold may not be a bad thing from a purely technical point of view anyway, as it may encourage dip buyers and those who missed out on the rally initially to step in when the metal approaches key support levels below market. Among the key support levels we are monitoring, the $1358-$1375 range is the most important region as this was the prior resistance area. So long as the metal holds above here, the technical bias would remain bullish even if it goes on to fall for several days to get there. Obviously, this area is some distance below where gold is trading around at the moment, which therefore means if gold were to get to this region it will require a great effort from the sellers. Perhaps, a more bullish scenario would be if instead of a price fall, gold works off its “overbought” conditions through time. What do I mean by that? Basically, a consolidation near its highs around $1400.

Source: Trading View and City Index.